Tips and Strategies for Paying Your Rent with a Credit Card

Many individuals today are exploring innovative avenues for handling their monthly living expenses. With the rise of digital financial solutions, people are increasingly interested in leveraging different methods to ease the burden of regular obligations. The convenience of technology has transformed traditional practices, allowing greater flexibility in managing finances.

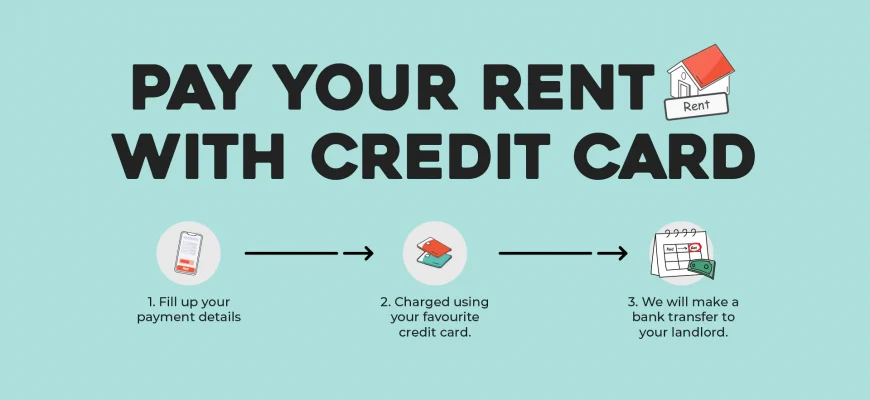

One option gaining traction is utilizing a specific type of financial tool that offers convenience and rewards. This approach not only streamlines the payment process but can also provide additional benefits, such as cash back or travel points, making the monthly obligation a bit more rewarding. It’s essential to understand the mechanics behind this method and how to implement it effectively.

In this guide, we’ll delve into the particulars of embracing this modern financial strategy. From selecting the right tool to navigating potential fees, we’ll cover everything you need to know to make informed decisions and optimize your financial experience.

Exploring Credit Card Payment Options

There are various methods to utilize financial instruments for settling monthly obligations, providing flexibility and convenience. Depending on your circumstances, countless platforms and services enable seamless transactions, allowing you to manage your expenses effectively.

One popular solution involves utilizing third-party services that accept various forms of financial instruments. These platforms often charge a fee for their services, but they can simplify the process significantly. Just remember to clarify the terms and conditions before proceeding.

Another alternative is to check if your landlord or property management company offers direct acceptance of financial instruments. This can save you the hassle of intermediaries and may come without additional costs. Always inquire about the available options when discussing your leasing agreements.

Regardless of the route you choose, being informed about potential fees, rewards programs, and interest rates is essential. Armed with knowledge, you can make a decision that suits your financial strategy while keeping your commitments in check.

Advantages of Utilizing Plastic for Housing Expenses

Using a financial tool to manage your housing obligations can offer several appealing benefits that might not be immediately obvious. This approach can enhance your budgeting strategy, making it easier to keep track of your expenses while providing some extra perks along the way.

One of the standout advantages is the opportunity to earn rewards or cashback on your transactions. Many financial institutions provide enticing programs that allow you to accumulate points or receive a percentage back on your spending, which can significantly benefit your overall financial goals. Why not earn something while meeting your obligations?

Additionally, handling housing expenses via a financial instrument can improve your credit rating over time. Regular, on-time payments contribute positively to your credit history, demonstrating your financial responsibility. This can lead to better financing options in the future, such as lower interest rates on loans or better credit limits.

Convenience is another factor to consider. Managing financial obligations can be quick and easy, especially with various payment platforms available today. It saves time and reduces the hassle of writing checks or handling cash. Plus, you have the flexibility to organize your expenses more efficiently.

Lastly, certain policies offer protections against fraud and unauthorized charges. This means your hard-earned money is safeguarded, giving you peace of mind as you manage your finances. Overall, exploring this means of transaction could enhance your financial experience significantly.

Potential Fees and Charges to Consider

When utilizing a card to make monthly housing payments, it’s important to be aware of any possible extra costs that could affect your overall budget. These additional expenses can come from various sources, and understanding them can help you make informed choices.

One common charge to watch out for is a convenience fee. Many landlords or property management companies impose this fee when tenants opt to use electronic payment methods. It’s typically a small percentage of the total amount due, but it can add up over time. Be sure to ask about this before proceeding.

Another aspect to keep in mind is interest rates associated with your plastic. If you don’t pay off your balance in full by the due date, you might incur hefty interest charges, which can negate any benefits gained from using your card. Maintaining a close eye on your spending will be essential to avoid unnecessary debt.

Finally, keep an eye out for potential transaction limits that some financial institutions may impose. If your payment exceeds these thresholds, you could face additional fees or even a declined transaction, which can be a hassle when you’re trying to meet deadlines.