Effective Strategies for Successfully Negotiating Credit Card Debt

Finding yourself in a tough spot with overspending can feel overwhelming. Many individuals face challenges when managing their financial responsibilities, and the weight of outstanding balances can become a significant source of stress. Yet, it’s essential to remember that you’re not alone in this journey. In fact, there are effective strategies to transform a heavy burden into a more manageable situation.

Engaging in a dialogue with financial institutions may seem intimidating, but with the right approach, it can lead to surprising outcomes. This process is less about confrontation and more about establishing a mutually beneficial understanding. By preparing adequately and embracing open communication, you can pave the way for a resolution that restores your financial peace.

Ultimately, the aim is to reclaim control over your finances and explore options that work for your unique circumstances. Whether it’s revising payment terms or seeking alternative solutions, taking that first step can lead to a brighter financial future.

Understanding Your Financial Obligation

Facing a situation where you owe money on your financial tools can feel overwhelming, but it’s essential to grasp the nuances of your situation. Knowing the ins and outs of what you owe is the first step toward taking control. The more aware you are of your obligations, the better prepared you’ll be to address them.

Many people find themselves in this scenario due to various factors, such as unexpected expenses or mismanaged funds. It’s crucial to take a closer look at your current circumstances, including the total sum owed, interest rates, and any applicable fees. This understanding will empower you to evaluate your options more effectively and develop a plan that suits your financial landscape.

Additionally, recognizing how your payment history and outstanding balance affect your overall financial health can help you appreciate the severity of the situation. This knowledge not only provides clarity but also helps you articulate your position if you decide to seek assistance or explore alternatives for managing what you owe.

Strategies for Effective Negotiation

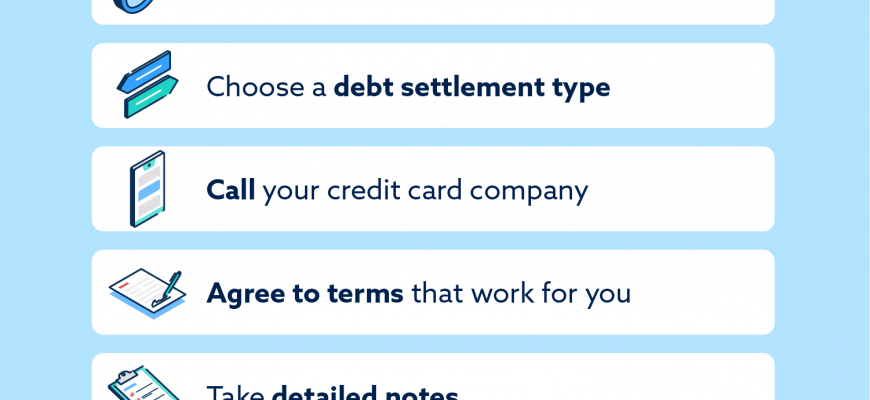

When it comes to managing financial obligations, having a solid game plan can make all the difference. It’s essential to approach discussions with a sense of preparedness and confidence. Armed with the right techniques, you can pave the way for more favorable outcomes and lessen the burden of what you owe.

First and foremost, gathering relevant information is crucial. Understand your financial situation inside and out, including your income, expenses, and any other outstanding responsibilities. This knowledge empowers you to articulate your position clearly and persuasively during talks.

Another key tactic is to establish rapport with the person on the other end. Treat them as a partner rather than an adversary. A friendly demeanor can foster goodwill, which might lead to more flexible terms. Everyone appreciates a pleasant conversation, and a positive interaction could work in your favor.

Timing is also vital. Find an appropriate moment to initiate a dialogue, preferably when the other party seems available and less pressured. Avoid busy periods or times when they’re likely to be overwhelmed with inquiries. Patience can pay off significantly.

Be honest about your situation, but also be strategic. It’s important to share your challenges, yet frame them in a way that highlights your commitment to managing responsibilities. This creates an impression of accountability and willingness to cooperate.

Lastly, don’t shy away from proposing your own solutions. Come prepared with a reasonable offer that you believe reflects your ability to settle the matter. Presenting an actionable plan demonstrates initiative and seriousness in addressing the matter at hand.

When to Seek Professional Help

Sometimes, managing financial obligations can feel overwhelming. Recognizing when you can no longer handle it alone is crucial. Assistance from experts can provide clarity and direction in turbulent times.

It’s wise to consider reaching out for support if you’re experiencing constant stress about your financial situation or if your monthly payments are becoming unmanageable. Signs such as receiving frequent calls from collectors or falling behind on bills are significant indicators that professional insight might be beneficial.

Additionally, if your attempts to resolve issues are met with resistance or confusion, seeking help can offer you a structured approach. Professionals possess the knowledge to devise a strategy tailored to your circumstances, ensuring that you take the right steps toward financial stability.

Taking action sooner rather than later can be pivotal. Remember, asking for help is a sign of strength, and many have found greater peace of mind through expert guidance.