A Comprehensive Guide to Entering a Credit Note in Xero for Efficient Financial Management

In the realm of financial management, occasionally, there comes a moment when numbers just don’t add up as anticipated. Whether it’s a return from a customer, an overpayment, or a simple billing error, it’s essential to have a process in place for handling these situations gracefully. Understanding how to accurately reflect these changes in your accounts can save you from future discrepancies and keep your records tidy.

Getting a handle on these adjustments not only ensures that your financial statements remain precise, but it also fosters trust with your clients and suppliers. By properly managing these modifications, you’re taking a proactive approach to maintaining the integrity of your accounting practices. It’s all about staying organized and keeping everything balanced, even when unexpected twists arise.

In this guide, we’ll walk you through the essential steps to process these adjustments efficiently within your accounting software. With a few straightforward actions, you can make sure that your financial records reflect the true state of your business, allowing you to focus on growth and success.

Understanding Credit Notes in Xero

When it comes to managing your financial records, there’s a useful tool that helps rectify billing discrepancies or returns. Think of it as a way to ensure that your accounts reflect true transactions. This element allows you to document situations where adjustments are necessary, ultimately maintaining the integrity of your financial statements.

These adjustments play a crucial role in customer relations. When items are returned or overcharged, having a system in place to address these issues can enhance satisfaction. It’s an essential aspect of clear communication with clients, ensuring that their accounts are accurate and that they feel valued.

Additionally, incorporating such instruments into your accounting practices can streamline your processes. Rather than complicating matters with refunds or laborious amendments, utilizing this option allows for a more straightforward solution. It provides clarity not only for your records but also for your clients, allowing a seamless review of transactions.

In short, grasping the significance of these financial adjustments can help elevate your accounting practices. With a better understanding, you ensure that your business operates smoothly while fostering good relationships with your customers.

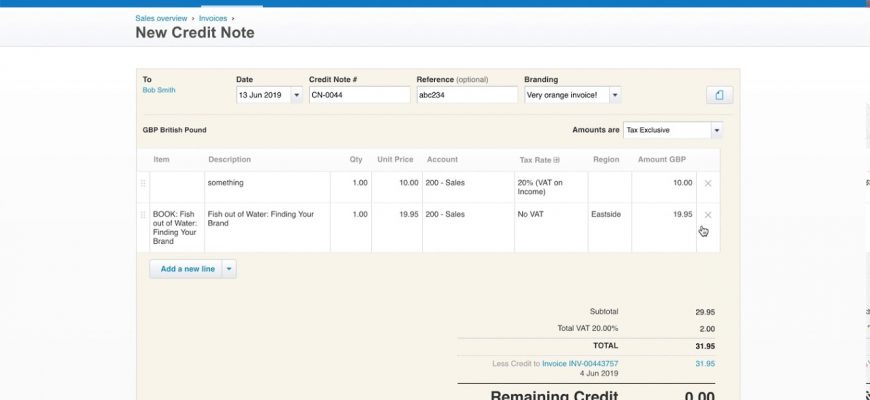

Step-by-Step Guide to Creating Credit Notes

Managing transactions can sometimes get a bit tricky, especially when adjustments are needed. This section will provide a straightforward approach to documenting returns or adjustments in your financial system. By following these steps, you’ll be able to efficiently record changes and ensure everything balances out in the end.

Step 1: First things first, log into your accounting software and navigate to the appropriate section. Look for the area dedicated to transactions or financial entries. This is where you’ll initiate the process.

Step 2: Once in the right spot, locate the option to create a new entry. You will typically see a button or link labeled something akin to “Add” or “New Entry.” Click on that to begin.

Step 3: Now, fill out the details of the transaction you’re adjusting. It’s important to include information such as the original transaction number, date, and the reason for the adjustment. Make sure everything is accurate to avoid any confusion later.

Step 4: After entering the key details, move on to the amounts. Specify the value being adjusted. Be careful to ensure that positive or negative amounts are entered correctly, as this will affect your records significantly.

Step 5: Review your entry for accuracy before finalizing it. Double-check all the information to catch any potential errors. A quick verification can save you from future headaches.

Step 6: Finally, save or submit your entry. Once confirmed, it will be recorded in your accounting records, reflecting the necessary adjustments. Don’t forget to keep a copy for your reference, just in case.

By following these simple steps, you’ll navigate through adjusting transactions with ease. It’s all about keeping your financial records neat and accurate!

Common Issues and Troubleshooting Tips

When managing financial transactions, various obstacles can arise that might complicate the process. Recognizing and addressing these common pitfalls can save time and enhance accuracy. Let’s take a look at some typical challenges users might face and explore effective solutions to overcome them.

Transaction Not Saving: One frequent issue is when a transaction fails to save properly. This can occur due to connectivity problems or server issues. Ensure you have a stable internet connection and try refreshing the page. If the problem persists, clearing your browser cache often resolves hidden errors.

Incorrect Amounts: Mistakes in the figures can lead to frustration. Double-check all entries for any discrepancies. If numerical errors continue, make sure you are working in the correct financial period and within the designated settings.

Overlapping Entries: Sometimes, duplicate transactions may end up causing confusion. Review your records carefully. If you identify any repetitions, removing the duplicates will streamline your information and enhance accuracy.

Navigation Difficulties: Users might struggle with the interface, especially when looking to perform specific actions. Familiarity with the layout can be greatly beneficial. Consider using the help guides available; they can provide clarity on the functionalities.

Support Resources: In cases where self-troubleshooting doesn’t yield results, reaching out to support teams can be invaluable. They often have insights or solutions for issues that aren’t easily solvable on your own. Building a relationship with these resources can make future interactions smoother.

By keeping these tips in mind, you can navigate the complexities of your financial management tasks with greater ease and confidence. Remember, it’s all about finding the right solutions and maintaining organized records!