A Comprehensive Guide to Freezing Your Credit Successfully

In today’s world, protecting your personal information is more crucial than ever. With increasing incidents of unauthorized access to sensitive data, many individuals are looking for effective measures to safeguard their financial identities. Taking proactive steps can help you maintain control over your financial accounts and mitigate the risk of fraud.

The process of restricting access to your financial history is a key strategy many choose to implement. By understanding the mechanics of this protective action, you can confidently navigate the steps needed to secure your information. This guide will provide you with all the essential insights you need to ensure that your financial life remains secure.

Whether you’re concerned about potential threats or simply wish to add an extra layer of security, knowing the right techniques can make all the difference. Let’s explore the best practices for safeguarding your information effectively and efficiently.

Understanding Credit Freeze Basics

In today’s financial landscape, safeguarding your personal information is crucial. One effective approach involves limiting access to your financial records, making it harder for potential fraudsters to misuse your details. This concept revolves around the idea of adding an extra layer of protection to your identity, especially when you’re concerned about unauthorized activities.

The process is relatively straightforward, yet it holds significant importance. By implementing this strategy, you essentially control who can view your sensitive information. This is particularly beneficial during times when you may suspect that your data might be at risk or if you’ve been a victim of identity theft in the past. Understanding the fundamentals will empower you to take decisive steps toward securing your financial future.

Before initiating this protective measure, it’s essential to grasp its implications. While it can provide peace of mind, it also means that lenders or service providers won’t have immediate access to your financial profile. Thus, being informed about its usage and the necessary steps to manage it is vital for an effective safeguarding strategy.

Steps to Initiate a Credit Freeze

Taking steps to enhance your financial security can be a wise decision. When it comes to safeguarding your sensitive information, you might want to consider placing restrictions on access to your financial profile. This process is straightforward and can provide you with peace of mind.

First, identify the major bureaus that maintain your financial records. Typically, there are three key players to reach out to. Make sure to have your personal information handy, as they’ll request details like your name, address, social security number, and date of birth to verify your identity.

Next, each bureau has its own specific method for requesting this protective measure. You can usually accomplish this online, over the phone, or by mail. Opt for the method that suits you best, keeping in mind that online requests tend to be the quickest.

Once you’ve submitted your request, you’ll receive a confirmation along with a unique PIN or password. This information is crucial for lifting the restrictions in the future, so store it in a safe place. Lastly, check your financial statements regularly to ensure everything remains secure and monitor any changes that may arise.

Impact of Freezing Your Report

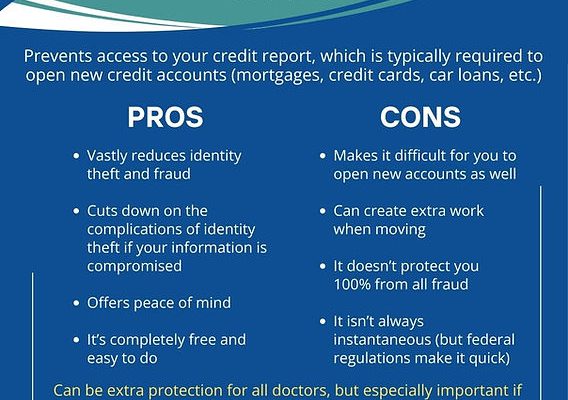

Taking the step to restrict access to your financial history can significantly affect various aspects of your life. While many see it as a solid way to enhance security against unauthorized activities, it comes with its own set of considerations that you should be aware of.

First and foremost, when you limit access to your records, it can make it challenging to secure loans, credit cards, or other financial products. Lenders often require a peek into your financial background to make informed decisions, and that could mean delays or even denials if your information is out of reach.

On the flip side, this protective measure provides peace of mind. Knowing that your sensitive data is safeguarded from potential fraudsters can reduce anxiety, especially in an era where identity theft is prevalent. It creates a barrier, making it harder for someone to impersonate you and open accounts in your name.

Additionally, consider how often you actually need to access your financial services. If you’re planning to move forward with major purchases like a home or car, you may find yourself needing to lift those restrictions temporarily. This isn’t a complicated process, but it does require some planning ahead.

In summary, while establishing a barrier to your financial information can deter criminals, it also requires a level of forethought regarding your long-term plans. Balancing security with accessibility is key.