Becoming a Self-Sufficient Student to Qualify for Financial Aid

In today’s world, the journey of pursuing higher knowledge often comes with various challenges, especially when it comes to securing the necessary resources for education. Many individuals find themselves navigating a complex landscape, where the ability to stand on one’s own two feet can significantly impact the opportunities available to them. Embracing a mindset of self-sufficiency can be transformative, and this section aims to explore the essential aspects of that path.

Establishing a sense of autonomy not only enhances personal growth but also opens doors to diverse possibilities. As one seeks to thrive amidst financial hurdles, understanding the parameters of eligibility and the significance of personal responsibility plays a vital role. It’s about gaining clarity on your circumstances and leveraging that knowledge to make informed decisions that align with your aspirations.

Throughout this exploration, we will delve into practical strategies and insights that can empower individuals to navigate their circumstances effectively. Whether it’s through making informed choices or managing resources wisely, there are numerous ways to cultivate a path toward success. Get ready to embark on a journey that can ultimately lead to greater control over your educational ambitions.

Understanding Financial Independence Criteria

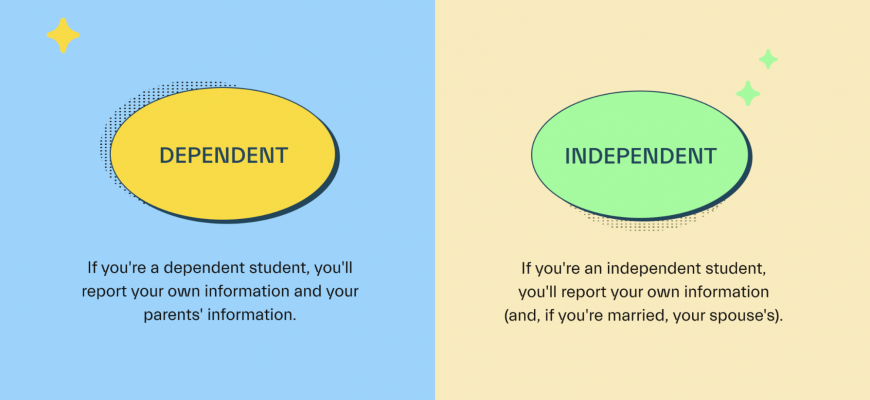

When it comes to securing support for your education, grasping the essential benchmarks that define autonomy is crucial. These parameters determine whether you will be treated as a self-sufficient learner or if your circumstances require parental input. Familiarizing yourself with these guidelines helps pave the way for greater personal control over your educational pursuits.

Typically, one of the primary factors includes your age. Generally, individuals over a certain age may qualify without needing to provide parental information. Additionally, aspects such as marital status or having dependents can play a significant role. Recognizing these elements allows you to showcase your unique situation effectively.

Employment history can also bolster your case. If you’ve been working and contributing to your own expenses, it’s a clear indicator of your personal capability. Furthermore, certain life experiences–like serving in the military–can automatically grant you the status you’re aiming for.

Moreover, it’s essential to understand the local regulations that apply to your context, as they can vary significantly. Tracking the criteria within your region can aid in making informed decisions that support your educational and financial ventures. With the right knowledge, you can navigate this complex landscape and enhance your prospects for obtaining the necessary resources.

In conclusion, understanding these criteria is a vital step in taking charge of your educational journey. By being aware of what qualifies as self-sufficiency, you position yourself more favorably when seeking resources to support your academic ambitions.

Strategies for Budgeting as a Student

Managing your expenses can seem daunting, but with the right approach, it becomes a manageable task. It’s all about creating a plan that helps you understand your income and where your money goes each month. By doing this, you can make informed choices that allow you to stretch every dollar further.

Start by tracking your spending habits. This can be done with apps or a simple notebook. Knowing where your funds go helps identify areas where you might be overspending. Once you have a clear picture, set specific limits for different categories, like food, entertainment, and books. This helps prevent impulsive purchases and encourages mindful spending.

Creating a realistic budget is key. Take into account all sources of income, from part-time jobs to allowances. Subtract your fixed costs such as rent and utilities to see how much is left for discretionary spending. Always remember to set aside a small amount for savings or unexpected expenses, as this can provide a cushion during tougher times.

Look for ways to cut costs. Consider meal prepping to save on groceries or using public transport instead of driving. Look out for student discounts and deals, as they can significantly lighten your load. Even small savings add up over time!

Lastly, review your budget regularly. Life changes and so do your financial needs. A monthly review allows you to adjust your plan and stay on track. With dedication and attention to your finances, achieving your goals becomes much easier.

Navigating the Financial Aid Application Process

Understanding the journey ahead can be a little tricky, but don’t worry–it’s manageable! Getting through the steps of securing support for your educational journey requires some organization and attention to detail. Let’s break it down into simple parts.

First off, preparation is key. Here’s what you should focus on:

- Gather necessary documents such as tax returns, bank statements, and other financial records.

- Keep an eye on deadlines for different types of assistance, as they can vary widely.

- Learn about the specific requirements of each program you’re interested in to avoid missing crucial information.

Once you have everything sorted, it’s time to tackle the application itself:

- Fill out the required forms with accurate information; this is where attention to detail comes into play.

- Seek help if needed–don’t hesitate to reach out to your school’s support services or consult resources.

- Double-check your submission to ensure that nothing is overlooked or completed incorrectly.

After submitting, patience is the name of the game. While waiting for a response, you can:

- Research potential scholarships and grants to increase your chances of receiving support.

- Examine budgeting options to prepare for any expenses that might arise during your studies.

- Stay proactive in seeking additional resources or programs that may be available to you.

With thorough preparation and a dedicated approach, navigating this path can lead to a more accessible educational experience. Keep at it, and the results will pay off!