Effective Strategies for Securing a Loan Even with Poor Credit History

Facing financial hurdles can be a daunting experience, especially when previous setbacks might come into play. It often feels as though traditional avenues for assistance are closed off. However, there are alternatives out there that can provide the support you need, even if your history isn’t pristine.

Understanding the landscape of options available can empower individuals to make informed decisions. It’s essential to explore various resources and strategies that can lead to a favorable outcome. By arming yourself with the right knowledge, these challenges can become manageable stepping stones toward a brighter financial future.

Embracing a proactive mindset and seeking out tailored solutions can pave the way for success. With a little research and the right approach, overcoming financial difficulties is within reach for anyone willing to take the first step.

Understanding Subpar Financing Options

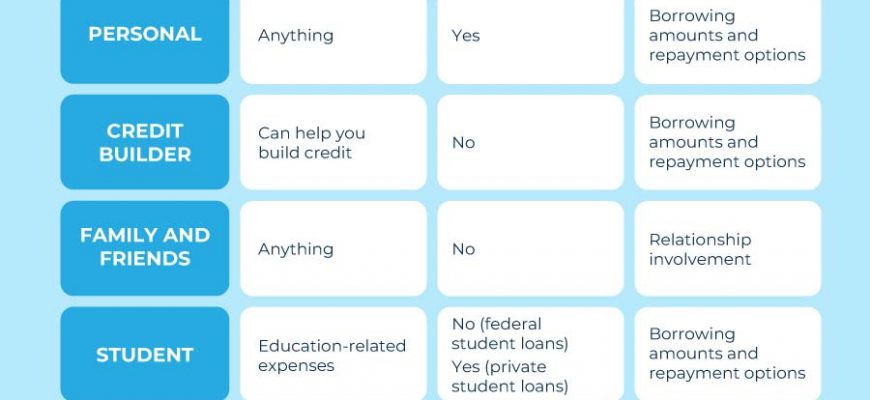

Getting funds when your financial history isn’t perfect can feel daunting, but it’s essential to explore the possibilities available out there. It’s not always a straightforward process, but knowing what to look for can make it easier. Various types of lenders cater to individuals facing credit challenges, making it feasible to secure financial support even if past circumstances have been less than ideal.

These specific financial products often come with unique terms and conditions. They may have higher interest rates or additional fees, which is something you’ll want to consider carefully. It’s crucial to evaluate each option thoroughly, ensuring that the cost of borrowing aligns with your budget and repayment capabilities. Transparency in understanding the terms will help you make informed choices.

Moreover, working on improving your overall financial stability can open up better opportunities in the future. Engaging with lenders who specialize in this niche can provide insights not only into immediate funding but also into steps you can take moving forward. Every small improvement can make a difference, transforming your financial landscape over time.

Alternative Lenders for Bad Credit

When traditional financial institutions turn you down, there are still options available that can offer assistance. These alternatives may provide different criteria for evaluation, focusing more on your current situation rather than past challenges. Understanding these choices can help you navigate your financial needs effectively.

Peer-to-Peer Lending platforms have emerged as a popular choice. They connect individuals seeking funds directly with those willing to lend, often without the strict requirements of banks. This can lead to more flexible terms and personalized attention, allowing for a better fit based on your circumstances.

Online Personal Loans are also an avenue worth exploring. Many online lenders have simplified their processes and offer quicker approvals. They might take a more holistic approach by considering factors beyond your financial history, making them a viable alternative.

Another intriguing option is Credit Unions. These member-owned institutions often have local ties and may provide more favorable terms to their members, especially those facing difficulties in securing funds elsewhere. Joining a credit union can be a beneficial step if you’re looking for a supportive financial environment.

Lastly, Secured Loans are something to consider if you have assets to leverage. By using collateral, you might increase your chances of approval, even when your financial background isn’t perfect. Just be cautious, as failure to repay could result in losing the asset.

Exploring these various opportunities can open doors to financial assistance you didn’t think were possible. Remember to assess your options carefully and choose the one that aligns best with your needs and capabilities.

Improving Your Chances of Approval

When seeking financial assistance, it’s essential to take steps that can enhance your likelihood of receiving a positive response. By focusing on certain strategies and adjustments, you can position yourself more favorably in the eyes of lenders. Understanding what factors play a significant role in decision-making can make a notable difference in your experience.

Start by checking your existing standing. Obtain a report to see what information is out there and ensure there are no errors that could weigh you down. Correcting inaccuracies can significantly boost your profile. Additionally, consider paying off small debts. Clearing these obligations can demonstrate responsible financial behavior and improve your overall standing.

Another effective way to improve your position is by presenting proof of a stable income. Lenders appreciate seeing a consistent flow of funds, as it suggests that you can manage repayments reliably. Providing documentation, such as pay stubs or bank statements, can help reinforce this point.

Engaging a co-signer can also be a strategic move. Having someone with stronger financial health to back you up can instill more confidence in lenders. Just be sure that both parties understand the responsibilities involved in this arrangement.

Ultimately, demonstrating a willingness to work toward financial stability can greatly impact decision-makers. Whether it’s saving up for a larger down payment or actively seeking to improve your financial habits, these actions show commitment and reliability, increasing your chances of receiving affirmative responses.