Tips and Strategies for Securing a Loan Without a Credit History

Finding financial assistance can feel overwhelming, especially when traditional avenues seem out of reach. Many individuals face challenges when trying to access necessary resources due to a lack of established financial records. It’s important to know that there are routes available, even for those who might not have a robust history of borrowing.

In today’s world, various alternatives cater to those seeking to improve their situations despite the absence of a traditional financial background. Understanding these options can open doors that once seemed closed. From personal arrangements to innovative services, there are ways to navigate this landscape effectively.

If you’re looking to explore these possibilities, it’s essential to approach the process with an informed mindset. Familiarizing yourself with the different methods can empower you to make confident decisions. Equip yourself with knowledge, and you’ll find that opportunities abound, no matter your past.

Understanding Your Loan Options

Exploring the various avenues for financial assistance can be a bit daunting, especially when traditional paths aren’t available. It’s essential to familiarize yourself with the different alternatives that can help you meet your monetary needs. Each choice has its own unique characteristics, benefits, and potential pitfalls.

Peer-to-peer lending is one option where individuals lend money to one another, bypassing banking institutions. This approach often offers more flexibility in terms of eligibility requirements, making it an appealing choice for those facing challenges elsewhere.

Another solution could be secured loans, where you offer an asset, like a vehicle or property, as collateral. This method not only improves your chances of approval but can also lead to better interest rates, although it does come with the risk of losing your asset if repayments fall behind.

Credit unions might also be worth considering. These member-owned financial organizations sometimes provide more lenient lending conditions compared to traditional banks, focusing on community support and member relationships rather than just credit scores.

Finally, it’s wise to look into microloans. These smaller lending amounts are often offered by non-profits or community organizations, specifically designed to assist those who may struggle to secure funding through conventional means. Understanding your options is the first step toward making an informed decision that best fits your situation.

Building Credit for Future Loans

Establishing a solid financial foundation is essential for those looking to enhance their borrowing capabilities down the line. A good track record can open many doors and provide peace of mind when seeking funding opportunities. It’s all about creating a positive history, showing that you’re responsible with financial obligations, and making informed decisions.

One effective approach is to start small. Secured cards are a great tool for beginners. By depositing a certain amount, you can borrow against it, ensuring the issuer that you’ll pay back what you spend. This method not only builds trust but also offers a chance to practice spending wisely.

Another strategy is to consider becoming an authorized user on someone else’s account. This can be especially beneficial if the primary account holder has a good standing. You’ll effectively inherit their positive payment history, which can help in your journey to establish a respectable profile.

Managing monthly expenses responsibly is crucial too. Paying bills on time has a significant impact. Whether it’s utilities or subscriptions, consistent on-time payments contribute positively to your overall financial picture, showcasing reliability to potential future lenders.

Finally, staying informed about your financial progress is vital. Regularly checking your report allows you to track improvements and identify areas that may need attention. It’s all part of becoming more financially savvy and positioning yourself for favorable borrowing opportunities in the future.

Tips for Improving Approval Chances

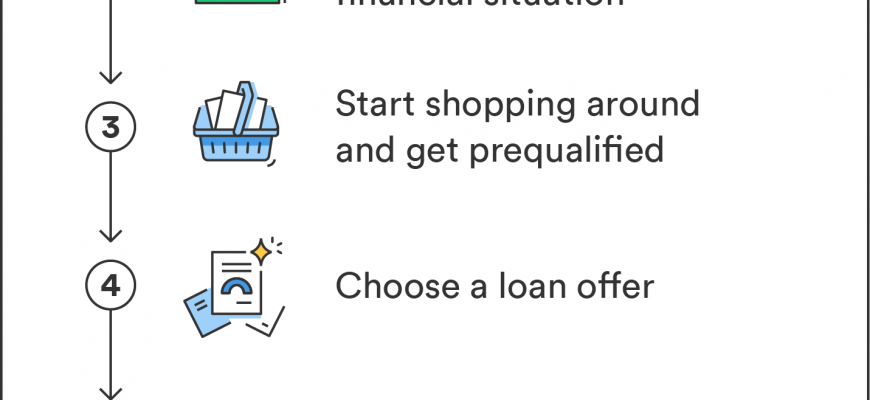

Securing funding when your financial history is limited or lacking can be challenging, but there are smart strategies to enhance your likelihood of success. Focusing on preparation and understanding what potential lenders are looking for can make a significant difference.

First and foremost, having a solid plan helps. Clearly outlining why you need the funds and how you intend to use them shows responsibility and foresight. This can instill confidence in those assessing your application.

Next, gathering necessary documentation is crucial. Providing proof of income, employment stability, and any assets can demonstrate your ability to repay. Even if your financial background is thin, showing a steady source of income can work in your favor.

Consider finding a co-signer. This person can vouch for your reliability and may provide the reassurance lenders need. A co-signer with a strong financial history can lend additional credibility to your request.

Improving your financial habits, even slightly, can have a big impact. Budgeting effectively, avoiding debt where possible, and saving can all create a positive impression. These actions indicate to lenders that you are committed to financial responsibility.

Lastly, exploring various lending options is advisable. Not all institutions have the same criteria, so researching different avenues could uncover opportunities that align better with your situation.