A Comprehensive Guide to Paying Your Capital One Credit Card Bill

Navigating the world of finance can be a bit overwhelming, especially when it comes to fulfilling your monetary responsibilities. It’s essential to stay on top of your due dates and ensure that your accounts are in good standing. A proactive approach not only helps maintain a positive relationship with your financial institution but also strengthens your overall financial health.

Finding the right methods to settle your outstanding balances ensures peace of mind. With various options available, you can choose what suits you best, whether it’s online solutions, automated services, or traditional ways. The key is to understand the procedures that make the process seamless and straightforward.

In the following sections, we’ll explore the various avenues available for completing those important transactions. Whether you prefer high-tech options or a more hands-on experience, there’s something here for everyone. Let’s dive into the details and simplify this task so you can focus on what truly matters.

Methods for Settling Your Capital One Bill

When it comes to managing your monthly obligations, having various options at your disposal can make the process a lot easier. Whether you prefer the convenience of online transactions or the traditional approach of sending a check, there are multiple ways to keep your balance in check. Understanding these options ensures you can choose the one that best suits your lifestyle and preferences.

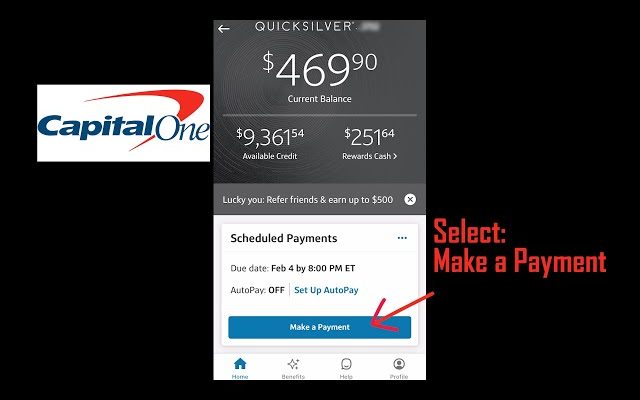

One of the simplest methods is utilizing online banking, which allows you to complete transactions at your convenience. Just log into your account, and you can quickly transfer funds. For those who enjoy using mobile technology, there are apps available that enable you to make payments right from your smartphone, offering even more flexibility.

If you prefer a more tangible approach, mailing a physical check is still an option. Just be sure to send it well before the due date to avoid any last-minute complications. Additionally, setting up automatic withdrawals can provide peace of mind, ensuring that payments are made on time without any extra effort on your part.

For those who appreciate the personal touch, you can visit a local branch or customer service center to settle your balance in person. This can be especially beneficial if you have questions or need assistance with your account. Each of these methods offers distinct advantages, allowing you to choose what works best for your financial routine.

Understanding Your Payment Options

Managing your financial responsibilities can be straightforward if you know the various methods available for settling your obligations. Exploring the different avenues for remitting funds can help you find a solution that fits your lifestyle and preferences. Each option carries its own benefits and may cater to specific needs.

You’ll discover that online transactions are a favored choice for many due to their convenience and speed. Simply access your account via a secure portal and follow the prompts to complete your transaction in just a few moments. This method allows for immediate updates to your balance, providing instant reassurance.

For those who prefer a more traditional approach, mailing a physical check remains a viable option. This method allows for a more tangible experience, although it does require additional time for processing. Ensuring your payment arrives on time is crucial, so plan ahead to avoid any late fees.

Another alternative is setting up an automatic withdrawal from your bank account. This ensures you never miss a deadline, taking the mental burden off your shoulders. Just be sure to monitor your finances regularly to keep everything in check.

Finally, you might consider using a mobile application that facilitates transactions. These apps often come with user-friendly interfaces and can streamline the process significantly. Whichever route you decide to take, having a clear understanding of what’s available to you will empower you to handle your finances more effectively.

Tips for Timely Payment Reminders

Staying on top of your financial obligations can sometimes feel overwhelming. Yet, being proactive about your responsibilities not only helps you avoid late fees but also contributes to a healthier financial outlook. Here are some smart strategies to ensure you never miss a deadline.

Set Up Automated Reminders: Leverage technology! Most financial institutions provide the option to schedule alerts. Whether through emails or text messages, these notifications can serve as gentle nudges when payments are due.

Organize Your Due Dates: Create a simple calendar specifically for your obligations. Mark important dates clearly, and consider using color codes to differentiate between various financial commitments. This visual representation can make it easier to stay informed.

Use Budgeting Tools: Keeping a close eye on your budget can prevent any unexpected surprises. Numerous apps can track your expenditures, making it easier to allocate funds for your upcoming responsibilities.

Set Up a Payment Strategy: Consider making smaller payments throughout the month rather than waiting until the last minute. This approach not only helps manage your cash flow but also reduces the risk of overspending.

Stay Informed: Regularly review your statements. Being aware of your balance and upcoming dues can empower you to make decisions that safeguard your financial health. Knowledge is key!

By implementing these straightforward practices, you can simplify your financial management and reduce stress related to on-time payments.