A Comprehensive Guide to Freezing Your Credit Using Experian for Enhanced Security

In today’s world, safeguarding personal information is more important than ever. With the rise of digital transactions and the increasing sophistication of cyber threats, many individuals are looking for ways to ensure that their financial data remains protected. Among various strategies available, one approach stands out for those seeking greater peace of mind concerning their financial identity.

This method involves temporarily restricting access to your financial profile, preventing unauthorized use and giving you a greater sense of control. It’s a proactive measure designed to deter potential fraudsters and secure your sensitive details from prying eyes. Many people find themselves considering this option to strengthen their financial defenses, especially after experiencing a data breach or other unsettling security incidents.

Engaging in this process can be straightforward if you know the right steps to take. In this article, we’ll explore a simple yet effective pathway to implement this protective strategy. It’s all about taking charge of your financial well-being and ensuring that your information stays safe, so you can focus on other aspects of your life without unnecessary worry.

Understanding Credit Freezing Process

Taking steps to safeguard personal financial information is essential in today’s world. The process you’re looking to grasp involves creating a barrier that prevents unauthorized access to sensitive financial data. By doing this, individuals can add an extra layer of security, ensuring their identities remain protected from potential misuse.

At its core, this method entails a straightforward series of actions. You usually begin by gathering necessary details such as identification and additional documents. These materials play a crucial role in establishing your identity and confirming your legitimacy during the request phase.

Once the required information is prepared, you’ll initiate the request through a designated platform. This action typically involves filling out an online form or making a phone call. Following your submission, the organization processes your request, often providing a confirmation that the protective measure is now active.

This approach not only enhances security but also empowers individuals to regain control over their financial journeys. The ability to enable or disable this protection gives users confidence in managing their personal information and guarding it against potential threats.

In summary, understanding this protective measure allows you to navigate the complexities of personal finance with greater ease. By adopting these strategies, you ultimately take significant strides toward securing your financial future.

Benefits of Temporarily Halting Access to Your Financial Records

Taking steps to limit access to your personal financial information can offer significant peace of mind. This action serves as a proactive measure, preventing unauthorized individuals from making financial decisions using your details. It’s not merely about securing your assets; it’s about reclaiming control over your own information.

One of the major advantages is the protection it offers against identity theft. When your information is safeguarded, it becomes exceedingly difficult for fraudsters to open new accounts or make purchases in your name. This essentially adds a layer of security, making it much harder for illicit activities to take place.

Another notable benefit is the convenience it provides. In the event you wish to apply for new services or loans in the future, you can easily reinstate access as needed. This flexibility allows you to manage your financial affairs on your terms, without being constantly vulnerable to risks.

Additionally, this action can foster a greater sense of financial awareness. By engaging with your personal information and taking steps to limit accessibility, you become more in tune with your financial status and any potential risks. This knowledge empowers you to make smarter choices regarding your finances.

Ultimately, choosing to restrict access to your financial records not only safeguards your identity but also enhances your overall financial management approach. It cultivates a proactive mindset, ensuring that you are always a step ahead in protecting what is rightfully yours.

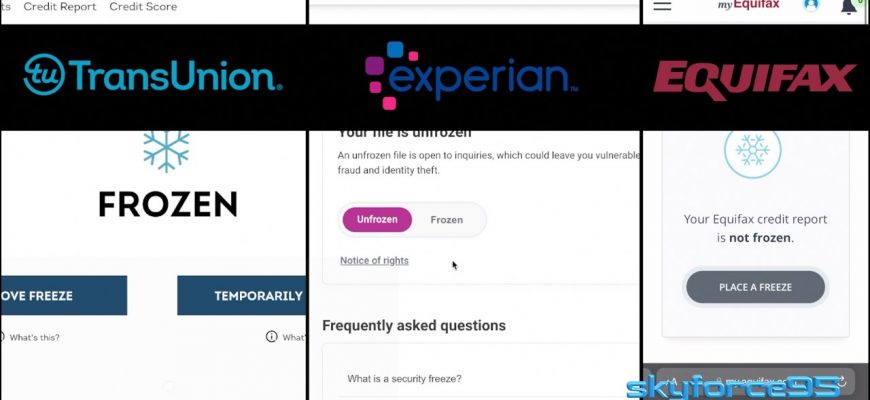

Step-by-Step Guide to Experian

This section is all about navigating the process of securing your financial identity. Whether you want to safeguard yourself from unauthorized access or simply wish to take a proactive stance in managing your financial affairs, understanding the steps involved is key. Let’s break it down so you can easily follow along and ensure your information remains protected.

First things first, you’ll need to gather some personal information. This includes your name, address, Social Security number, and other identifying details. Having this info ready will make the subsequent steps much smoother.

Next, visit the official website of the relevant agency. Look for the section dedicated to accessing security measures. You’ll likely find an option that allows you to initiate the protective process. It’s designed to walk you through the necessary actions without any hassle.

Once you’re on the right page, you’ll be prompted to enter your personal details. Make sure everything is accurate, as this will be crucial in verifying your identity. After submitting your information, you may receive a confirmation via email or text. Keep this handy for future reference.

The next stage usually involves setting up a personal identification number or password. This will help you manage your account going forward, so choose something secure that you can easily remember. It’s important to protect this information closely.

Finally, you might receive additional instructions or options for monitoring your accounts. Take advantage of these resources to stay informed about any changes or suspicious activities that could arise. Being proactive is your best defense against potential issues.

By following these steps, you can confidently enhance your financial security and enjoy peace of mind knowing your personal data is under your control.

Such a captivating presence! Every second of this video is filled with beauty!