A Comprehensive Guide to Refunding a Credit Note in Xero

Maintaining clear and accurate financial documentation is crucial for any business. Sometimes, transactions may require modifications or reversals, leading to the need for some adjustments in your accounting systems. Understanding the proper approach to managing these corrections can save you time and maintain your financial integrity.

In any financial platform, it’s essential to know how to process these changes efficiently. This ensures that both your records and customer relationships remain in good standing. Whether it’s issuing a return, applying a balance to a future purchase, or rectifying an overpayment, a well-planned strategy can help streamline the whole process.

By following the right procedures, you can navigate the intricacies of transaction management with confidence. Emphasizing efficiency and accuracy allows for smoother operations and fosters trust with your clients or partners. As we explore the best practices for handling these situations, you’ll gain the insights needed to enhance your operational workflow.

Understanding Credit Notes in Xero

In the world of accounting software, there exists a mechanism that helps businesses manage adjustments to previous transactions. This tool serves as a way to reflect alterations, whether due to returns, overpayments, or adjustments. It’s essential for maintaining accurate financial records and ensuring that customer accounts are handled properly.

When a business issues an adjustment document, it acts as a formal acknowledgment of a transaction modification. This process can simplify bookkeeping tasks and enhance customer relations by ensuring transparency regarding changes to amounts owed or refunds.

Using this tool effectively can lead to smoother operations, making it easier for companies to keep track of their financial interactions. By understanding the underlying principles, users can leverage this feature to improve their accounting efficiency and maintain positive customer experiences.

Steps to Process a Credit Note Refund

When it comes to handling financial documents, it’s important to ensure the proper return of funds to maintain good relations with clients. This section will guide you through the necessary actions to carry out an effective reimbursement process.

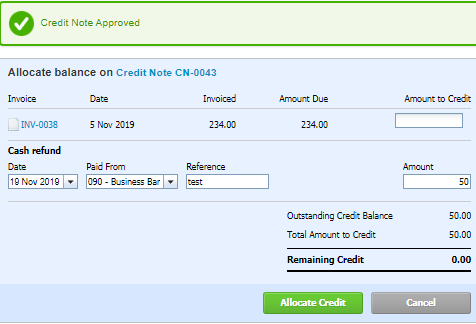

First, navigate to the relevant financial record within your accounting system. It’s essential to locate the specific transaction that you’ll be addressing. Once you have the right entry in view, ensure that all details match with the customer’s original transaction to avoid any discrepancies.

Next, initiate the process by selecting the option that allows you to issue funds. This often involves confirming the amount that needs to be returned and the payment method preferred by the client. Depending on your financial settings, you might have a variety of options available, such as bank transfer or credit card processing.

After confirming the details, proceed to finalize the transaction. Keep an eye out for any prompts that may require additional confirmation to ensure the action is completed accurately. Once the process is finalized, send a notification to the customer, providing them with all necessary details regarding their payment return.

Finally, it’s always a good idea to record this transaction for your records. Having a clear documentation trail not only helps in future reference but also aids in maintaining an organized accounting system. Just a few simple steps can ensure a seamless experience for both you and your valued clients.

Common Issues and Solutions for Refunds

When dealing with transactions, it’s not uncommon to face a few bumps along the way. Sometimes things don’t go as planned, and figuring out the right approach can be a bit tricky. Let’s explore some typical hurdles you might encounter and how to tackle them effectively.

One frequent challenge is the system rejecting your reversal attempt. This usually happens when the transaction was not properly recorded or if certain details are missing. To fix this, double-check all entries for accuracy, ensuring every piece of information is complete. Making sure you have the correct reference numbers can also save you a lot of headaches.

Another issue might involve discrepancies in account balances. This can occur if there are multiple transactions affecting the same account or if adjustments have been made. To resolve this, go back through recent entries and reconcile any differences. Keeping a clear log of all activities will help track down any inconsistencies.

You might also run into situations where the recipient claims they haven’t received the funds. It’s important to maintain clear communication with them and provide proof of the transaction. Always keep records of dates and amounts transferred, as this documentation can be invaluable in resolving disputes.

Lastly, sometimes users simply feel overwhelmed by the interface or functionalities available. If that’s the case, don’t hesitate to consult the help section or reach out to support. They can provide guidance tailored to your specific situation, ensuring you navigate through the process smoothly.