Effective Strategies for Paying Off Your Credit Card Debt More Quickly and Efficiently

Finding yourself in a challenging financial situation can be overwhelming. Many individuals are navigating similar waters, seeking ways to regain control over their monetary commitments. It’s not uncommon to feel trapped by the weight of outstanding balances that seem to grow larger with every passing month. Luckily, there are effective strategies that can pave the way to financial freedom.

Building a solid plan involves understanding your current standing and identifying practical steps to improve it. Small changes in daily habits, smart budgeting, and targeted repayments can gradually clear the path toward a brighter financial future. It’s all about making informed choices and staying motivated throughout the journey.

With determination and the right approach, you can turn the tide and emerge from this cycle of financial strain. Empower yourself with knowledge and take actionable steps to reclaim your peace of mind. Every small victory will bring you closer to your goal, ensuring that you not only manage your responsibilities but also build a healthier relationship with your finances.

Understanding Interest Rates

When it comes to borrowing funds, one aspect that often gets overlooked is the cost of borrowing. This figure can significantly impact your finances, affecting how much you ultimately repay over time. It’s essential to grasp the mechanics behind these rates to navigate your financial obligations wisely.

Interest rates essentially represent the price of your borrowed funds, expressed as a percentage. They can vary widely based on numerous factors, including creditworthiness and the lender’s policies. Knowing this can help you make informed decisions about any financial commitments you undertake.

Another important point to consider is the difference between fixed and variable rates. A fixed rate remains constant throughout the life of your obligation, while a variable rate can fluctuate based on market conditions. Understanding these distinctions can aid in anticipating potential costs and help you plan your repayment strategies more effectively.

Moreover, many lenders calculate interest on a daily or monthly basis, meaning the faster you manage your finances, the less you may end up spending in the long run. By familiarizing yourself with how these rates work, you empower yourself to make smarter financial moves.

Strategies for Reducing Debt Quickly

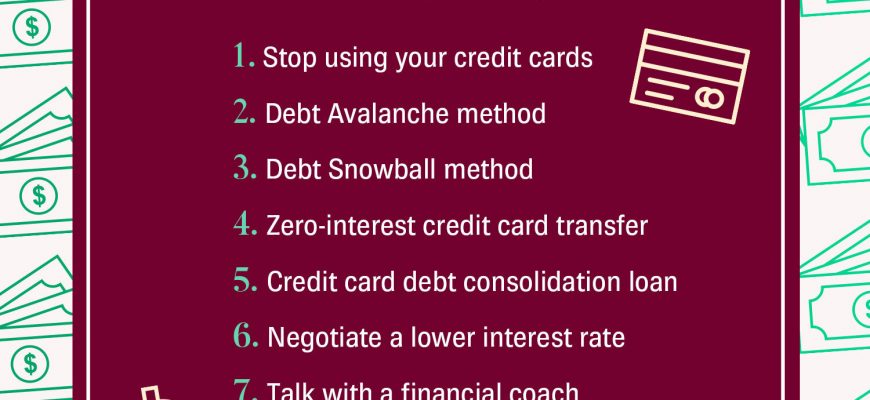

Finding effective ways to lighten financial burdens can often feel overwhelming, but there are practical methods to expedite the process. Approaching the situation with a clear plan and determination can lead to significant progress. By adopting strategic habits and making informed choices, you can regain control over your finances faster than you might think.

One popular approach is to tackle the highest interest obligations first. This method, often referred to as the avalanche technique, minimizes the total interest paid. Another option is the snowball method, which focuses on smaller amounts. Paying these off quickly can boost motivation and provide a sense of achievement.

Reviewing spending habits is also crucial. Identifying unnecessary expenses can free up extra funds to redirect toward reducing outstanding balances. Additionally, creating a strict budget helps maintain focus and prioritize financial goals.

Consider increasing income through side jobs or freelance work. Any extra earnings can significantly contribute to settling obligations more rapidly. Moreover, reaching out to lenders to negotiate lower interest rates or explore consolidation options can provide relief.

Lastly, staying committed and reminding yourself of your goals will keep you motivated throughout this journey. With dedication and the right strategies in place, it’s possible to eliminate outstanding amounts and achieve a healthier financial future.

Creating a Sustainable Budget Plan

Establishing a reliable financial plan is essential for anyone looking to regain control over their finances. A well-structured approach helps in managing expenses, setting realistic goals, and ensuring that you can meet your obligations while also saving for the future. This section will guide you through the basics of crafting a budget that not only fits your current lifestyle but also promotes long-term financial health.

Start with a Clear Picture: It’s crucial to get an overview of your income and expenditures. List everything that comes in and goes out each month. This transparency is the foundation of your budgeting efforts.

Identify Necessities and Luxuries: Once you have a grasp of your financial situation, categorize your expenses. Recognizing what you need versus what you want can help prioritize spending and highlight areas for potential cuts.

Set Realistic Goals: Aim for achievable objectives within your budget. Whether it’s savings milestones or reduced expenses, having clear targets keeps you motivated and focused.

Track Your Progress: Regularly reviewing your budget is vital. This practice allows for adjustments based on changing circumstances and helps keep your ambitions in check.

Be Flexible: Life is unpredictable, and your financial plan should accommodate unexpected developments. Embrace the idea of modifying your strategy as needed to maintain stability.

By following these guidelines, you can create a budget plan that supports your goals and makes it easier to manage your resources effectively over time.