Tips for Effectively Managing and Maintaining Your Credit Card

In today’s fast-paced world, having a small piece of plastic that offers convenience and purchasing power is a game-changer. But with great power comes great responsibility. Knowing how to navigate this financial tool can make a significant difference in your everyday life.

It’s essential to foster a healthy relationship with this financial instrument to reap its benefits while avoiding potential pitfalls. Understanding the ins and outs of usage, along with strategic approaches for maintaining its benefits, sets you on the path to financial wellness.

Staying informed and making mindful choices can lead to enhanced financial security and peace of mind. Let’s explore some practical tips to ensure that your plastic companion serves you well in your journey towards financial freedom.

Essential Tips for Financial Management

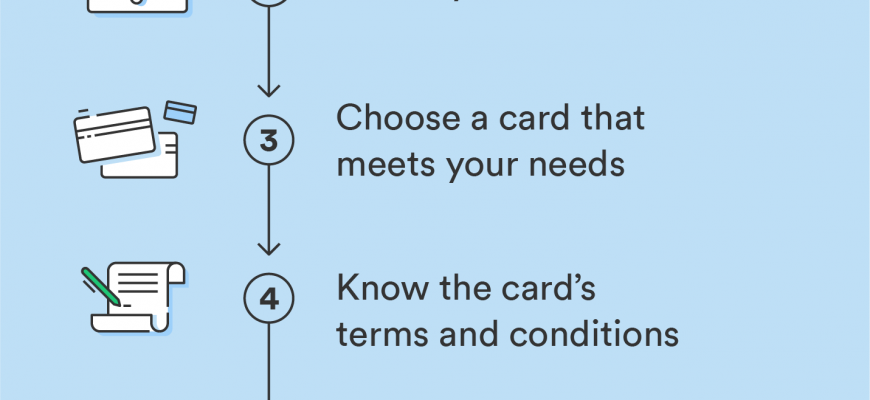

Managing your financial tools effectively is crucial for maintaining a healthy monetary life. With the right strategies, you can ensure that your accounts serve you well, providing benefits without leading to unnecessary stress. Let’s explore some fundamental advice that can guide you toward smart decisions.

First and foremost, always stay informed about your spending habits. Keeping track of expenditures can help you make better choices and avoid overspending. Regularly reviewing your statements allows you to categorize expenses and pinpoint areas where you can cut back.

Another critical aspect is making timely payments. Setting up reminders or automating your bill payments can prevent late fees and potential interest rate hikes. Timeliness also reflects positively on your financial profile, which can be beneficial in various situations.

Don’t overlook the importance of understanding the terms associated with your financial tools. Familiarize yourself with interest rates, fees, and rewards programs. This knowledge empowers you to utilize your accounts more effectively–maximizing benefits while minimizing costs.

Additionally, consider maintaining a healthy balance. Utilizing a sensible percentage of your limit can enhance your overall financial standing. Strive to pay off outstanding amounts in full whenever possible to avoid interest accumulation and maintain good standing.

Lastly, regularly reviewing your financial approach enables you to make adjustments as needed. Reflect on your goals and circumstances, and be ready to pivot if certain strategies aren’t working well. Proactive management can lead to greater stability and freedom in your monetary decisions.

Understanding Interest Rates and Fees

When it comes to managing a financial instrument, it’s crucial to grasp the nuances of rates and additional charges. These elements can significantly impact your overall balance and choice of usage. Recognizing how they work will not only save you money but also enhance your financial decision-making.

Let’s break down these concepts:

- Interest Rates: This is the cost you incur for borrowing funds. It’s typically expressed as an annual percentage and can vary based on several factors such as creditworthiness and market conditions.

- Annual Fees: Some financial tools come with a yearly charge for maintenance and membership. Always check if the benefits justify this cost.

- Transaction Fees: Certain transactions may incur additional costs, especially if you make purchases in a foreign currency or exceed your allotted limit.

- Late Payment Fees: Missing a payment can lead to hefty fines. Timely payments can help you avoid these extra charges.

Understanding these charges is essential for practical financial management. Always read the terms carefully and stay informed about any changes that may occur. Knowledge is power, and being educated can lead to more favorable financial outcomes.

Building Credit History Responsibly

Creating a solid financial foundation is essential for anyone looking to navigate the world of personal finance. Making informed choices can significantly impact your financial future, especially when it comes to establishing a trustworthy reputation among lenders. This journey involves understanding how to manage your financial tools wisely, ensuring that you are seen as a reliable borrower.

First, it’s crucial to understand that timing and utilization play a significant role in this process. Regularly using your financial resources for small purchases and paying them off promptly not only demonstrates responsibility but also shows that you can manage your obligations effectively. This practice helps in cultivating a positive record over time.

Additionally, keeping track of your spending habits is equally important. By regularly monitoring your transactions, you empower yourself to make better decisions while avoiding potential pitfalls. Setting reminders for payment due dates can prevent missed payments, which can negatively affect your standing.

Another effective strategy involves diversifying your financial engagements. Engaging with different products can showcase your ability to handle various commitments. However, it’s vital to ensure that any new financial engagement aligns with your overall strategy and does not lead to unnecessary debt.

Lastly, reviewing your credit report periodically allows you to stay informed about your progress and catch any discrepancies early. Addressing any issues promptly can help you maintain a clean slate, leading you toward achieving your financial goals seamlessly.