Essential Steps to Effectively Request Your Credit Report and Understand Its Importance

Taking control of your financial landscape is key to making informed decisions about your future. Many people might not realize the importance of keeping an eye on their financial profile, which can impact everything from loan approvals to insurance rates. Understanding the information contained within this critical document is essential for maintaining a healthy economic standing.

Acquiring insights into your financial history is not just a smart move but also a crucial step towards achieving your financial goals. There are several ways to access this valuable information, and it’s important to know the right methods and resources at your disposal. In this guide, we’ll explore the steps you need to take to obtain this essential snapshot of your financial habits and how to leverage that information effectively.

By knowing the key elements that influence your financial credibility, you can make better choices, enhance your fiscal strategies, and work toward securing the best possible outcomes for your financial well-being. Let’s dive into the process of obtaining this valuable information and empowering yourself for the road ahead.

Understanding Financial Assessments and Their Importance

When it comes to managing your financial life, there’s a key element that plays a crucial role in shaping your opportunities. It’s that detailed snapshot of your monetary behavior that lenders rely on when deciding whether to extend a loan or offer you credit. This overview not only reflects your past actions but also influences your future financial decisions.

These assessments hold significant weight in today’s economy, as they help institutions gauge risk and determine the terms they’re willing to offer. A solid understanding of this document is vital because it can impact everything from mortgage rates to insurance premiums. When you keep an eye on your financial health and understand what goes into these evaluations, you’re taking strides toward making informed decisions that align with your aspirations.

Moreover, being aware of the elements contained in this evaluation can empower you to enhance your financial standing. By identifying your strengths and areas for improvement, you can work towards building a healthier financial future, ensuring you’re in the best position to seize opportunities when they arise.

Step-by-Step Guide to Requesting Your Report

Understanding your financial history is essential, and accessing your personal records can help you stay informed. Here’s a straightforward approach to obtaining this valuable information, ensuring you have a clear picture of your financial status.

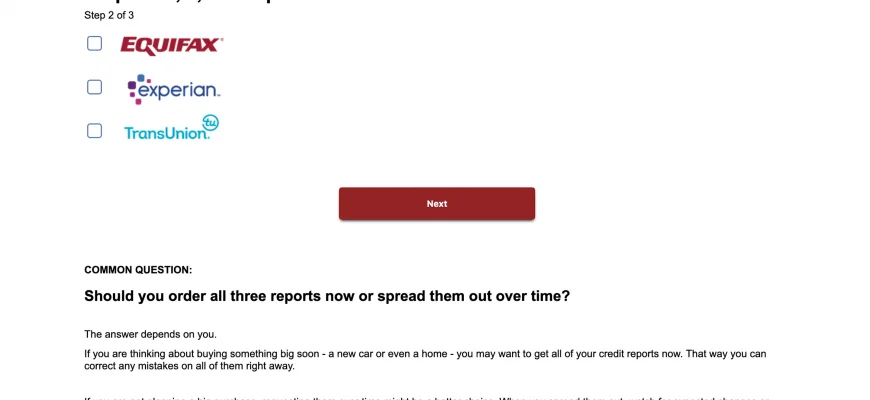

Start by identifying the agencies that compile this crucial data. You’ll typically want to reach out to the major organizations that collect and distribute this information. Gather their contact details, ensuring you have everything you need for a smooth process.

Next, you may need to prepare specific documentation. Be ready to provide personal identification, such as your name, address, and social security number. This step is vital for verifying your identity and ensuring accuracy in what they provide you.

Once you have your documents ready, choose your preferred method for obtaining the information. You can either visit their website for online access or opt for traditional mail. Both methods work, but online might be quicker for those who seek immediate insights.

After submitting your information, anticipate a confirmation. Each organization may have different processing times, so patience is key while waiting for your detailed overview to arrive.

Finally, once you’ve received your documents, take some time to review everything carefully. Look for discrepancies or errors, and if you notice any issues, don’t hesitate to contact the appropriate agency. Keeping an eye on your financial information helps you make informed decisions moving forward.

Common Mistakes to Avoid When Seeking Your Financial Summary

Getting your financial summary is an essential step towards taking charge of your finances. However, there are some frequent missteps people make during this process that can lead to issues or delays. Being aware of these pitfalls will help you navigate more smoothly.

- Not checking eligibility requirements: Before diving in, it’s crucial to be aware of any prerequisites for obtaining your summary, as some services may have specific conditions.

- Using unreliable sources: Stick to trusted and authorized platforms to ensure you receive accurate and secure information.

- Ignoring the timing: The timing of your inquiry may impact the availability of your details, especially if it’s near month-end or during peak periods.

- Overlooking documentation: Always have your identification and personal details ready to avoid unnecessary delays.

- Neglecting to review information: After you obtain your summary, take the time to examine it carefully for any inaccuracies or discrepancies.

Avoiding these common errors will streamline your experience and empower you to make informed financial decisions for the future.

Wow;this is perfection. Her grace;style;and effortless charm are all on full display. What an incredible presence—this video is a masterpiece.