A Comprehensive Guide to Freezing Your Credit with Equifax for Enhanced Security

In today’s world, safeguarding your personal information has become essential. With the rise of identity theft and financial fraud, ensuring that your sensitive data remains under your control is more important than ever. Taking proactive steps can help you manage your financial identity and keep unwanted access at bay.

One effective method for protecting your financial information involves restricting access to your financial dossier. By doing this, you create an added layer of defense against potential threats that could jeopardize your resources. It’s all about taking charge and making informed decisions regarding who can view your financial history.

There are various options and procedures available for implementing these protective measures, and it’s crucial to understand the specific steps involved. Simplifying the process can alleviate concerns and empower you to make choices that benefit your peace of mind. So, let’s explore the necessary actions to ensure your information remains secure and private.

Understanding Credit Freezing Benefits

When it comes to safeguarding your financial identity, there are several advantages to consider. This tactic serves as a protective measure that makes it challenging for unauthorized individuals to access certain information about your financial history. As a result, you gain peace of mind, knowing that your sensitive data is better shielded from potential threats.

One of the most significant perks is the substantial reduction in the risk of fraud. By restricting access to your financial records, the likelihood of someone opening accounts in your name or engaging in other illicit activities is greatly diminished. This proactive approach not only secures your assets but also enhances your overall financial wellbeing.

Another notable benefit is the convenience it offers during times of uncertainty. Whether you’ve experienced a data breach or just want additional layers of security, this action can provide a safety net. It’s like having a reliable guard standing watch over your financial information, ensuring that only you have control over what happens next.

Ultimately, taking this step safeguards your financial future while allowing you to resume your daily life with confidence. You can proceed with transactions and manage your finances knowing that your protective measures are in place, making it much harder for harmful schemes to disrupt your life.

Step-by-Step Guide to Freezing Credit

Ever thought about giving your personal finances a little extra protection? It’s simpler than you might imagine! Taking the necessary steps to secure your financial identity can provide peace of mind and help prevent unauthorized use of your information.

Let’s break it down into manageable steps. First, gather all pertinent information, including your personal details like Social Security number, address history, and any relevant identification documents. This will make the process much smoother.

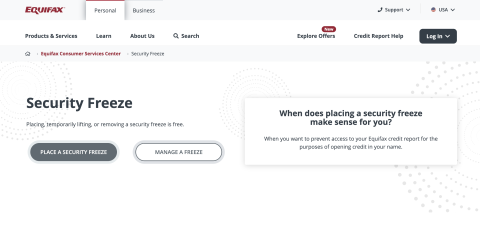

Next, visit the official website of the chosen credit bureau. It’s essential to focus on their designated section for security measures. Once there, you’ll likely need to create an account or log in if you already have one.

After authentication, find the option that offers a means to restrict access to your profile. Follow the prompts carefully, filling in all required data. Most organizations will ask for verification, so be prepared to provide additional details as needed.

Once you complete the process, you should receive confirmation. Keep this information safe; it may be necessary to lift restrictions in the future, should you decide to apply for loans or credit on your terms.

Lastly, remember that you can repeat this process for other bureaus as well. Each one operates independently, and ensuring your information is secure across the board is a wise move. Take control of your financial health today!

Unblocking Your Financial Profile Later

When the time comes to restore access to your financial information, it’s important to know the steps involved. Whether you’re ready to apply for a loan or open a new credit account, regaining your status is a straightforward process. With just a few easy actions, you can ensure that lenders can review your details without a hitch.

First, gather any necessary information, such as your identification and the PIN or password you received when you initially restricted access. This information is crucial for confirming your identity. Whether you prefer online methods, phone calls, or mailing in your requests, there are multiple options available to suit your preferences.

If you choose the online route, visit the specific website of the bureau and look for the appropriate section for making adjustments. Follow the prompts to enter your details and re-enable access. If you opt for a phone call, be prepared to navigate through automated systems or speak directly to a representative who can assist you.

Keep in mind that unblocking your profile usually takes effect almost immediately, although it might take longer in certain cases. It’s wise to check back a day or two later to ensure everything is set up properly. Planning ahead can save you from delays, especially if you have upcoming financial plans!

Absolutely stunning! You bring so much energy and grace to this video!