A Comprehensive Guide to Successfully Filing for Financial Aid

In today’s world, pursuing education or enhancing one’s skills often comes with substantial costs. Many individuals seek ways to ease this financial burden, opening doors to opportunities that might otherwise remain closed. Finding the right resources and understanding the process can feel daunting, but rest assured, you’re not alone on this journey.

Exploring options to receive monetary support is an important step for students and their families. Whether it’s scholarships, grants, or loans, there are various avenues to consider based on your specific situation. This guide will help you navigate through the necessary steps, making the experience smoother and more manageable.

Getting started might seem overwhelming, but breaking it down into smaller, actionable tasks can ease the process. With a little guidance and a proactive approach, anyone can discover the assistance they require. Let’s delve into the essentials that will lead you on the right track toward obtaining the support you need.

Understanding Financial Aid Options

When it comes to funding your education, there are various resources available to help ease the burden. It’s essential to explore the different types of support that may be accessible, allowing you to make informed choices about your educational journey. Knowing what’s out there can transform your approach to managing the costs of schooling.

Broadly speaking, assistance can fall into several categories: grants, scholarships, work-study programs, and loans. Each offers unique benefits and requirements. Grants are typically need-based and don’t require repayment, making them an attractive option. Scholarships, on the other hand, can come from a variety of sources and are often awarded based on merit or specific criteria, such as talents or background.

Work-study initiatives provide an opportunity for students to work part-time while pursuing their studies, helping to cover expenses without overwhelming commitments. Lastly, loans are a common route but come with the responsibility of repayment in the future, which is an important aspect to consider before taking this path.

Understanding these resources helps you to create a comprehensive plan that aligns with your financial situation and educational goals. Being proactive in researching options can lead to significant savings and a smoother path to achieving your desired degree.

Essential Documents for Application

When you’re preparing to embark on your journey toward securing support, gathering the right paperwork is absolutely crucial. Having everything in order not only streamlines the process but also enhances your chances of success. So, let’s dive into what you’ll need to keep handy as you navigate this important step.

First up, you’ll typically require proof of income. This may include recent pay stubs, tax returns, or even a letter from your employer. These documents help illustrate your financial circumstances and can often make a significant difference in the assessment.

Next, it’s wise to have identification documents on hand. This could be a government-issued ID, social security number, or other identifiers that confirm your identity. These details are essential to ensure that your application is associated with the right individual.

Additionally, educational records might come into play. Whether it’s transcripts, diplomas, or enrollment verification, having these ready shows that you’re a dedicated student and helps paint a complete picture of your academic journey.

Lastly, consider any supporting letters or recommendation notes. These can offer insights into your character, work ethic, and ambitions, further strengthening your submission. The effort you put into gathering these crucial items can truly pay off in the long run.

Navigating the Application Process

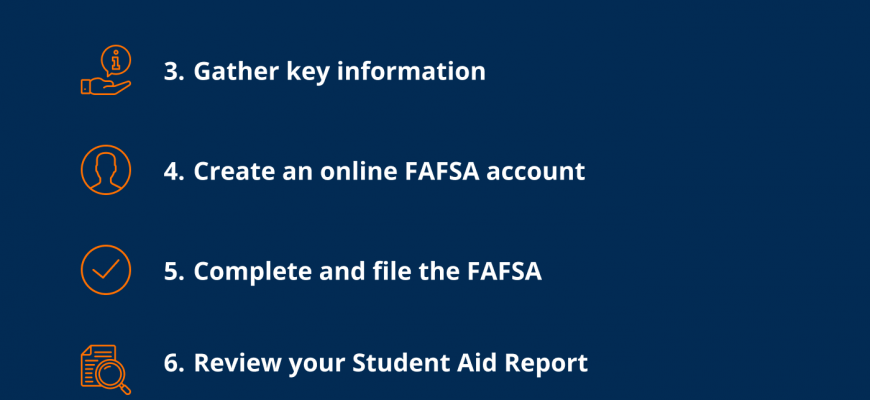

Getting through the application journey can feel overwhelming, but it doesn’t have to be. With the right approach and a bit of preparation, you can simplify the steps and reduce the stress involved. The key is understanding what to expect and organizing your materials in advance, making the entire experience smoother.

Start by gathering all necessary documents, such as tax returns and bank statements. Having everything on hand not only saves time but ensures you won’t scramble at the last minute. Familiarize yourself with the different platforms or forms you’ll be dealing with, as each might have unique requirements or deadlines you need to meet.

Don’t hesitate to seek assistance if you encounter challenges. Many schools and organizations offer resources to help applicants navigate this process. Additionally, reach out to friends or family members who have gone through it before; their insights can be valuable and might shed light on aspects you hadn’t considered.

Lastly, keep track of all submissions and communications. Staying organized is crucial, as it helps monitor your status and respond promptly to any requests for additional information. With careful planning and support, you can navigate this journey with confidence and ease.