A Comprehensive Guide to Issuing Credit Notes

In the world of finance and transactions, there occasionally arises a need to rectify previous entries or provide amendments for various reasons. Whether it’s due to an overcharge, a returned product, or a simple mistake, knowing the right approach to these adjustments is essential for maintaining accurate records. This article will guide you through the essentials of making these updates effectively and efficiently.

Creating an official adjustment involves a few key steps that ensure both parties are clear about the changes made. Communicating effectively and providing the necessary documentation helps to build trust and maintains a good relationship with clients or customers. In this guide, we’ll break down everything you need to know about producing these essential documents to keep your transactions seamless.

With the right understanding and tools at your disposal, navigating this process can be straightforward. Whether you’re managing personal accounts or handling business finances, knowing how to implement these changes can save you time and reduce potential confusion down the line. Let’s dive into the specifics and get you equipped to tackle these requirements with confidence!

Understanding the Purpose of Credit Notes

When it comes to managing financial transactions, certain documents play a vital role in ensuring clarity and transparency between parties. One such document serves a specific function in rectifying or adjusting figures that may not align with previous agreements. This tool is essential for maintaining trust and accuracy in business dealings.

The main objective of this instrument is to address discrepancies that might arise after a sale has been completed. Whether it’s due to returns, pricing errors, or other amendments, this document allows businesses to correct records in a seamless manner. It acts as a formal acknowledgment of adjustments, ensuring that both seller and buyer are on the same page.

Furthermore, utilizing this type of paperwork can significantly enhance customer relations. By promptly addressing issues and providing a formal solution, businesses can foster goodwill and demonstrate their commitment to quality service. This proactive approach can lead to increased customer satisfaction and loyalty.

Step-by-Step Guide to Issuing Credit Notes

Creating a document to correct or adjust a transaction may seem daunting, but it’s a straightforward process that can enhance customer satisfaction and keep your accounts accurate. In this section, we’ll walk you through the necessary steps to generate a document effectively and efficiently, ensuring that both you and your clients remain on the same page.

Begin by gathering all relevant information related to the transaction in question. This includes any previous invoices, order details, and the reasons for the adjustment. Having everything at hand will streamline the next steps of the process.

Next, choose the appropriate template that fits your business style. Many accounting software programs offer customizable templates that make this task easier. Select a format that clearly presents your data while aligning with your company’s branding.

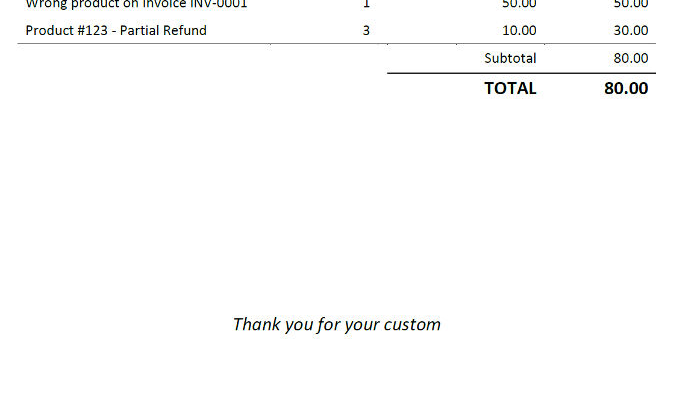

Fill in the details accurately. Start with your business information, then specify the recipient’s details. Clearly outline the reasons for this adjustment, whether it’s a return, a pricing error, or some other cause. Transparency is crucial in maintaining trust.

Make sure to include a unique identification number for tracking purposes. This helps in maintaining proper records and provides a reference point for both parties to refer back to if needed.

After completing the document, review it thoroughly for accuracy. Double-check all figures and ensure that the wording is clear and concise. An error-free document reflects professionalism and attention to detail.

Once satisfied, distribute this document to your customer promptly. Whether through email or a physical copy, ensure it reaches them without delay. Following up with a conversation or email can be beneficial to confirm receipt and address any questions.

Lastly, keep a copy for your own records. This will be essential for future reconciliations and audits. By following these simple yet effective steps, you can handle adjustments smoothly and foster positive relationships with your clients.

Common Mistakes to Avoid When Issuing

When it comes to creating adjustment documents, there are a few pitfalls that can easily trip you up. Many people rush through the process, which can lead to costly errors or misunderstandings. Taking the time to steer clear of these common missteps can save you and your clients a lot of headaches later on.

One frequent error is neglecting to include all necessary information. Omitting details like the date, invoice number, or recipient’s information can create confusion. Always ensure every relevant piece of data is present and clearly stated.

Another common issue is failing to communicate effectively with your client. Not informing them about the changes or why adjustments were made can lead to distrust. A simple explanation goes a long way to maintain a good relationship.

Additionally, mistakes in the calculations are often overlooked. Always double-check your figures to avoid discrepancies that could complicate matters. Simple arithmetic errors can result in significant financial implications.

Lastly, don’t forget about the proper formatting. A disorganized document can make it difficult for clients to understand the adjustments. Ensure everything is neatly laid out and easy to read to keep the process smooth.