A Comprehensive Guide on the Process of Applying for a Credit Card

In today’s fast-paced world, having an extra financial tool in your wallet can be incredibly beneficial. Whether you’re looking to manage expenses, build your credit history, or simply enjoy perks like cashback and rewards, understanding the steps to get one can set you on the right track. It’s not just about filling out forms; it’s about making an informed choice that suits your lifestyle and needs.

Before you dive in, it’s important to gather some essential information. Consider your financial habits, preferences for benefits, and the terms that different institutions offer. This approach will help you navigate the vast options available and ensure that you select the most suitable financial instrument for your situation.

Once you’ve gathered your thoughts and materials, you’ll find that the process can be straightforward. With a little preparation and understanding of your financial landscape, you can confidently take the next steps toward enhancing your economic flexibility.

Understanding Different Types of Credit Cards

When it comes to choosing a plastic payment solution, it’s essential to know that there isn’t just one kind available. Each variant is tailored to meet diverse financial needs and lifestyles, opening up a world of opportunities. By familiarizing yourself with these options, you can select one that aligns perfectly with your habits and goals.

Rewards Programs are extremely popular among consumers who love to earn bonuses. Whether it’s cashback, travel points, or discounts with specific merchants, these options provide perks for your everyday spending. If you tend to shop frequently or travel a lot, this type can enhance your spending experience.

Low-Interest Options are designed for individuals who may carry a balance from month to month. These financial tools come with lower annual percentage rates, helping reduce the overall interest paid. It can be a smart move for managing larger purchases without incurring heavy charges.

Secured Options are particularly beneficial for those new to the world of spending plastic or looking to rebuild their financial history. By providing a cash deposit as collateral, it allows individuals to establish or improve their credit profiles while enjoying the convenience of a payment method.

Business Variants cater to entrepreneurs and small business owners, providing features tailored to them. These offerings may include expense tracking, enhanced rewards for business-related purchases, and tools to manage cash flow effectively, helping business ventures flourish.

Exploring these various solutions allows for a more informed decision, making it easier to find the perfect fit for your financial journey. Embracing the right option can unlock a range of benefits, all while assisting in managing your spending responsibly.

Steps to Prepare Your Application

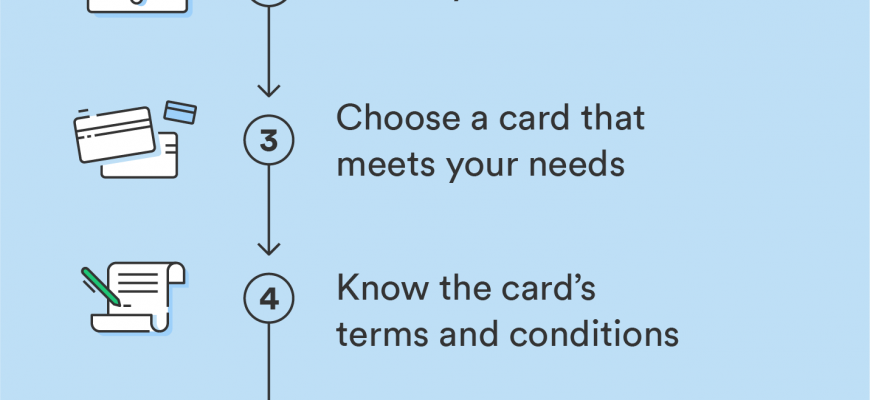

Before diving into the world of financial products, it’s useful to lay the groundwork for a smooth journey. Taking a moment to gather necessary information and documents can make your experience both easier and faster. A little preparation goes a long way in increasing your chances of getting positive results.

First off, start by reviewing your personal financial situation. Knowing your income, expenses, and outstanding debts will give you a clearer picture of what you can comfortably manage. This helps in selecting the right product that fits your financial lifestyle.

Next, it’s essential to check your credit history. Understanding your score and the factors influencing it can empower you to make informed choices. You can obtain reports from authorized services to see if there are any discrepancies to address before moving forward.

Gather relevant documents, such as proof of income, identification, and any other supporting information. Having these on hand will streamline the process, allowing you to fill out forms without unnecessary delays.

Finally, review various options available in the market. Each option may offer different benefits, fees, and terms, so take some time to compare them. Being well-informed will help you make a choice that aligns with your financial goals and needs.

Common Mistakes to Avoid When Applying

Navigating the world of plastic payment options can be tricky, and many individuals make errors that could cost them. Being mindful of these pitfalls can save time and stress during the process. Let’s take a look at some typical missteps that can hinder your chances of getting the best deal.

One of the biggest blunders is not checking your financial history beforehand. Lenders will review your background, so knowing your score can help you determine what to expect. Another common oversight is applying for multiple options at once. This can raise red flags and lower your score, making you appear desperate.

Additionally, many people overlook the fine print. Details like fees, interest rates, and rewards may not be immediately obvious, but they are crucial for understanding the terms. Make sure to read everything carefully before making a decision.

Lastly, don’t forget to consider your own spending habits and lifestyle. Choosing an option that doesn’t align with your needs can lead to missed benefits or unnecessary expenses. A little research and reflection can go a long way in securing a favorable arrangement.