A Comprehensive Guide to Becoming a Member of a Credit Union

Ever wondered about the unique world of cooperative financial institutions? These member-focused organizations offer a refreshing alternative to traditional banks, providing a sense of community and a range of personalized services. As you explore the possibilities, you may discover a welcoming environment where individuals pool their resources for mutual benefit.

Becoming a part of this community can open doors to various financial opportunities. From competitive loan rates to personalized savings plans, the advantages are plentiful. But the process of becoming a member isn’t a mystery; it simply requires a few straightforward steps to embark on your journey toward financial collaboration.

As you delve into this inviting realm, you’ll find that the emphasis on member satisfaction sets these institutions apart. Whether seeking assistance with your savings or looking for a loan, the cooperative spirit thrives here, ensuring that your needs are prioritized. Let’s explore the essential steps to becoming part of this enriching experience!

Understanding Savings Cooperatives: Benefits and Features

When exploring alternative financial institutions, it’s essential to grasp what makes these community-focused organizations stand out. They’re more than just places to park your funds; they offer a unique approach to banking that emphasizes member benefits over profit maximization. This collaborative model fosters a sense of belonging and encourages a more personal banking experience.

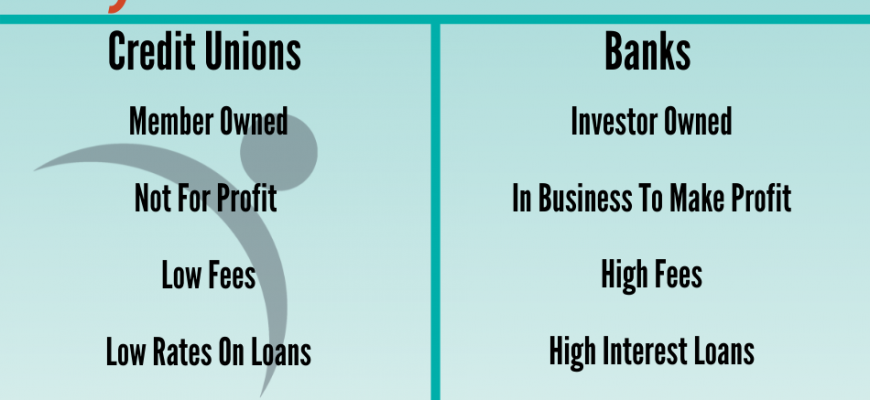

Access to Lower Fees and Rates: One of the most appealing aspects of these establishments is the potential for lower costs. Without the burden of shareholder expectations, they often provide more favorable loan rates and reduced fees, allowing members to save money in the long run.

Personalized Service: Members are not just account holders; they’re part of a family. This inherently personal touch means you can expect attentive service tailored to individual needs. Staff members are often more invested in your financial well-being, leading to stronger relationships.

Community Focus: These organizations prioritize local needs, often reinvesting profits back into the community. This commitment can result in various programs and services that directly benefit the local population, strengthening the community as a whole.

Member Engagement: Being part of such an organization invites opportunities for involvement. Members can have a say in critical decisions, influencing the offerings and policies that affect them. This democratic approach fosters a sense of ownership that is often lacking in traditional banks.

Financial Education: Many of these institutions provide resources and workshops aimed at improving financial literacy. This focus on education empowers individuals to make informed financial decisions, paving the way for better money management.

In summary, the attributes of these establishments–lower costs, personalized interactions, community involvement, member engagement, and emphasis on financial education–create a rich fabric that enhances the overall banking experience. Embracing such a financial partner can lead to significant advantages for individuals and the wider community alike.

Eligibility Criteria for Membership

Understanding the requirements for becoming a member of a financial cooperative is essential for anyone considering this option. Each organization has its own set of rules and guidelines that dictate who can become a part of their community. These criteria usually stem from specific affiliations, including employment, geographical location, or shared interests.

Most often, agencies look for connections to certain groups or regions. For instance, if you work for a particular company or reside in a designated area, you might be in luck. Additionally, some institutions focus on specific professions or industries, inviting individuals from those fields to participate. It’s important to explore these associations, as they can significantly influence eligibility.

Many cooperatives also take into account familial ties. If you have a relative who is already a member, you may have a smoother path to gaining access. This approach fosters a sense of community and support among members, creating a more connected environment.

Don’t forget to check whether there are any financial requirements or minimum deposit mandates that might apply. Understanding these aspects will help you better prepare for the process ahead, ensuring a smooth and informed transition into this type of financial system.

Steps to Successfully Apply for Membership

If you’re looking to become part of a cooperative financial organization, you’re in for a rewarding experience. The process involves several straightforward actions that will help you navigate the journey toward membership with ease. Here’s a simple guide to get you started.

First up, gather your essential documents. Typically, you’ll need identification, proof of address, and sometimes even income verification. Having these items ready will streamline your application process.

Next, research different organizations to find one that aligns with your values and financial needs. It’s important to understand their mission, services, and membership criteria, as these can vary widely.

Once you’ve chosen the right fit, filling out the application is your next step. Many organizations offer online forms for convenience. Be sure to provide accurate information, as this can speed up your approval.

After submitting your application, keep an eye on your email or inbox for any follow-up communication. They might need additional information or documents, so staying responsive is key.

Finally, once you’re welcomed aboard, you’ll often have the opportunity to attend an orientation. This is a great chance to learn more about the available services, benefits, and how to get the most out of your new membership.