Tips and Guidance for Joining a Credit Program

Engaging with various financial solutions can open new doors to managing your resources effectively. The landscape of funding is vast, filled with opportunities to enhance your purchasing power and invest in your personal goals. Understanding the essentials of these options is crucial for making informed decisions.

For many, stepping into the world of financial services might seem daunting at first. Yet, with the right approach and a bit of knowledge, navigating this terrain can become much simpler. From understanding terms and conditions to exploring different plans, it’s about finding what aligns best with your ambitions and needs.

Whether you’re considering a specific facility for personal use, or aiming to improve your financial standing, exploring available pathways can be rewarding. Let’s delve into the process of becoming a part of this expansive financial ecosystem, ensuring you make choices that serve your interests well.

Understanding Credit Union Benefits

Have you ever considered the perks of being part of a financial cooperative? These organizations offer a unique set of advantages that can enhance your banking experience. Members often find themselves enjoying lower fees, better interest rates, and a more personal touch when it comes to service.

One of the standout features is the focus on members rather than profits. Unlike traditional banks, which are driven by shareholder interests, these cooperatives prioritize their members’ needs. This often leads to more favorable terms on loans and savings accounts.

Additionally, community involvement is a significant aspect of these institutions. Many focus on supporting local initiatives and fostering a sense of belonging among their members. This connection creates a welcoming atmosphere where individuals can feel valued and engaged.

Another important benefit is access to a range of financial products tailored to suit various lifestyles. From personal loans to specialized savings accounts, there are options available that can help you achieve your financial goals more effectively.

In summary, being part of a financial cooperative comes with numerous advantages that can enhance your overall financial well-being. With a focus on member satisfaction, community engagement, and diverse product offerings, these institutions present a compelling alternative to traditional banking.

Steps to Become a Member

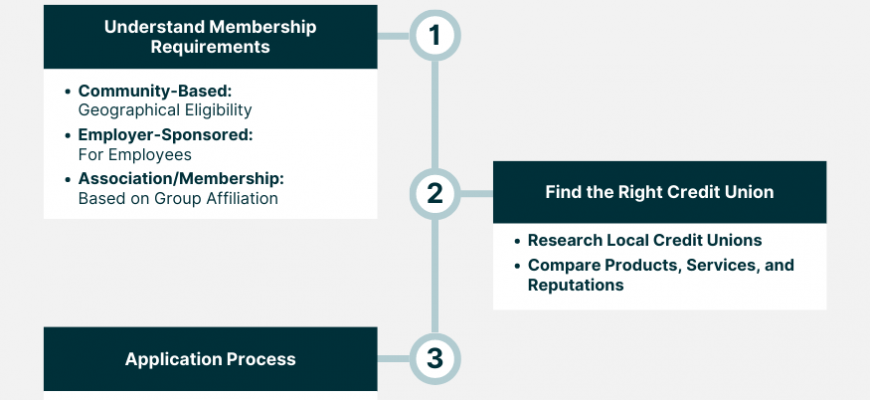

Embarking on the journey to become part of a financial collective can be an exciting opportunity. This process typically involves a few key actions that help establish your connection and ensure you make the most of the offerings available. Take your time and follow these steps to seamlessly integrate into the community while enjoying the benefits it brings.

First, it’s essential to research the various organizations that align with your financial needs and goals. Compare their services, membership requirements, and overall reputation. This will give you a better understanding of where you fit in and which community resonates with your aspirations.

Once you’ve identified a suitable option, the next step involves gathering the necessary documentation. This may include personal identification, proof of residence, and financial statements. Preparing these documents in advance will streamline the process and help you avoid any unnecessary delays.

After assembling your paperwork, reach out to the chosen organization. Many offer online platforms for applications, but you may also find options for in-person visits or phone consultations. Make sure to follow any specific guidelines they provide to ensure your submission meets all necessary criteria.

Once you’ve submitted your application, be patient as it undergoes review. This typically involves a verification process where they assess your eligibility and fit for the community. Stay informed by checking your email or the organization’s website for updates.

Finally, once your application is approved, take the time to explore the resources and benefits available to you as a new member. Engage with the community, attend events, and make the most of the financial tools offered. Embrace this new chapter and use your membership to secure a brighter financial future.

Managing Your Credit Account Effectively

When it comes to overseeing your borrowing relationship, staying organized and informed is key. It’s all about making smart choices that can help you maintain a healthy balance between your obligations and your financial freedom. The more proactive you are, the better you’ll navigate the maze of payments, interest rates, and benefits available to you.

Regularly monitoring your statements is essential. Keeping an eye on your transactions can protect you from unauthorized charges and ensure you’re aware of your spending habits. Setting up alerts for due dates can also save you from late fees and potential penalties, helping you stay on top of your commitments.

Furthermore, it’s wise to make payments that exceed the minimum required amount when possible. This approach helps reduce your outstanding balance faster, which can positively impact your overall standing. Additionally, understanding the terms of your agreements allows you to leverage the advantages offered, whether that’s cash back, rewards points, or other perks.

Lastly, don’t hesitate to reach out to customer service if you have questions or concerns. Building a rapport with your financial institution can provide added insight and support as you manage your account. With a bit of diligence and awareness, you can effectively steer your financial path in a positive direction.