Effective Strategies for Challenging Errors in Your Credit Report

When it comes to keeping your finances in check, the accuracy of your financial documentation plays a crucial role. These records can significantly influence various aspects of your financial life, from loan approvals to insurance rates. It’s essential to ensure that all details reflect reality, as discrepancies can lead to misunderstandings and unwanted complications.

Many individuals find themselves facing the challenge of correcting erroneous entries or outdated information that can negatively impact their financial standing. Fortunately, there are effective strategies to address these inaccuracies and set the record straight. Gaining clarity and taking proactive steps can empower you and enhance your overall financial health.

Whether it’s an oversight or a more serious error, knowing the right approach can make all the difference. You’ll want to take action sooner rather than later, as prompt correction can mitigate any potential damages and help restore your peace of mind. In this section, we will explore practical steps to tackle those pesky inaccuracies effectively, ensuring you regain control over your financial documentation.

Understanding Your Financial Statement Errors

We’ve all been there–looking at a statement and spotting something that doesn’t quite add up. These inaccuracies can have significant implications, affecting your ability to access loans, secure a rental, or even get a job. It’s essential to recognize these discrepancies and understand what they mean for your financial well-being.

Errors often stem from various sources, such as clerical mistakes, outdated information, or even identity theft. The problem lies in the fact that these inaccuracies can lead to a skewed perception of your financial reliability. You might find incorrect accounts listed, wrong balances, or even incorrect personal details. Each inaccuracy presents a unique challenge that needs careful consideration.

Being aware of common blunders, like duplicated entries or accounts that don’t belong to you, can empower you to take action. Regularly reviewing your statements is key, as it allows you to catch these missteps early on. The sooner you identify these issues, the better prepared you’ll be to address them and protect your financial future.

Ultimately, understanding the errors that may appear in your financial records isn’t just about correcting inaccuracies; it’s about taking control of your financial narrative. Recognizing the potential for mistakes can help you to maintain a clear picture of your financial health and improve your overall security.

Steps to File a Dispute Efficiently

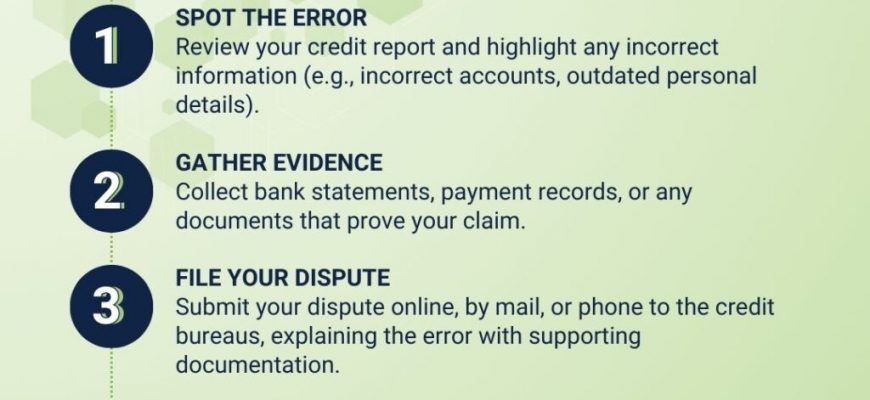

Taking action when you find inaccuracies in personal financial information is essential. To address any discrepancies effectively, you’ll want to follow a series of well-organized steps that ensure your concerns are heard and acted upon swiftly.

1. Gather Your Documentation

Before reaching out, collect all relevant documents that support your claims. This may include statements, emails, or any other materials that provide evidence of the errors in question.

2. Identify the Source

Determine which agency or provider is responsible for the information in question. It’s important to know where to send your concerns accurately. Each organization may have specific procedures for addressing inaccuracies.

3. Draft Your Statement

Compose a clear and concise letter outlining the inaccuracies you’ve identified. Explain why the information is incorrect and reference your supporting documents. It’s vital to be precise; this will help streamline the process.

4. Submit Your Request

Send your letter to the appropriate organization, either via mail or through their online platform if available. Make sure to keep a copy for your records.

5. Follow Up

After submitting your request, give it some time and then check in to ensure your case is being processed. Persistence can make a significant difference in the speed of resolution.

6. Review the Response

Once you receive a reply, carefully review their findings. If they confirm your claims, great! If not, you may need to provide additional evidence or reconsider your next steps.

By following these organized actions, you increase your chances of resolving inaccuracies efficiently, putting you back in control of your financial narrative.

Recovering from a Disputed Credit Score

Finding your way back after a challenge with your financial standing can feel overwhelming, but it’s entirely possible to regain control and boost your standing. The journey often involves a mix of patience, strategy, and understanding of the factors that affect your score. Taking proactive steps can lead you to a healthier financial outlook.

First, stay informed. Keep an eye on your financial tasks and remain in the loop about the factors influencing your standing. You can obtain a summarized overview of your financial activity from various online platforms, which can help identify areas needing attention. Staying vigilant is key to making informed decisions moving forward.

Next, work on improving habits. Cultivating responsible behaviors, like managing expenses and making timely payments, will have a positive impact over time. Additionally, explore options to diversify your financial portfolio, as this can further enhance your standing. Consistently implementing good habits is a significant step towards recovery.

Lastly, seek assistance if needed. Sometimes, having a trusted advisor can make all the difference. Professional support can provide personalized strategies tailored to your situation, ensuring you navigate this landscape with greater ease. Don’t hesitate to reach out if you feel overwhelmed; guidance can be invaluable during these times.