Understanding the Amount of Financial Aid You Have Received

When it comes to pursuing higher education, navigating the world of support options can sometimes feel overwhelming. With various types of assistance available, it’s essential to get a clear picture of what resources are at your disposal. Many students find themselves uncertain about the levels of support they are eligible for and how to go about assessing their situation effectively.

Imagine embarking on a journey where the right guidance could lead to a fantastic opportunity. It’s all about uncovering the details that can significantly ease your financial responsibilities during your academic career. Whether it’s grants, scholarships, or other forms of support, understanding the scope of what is available can make a tremendous difference in your educational experience.

In this guide, we’ll walk through the steps to unravel the complexities surrounding your support options. With the right approach, you can confidently determine what assistance can be harnessed to make your educational dream a reality.

Understanding Your Financial Aid Package

Diving into the details of your assistance offer can feel overwhelming, but it’s crucial to grasp what’s available to you. Each package contains various components that can significantly impact your educational journey. Familiarizing yourself with these elements will empower you to make informed choices about funding your studies.

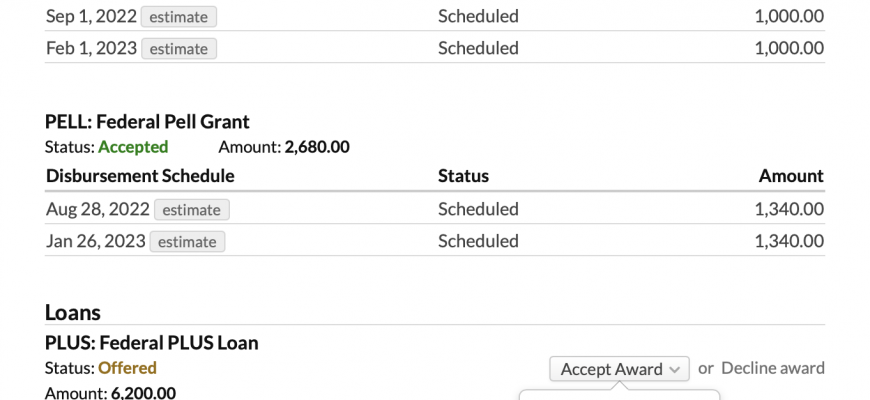

First things first, it’s essential to identify the different types of assistance included in your offer. This might encompass scholarships, grants, work-study opportunities, and loans. Each component serves a unique purpose, and knowing their distinctions can aid in strategic planning for your finances.

Next, take note of the amounts and any specific conditions tied to each type. For instance, some awards may be need-based, while others might reward academic excellence. Understanding the criteria will help you navigate your responsibilities and manage the resources effectively.

Finally, don’t forget to consider the long-term implications of accepting certain types of support. While grants and scholarships can ease the financial burden without requiring repayment, loans might pose future challenges. Evaluating these factors will ensure you choose the best options for your personal situation.

Key Sources of Financial Assistance

For many, managing educational costs can be challenging, and it’s essential to explore various avenues for support. Diverse resources are available to help ease the burden, often tailored to different situations and backgrounds. Understanding where to look can make a significant difference in accessing the necessary funds.

Scholarships are one of the most sought-after forms of support. They often come from institutions, private organizations, or community groups, and don’t require repayment. This type of funding is usually competitive, so showcasing achievements and unique qualities can help stand out.

Grants represent another valuable option. Typically provided by government entities or educational institutions, these funds are often based on financial circumstances and do not need to be repaid. Investigating federal and state programs can unveil opportunities that many might overlook.

Loans can also be a realistic consideration. While this type of assistance requires repayment, they often come with lower interest rates and flexible repayment plans. Numerous lenders offer specific programs aimed at students, making it easier to manage costs over time.

Employment opportunities, such as work-study programs, enable individuals to earn money while pursuing their studies. This approach not only helps finance education but also provides valuable work experience, enhancing skills for future careers.

Lastly, private organizations and foundations may offer a range of unique funding options. Many focus on specific fields of study, demographics, or career goals, creating opportunities that align with personal aspirations.

Steps to Calculate Your Assistance Amount

Determining the total resources available can seem challenging, but breaking it down into manageable stages makes the process easier. Everyone’s situation is unique, so customizing your approach is essential. Following a clear series of actions can guide you toward understanding your support better.

1. Gather Financial Documents: Start by collecting your income tax returns, W-2 forms, and any other relevant financial statements. These documents provide a foundation for the evaluation of your resources.

2. Understand Eligibility Criteria: Familiarize yourself with various programs and their specific guidelines. Knowing the requirements will help you identify which options apply best to your circumstances.

3. Use Estimators: Many institutions offer online calculators designed to estimate potential support based on your provided information. These tools can give you a preliminary sense of what to expect.

4. Review Cost of Attendance: Take a close look at tuition fees, living expenses, and other necessary costs associated with your program. This full picture will help you assess your needs more accurately.

5. Analyze Your Contribution: Be honest about personal savings, earnings from employment, or other resources you can tap into. Understanding your input is crucial for a complete picture.

6. Contact Support Services: If you’re still unsure, reach out to your institution’s support services. They’re there to assist you and can clarify any complex terms or figures.

By taking these steps, you’ll move towards having a clearer understanding of the assistance available to you. Each part plays a role in creating a comprehensive overview of your situation that can guide your decisions moving forward.