Tips and Guidelines for Preparing Unaudited Financial Statements Effectively

Creating a clear picture of your business’s economic health is essential for informed decision-making. While some may rely on formal assessments, there exists a simpler approach that doesn’t require extensive auditing processes. This type of documentation can provide valuable insights without the complexities of traditional reviews.

Think of this practice as a way to gather essential data in a straightforward format. It’s about showcasing your organization’s performance in a manner that anyone can grasp. Whether you’re looking to attract investors, apply for financing, or simply keep track of your growth, this method offers a pragmatic solution.

As you delve deeper, you’ll realize that compiling these records is not just for large corporations. Small businesses and startups can significantly benefit from this process as well. Understanding the fundamentals empowers you to take ownership of your organization’s narrative and progress.

Understanding Unaudited Financial Statements

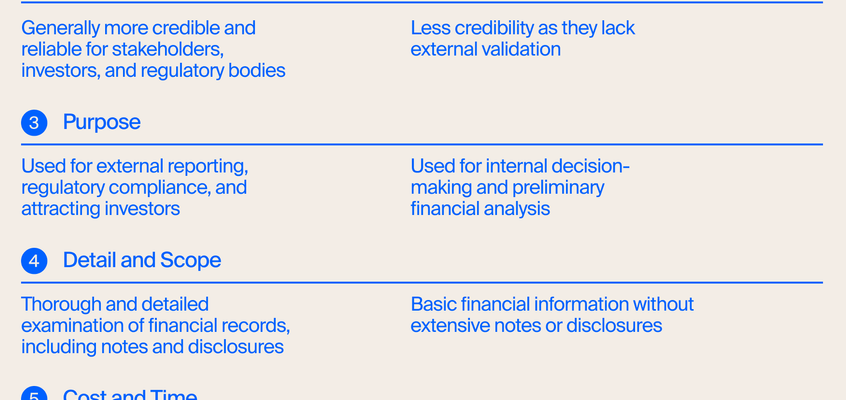

When it comes to assessing the health of a business, you might stumble upon documents that have not gone through a rigorous scrutiny process. These records provide a snapshot of the company’s performance but lack the assurance that comes with thorough examination. They can be useful for a variety of stakeholders, including management and potential investors, offering insights without the bells and whistles of a certified review.

These informal records generally include key elements like income, expenses, assets, and liabilities. They can present a clearer picture of ongoing operations, making it easier for users to grasp the financial scenario of an organization over a specific period. It’s important to approach these documents with an understanding of their nature; they serve as a foundation for more detailed analysis rather than an end-all-be-all report.

One of the major advantages of these records is their accessibility. Businesses often compile them more quickly and without the need for extensive outside assistance. This can be particularly beneficial for smaller enterprises or startups that need to keep costs down while still sharing their performance data. However, it’s essential to remember that their informal status may mean they lack certain assurances, which could impact how they’re perceived by external parties.

Key Components of Financial Preparation

When it comes to crafting a robust overview of a business’s monetary standing, several foundational elements come into play. These components work together to paint a clear picture, allowing stakeholders to make informed decisions. Let’s explore what these essentials are and how they contribute to creating a compelling summary of a company’s economic health.

- Balance Sheet: This document showcases the assets, liabilities, and equity of a company at a specific moment. It highlights what the business owns and owes, reflecting its financial position.

- Income Statement: Serving as a report card, this item summarizes revenues and expenses over a particular timeframe. It helps track profitability and operational efficiency.

- Cash Flow Statement: A vital piece that illustrates how cash moves in and out of the organization. This report indicates liquidity and the ability to meet obligations.

- Notes to Financial Overview: These are additional explanations and clarifications that accompany the main documents. They provide context and deeper insights into the numbers presented.

- Accountant’s Review Letter: Although not a formal audit, a review by an external accountant can lend credibility and assurance to the information provided.

Each of these elements plays a significant role in conveying the overall financial narrative. Understanding their importance will help anyone involved in the business landscape grasp the nuances of economic realities and make better decisions moving forward.

Common Mistakes to Avoid in Drafting

Creating documents that reflect the true essence of a business’s performance can be a challenging task. While the goal is to present an accurate picture, many encounter pitfalls along the way that can lead to confusion or misinterpretation. Here are some key blunders to sidestep in order to enhance clarity and ensure reliability.

Neglecting Thorough Reviews is a frequent oversight. Rushing through the check phase often results in missed errors or inconsistencies. Taking time to revisit and revision can significantly improve the quality of the content.

Inconsistent Terminology can mislead readers. Using different terms to describe similar concepts creates ambiguity, which can distort understanding. It’s vital to maintain consistency throughout the document to convey information effectively.

Overcomplicating Language is another common error. It’s easy to get caught up in jargon or complex phrases, thinking it elevates the credibility. However, clear and straightforward language is usually more effective and appreciated by the audience.

Ignoring Audience Needs is a mistake that can diminish the impact of your work. Understanding who will read the document helps tailor the content to meet their expectations and level of expertise, making it more relevant and engaging.

Overlooking Supporting Information can weaken arguments and conclusions. Providing adequate context, explanations, and evidence strengthens the narrative, allowing readers to make informed assessments.

Failing to Follow Standard Formats can lead to disorganization. Readers often expect a particular structure, and deviating from it can create frustration. Adhering to standard layouts improves navigability and understanding.

By recognizing and steering clear of these common missteps, one can foster a more precise and recognizable narrative that truly encapsulates a business’s standing without causing unnecessary confusion.