A Comprehensive Guide to Freezing Your Credit for Enhanced Security

In today’s world, safeguarding your financial identity is more crucial than ever. With the rise of digital transactions and online services, ensuring that your personal information remains secure is key. You might wonder about the best strategies to keep potential threats at bay and maintain control over your financial profile.

Taking proactive steps to limit access to your financial history can serve as a strong defense against identity theft. Understanding the mechanics behind this protective measure can empower you to make informed decisions about your finances. After all, in the realm of financial security, knowledge is a powerful ally.

So, let’s explore the methods and benefits associated with this essential practice. By learning how to effectively manage access to your financial information, you can sleep easier, knowing you have taken the necessary steps to protect what is rightfully yours.

Understanding Credit Freezes and Their Importance

In today’s world, safeguarding personal financial information has become essential. As individuals navigate the complexities of identity protection, certain measures emerge as vital tools. One such strategy involves implementing restrictions on access to sensitive financial data, preventing unauthorized entities from exploiting it.

This method serves as a protective barrier, ensuring that only authorized individuals can initiate new accounts or loans under your name. By taking this precaution, you can significantly reduce the risk of falling victim to fraud. It’s not just about being cautious; it’s about taking proactive steps to preserve your financial integrity and peace of mind.

Understanding this approach is crucial, especially as the digital landscape evolves and threats become more sophisticated. By familiarizing yourself with these protective measures, you empower yourself to maintain control over your financial future while also deterring potential risks associated with identity theft.

Step-by-Step Guide to Freezing Credit

In today’s world, protecting personal financial information is vital. Taking proactive steps can help safeguard your identity and prevent unauthorized access. This section provides clear, actionable instructions to secure one’s financial profile effectively.

First, gather necessary details such as your Social Security number, addresses, and other identifying information. Make sure to have a reliable form of identification on hand, like a driver’s license.

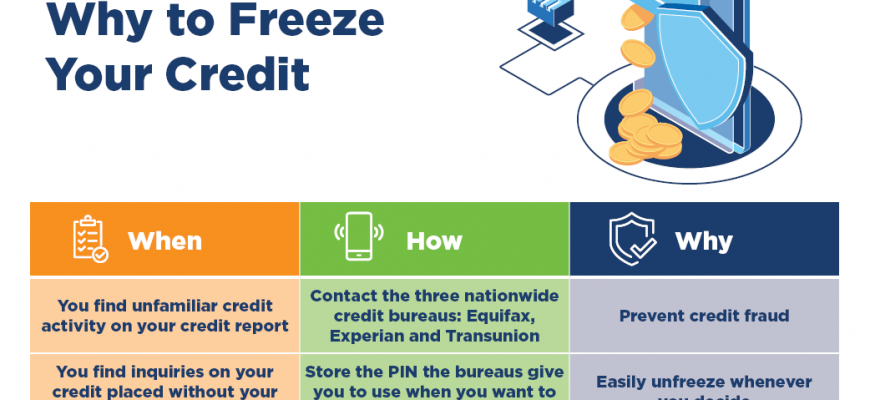

Next, reach out to each of the three major bureaus: Experian, Equifax, and TransUnion. Each agency has its own process, so it’s essential to follow specific instructions they provide. You can manage most tasks online, but phone options are available too.

Once contacted, request the restriction on your account. Be prepared to verify your identity through various questions or codes sent to your phone or email. Some companies may require additional documentation, so stay organized.

After submitting your request, expect to receive confirmation. This is often communicated via email or postal mail. Keep this information safe; it may be necessary for future transactions or unlocking your account.

Finally, remember to maintain updates. If you change addresses or get a new phone number, inform the agencies promptly. Regularly reviewing your accounts can also help you catch any anomalies early.

Following these steps will empower individuals to take charge of their financial security, ensuring peace of mind in an increasingly digital age.

Managing Finances After Securing Protection

Once you’ve taken steps to safeguard your financial identity, it’s essential to stay proactive in managing your financial health. It’s not just about locking things down; it’s also about knowing how to navigate through your financial landscape efficiently. By doing so, you ensure that your finances remain in good standing while remaining protected from potential threats.

First up, keep tabs on all your accounts. Regularly checking statements can help you quickly detect any unusual activity. Setting up alerts or notifications can also be beneficial, ensuring you’re immediately informed of any transactions or changes. Awareness is key, and you want to remain in control of your financial situation.

When it comes to applying for new lines of credit or loans, remember that you’ll need to temporarily lift those protective measures. Take note of how to do this through the institutions you originally interacted with. Make sure to plan ahead, especially if you have a specific timeline or goal in mind, so you’re not caught off guard.

Don’t forget that managing your finances is a long game. Continue to enhance your financial literacy. Understanding how different factors, like payment history and credit utilization, affect your standing is vital. Consider seeking out resources or consulting professionals to gain deeper insights.

Lastly, always maintain open lines of communication with creditors. If you encounter any issues, reaching out and discussing your concerns can often lead to workable solutions. Strong relationships with your lenders can provide additional peace of mind as you move forward with a secured identity.