Effective Strategies for Paying Off Your Credit Card Debt Efficiently and Quickly

Managing financial obligations can often feel overwhelming, especially when it comes to outstanding balances. Many individuals find themselves in situations where excess spending leads to a cycle of repayment that seems never-ending. Today, we’ll explore effective methods to alleviate those burdens, guiding you toward a more stable financial future.

It’s important to remember that you’re not alone in this journey. People from all walks of life face similar challenges, and there are proven techniques to regain control over your finances. Whether you’re aiming to reduce the total amount owed or seeking ways to simplify your repayment process, establishing a clear plan is essential.

In this discussion, we’ll delve into various approaches that can facilitate your journey toward financial clarity. By implementing these strategies, you’ll not only manage your obligations more effectively but also enhance your overall financial well-being. Let’s get started on this path together!

Understanding Your Credit Card Debt

Managing financial obligations can often feel overwhelming, especially when it comes to various forms of borrowing. It’s essential to grasp the factors that contribute to the amount you owe, as well as the impact this has on your overall financial health. By breaking it down into understandable parts, you can make informed decisions that will lead to a more secure financial future.

At the heart of financial commitments lies the concept of balance and interest. Knowing how these elements interact can significantly affect your journey toward regaining control. Additionally, various fees and penalties can accumulate, further complicating the situation. Being aware of these can help you avoid unnecessary costs and navigate your finances more effectively.

An important aspect of comprehending your obligations is recognizing the terms associated with them. This includes understanding payment cycles, minimum requirements, and the consequences of late submissions. By familiarizing yourself with these terms, you can develop a strategy that ensures timely and effective management of your fiscal responsibilities.

Ultimately, taking a proactive approach to your borrowed funds empowers you to overcome obstacles and make better financial choices. Gaining a clear perspective on what you owe and the mechanics behind it lays the groundwork for improved financial stability.

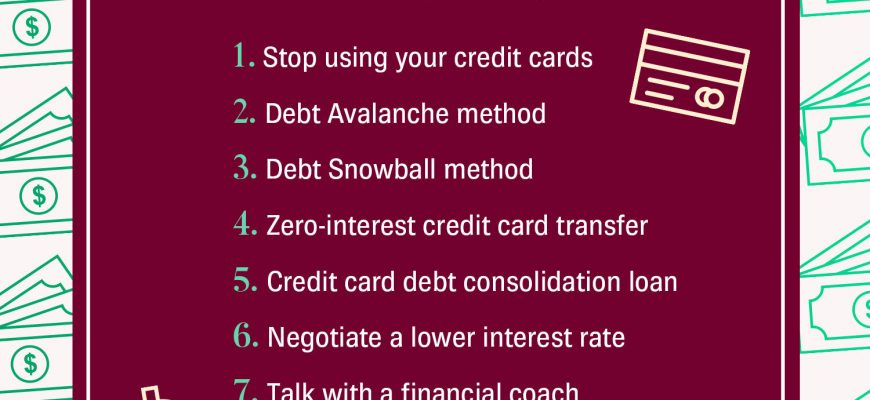

Strategies for Effective Debt Repayment

Managing financial obligations can feel overwhelming at times, but with the right approach, you can take control and work towards a brighter future. It’s about finding the right techniques that will make the journey smoother and more achievable.

Prioritize Your Balances – Start by identifying which debts have the highest interest rates. Directing your efforts towards these can save you money in the long run. Consider focusing on one at a time, which can provide a sense of accomplishment as you see progress.

Create a Budget – Establishing a solid budget is crucial. Track your income and expenses to determine where you can cut back. This freed-up cash can be dedicated to reducing your financial burdens more effectively.

Utilize the Snowball Method – This technique involves tackling smaller debts first to gain momentum. As each balance is cleared, you apply that same payment to the next one, creating a snowball effect that propels you forward.

Set Up Automatic Payments – To avoid late fees and missed deadlines, automate your repayments. This reliability not only simplifies your process but also helps to build a positive repayment history, which can boost your credit standing over time.

Consider Debt Consolidation – If it makes sense for your situation, merging multiple obligations into a single loan with a lower interest rate can streamline your efforts and potentially reduce overall payments.

Seek Professional Advice – Don’t hesitate to reach out for help. Financial advisors can provide tailored strategies based on your individual circumstances, offering insight that could lead to more effective resolution of your debts.

Embracing these strategies can empower you, turning what once felt like a mountain of worry into a manageable path toward financial freedom. Take the first step today!

Building Good Financial Habits

Establishing positive money management practices is essential for your overall financial well-being. These habits can help you navigate your finances more effectively, leading to reduced stress and improved stability. By focusing on what you can control and making intentional choices, you can pave the way for a secure and prosperous future.

Consistency is key. Developing a routine around your financial activities–like budgeting, tracking expenses, and setting savings goals–can make a significant difference. The more regular you are with these tasks, the more natural they will become, and you’ll find it easier to stay on top of your finances.

Another crucial aspect is understanding your spending patterns. Take a moment to analyze where your money goes each month. Recognizing unnecessary expenditures allows you to make informed adjustments to your lifestyle. This awareness not only empowers you, but also aids in making wiser financial choices moving forward.

Additionally, fostering an emergency fund can serve as a safety net during unexpected situations. Having a cushion of savings helps alleviate the burden of unforeseen expenses and provides peace of mind. Aim to set aside a portion of your income regularly until you grow a robust fund that can cover several months’ worth of expenses.

Finally, cultivating a mindset of growth is vital. Embrace opportunities to learn about personal finance–whether through books, podcasts, or workshops. Continuous education empowers you to make proactive decisions and adapt to changing circumstances. Remember, every little step taken toward better financial habits contributes to your long-term success.