A Comprehensive Guide on Applying for a Zolve Credit Card

In today’s fast-paced world, having access to flexible financial solutions can significantly enhance your lifestyle. Whether you’re looking to manage your expenses more effectively or seek out new experiences, mastering the art of obtaining a reliable financial instrument can open many doors. This pursuit can feel daunting, especially if you’re new to this arena, but fear not–it’s a straightforward process that anyone can undertake.

With the right information at your fingertips, you can seamlessly navigate the necessary steps to secure a suitable option that aligns with your financial plans. You don’t need to navigate this journey alone; understanding the requirements and having an organized approach can make all the difference. No matter your credit history or financial background, there’s a pathway that can lead you closer to achieving your goals.

In this guide, we will walk you through the essentials and provide you with valuable insights to streamline your experience. By the end, you’ll be equipped with the knowledge to move forward confidently, paving the way for potential rewards and benefits that could transform your financial landscape. Get ready to embark on a journey towards newfound financial freedom!

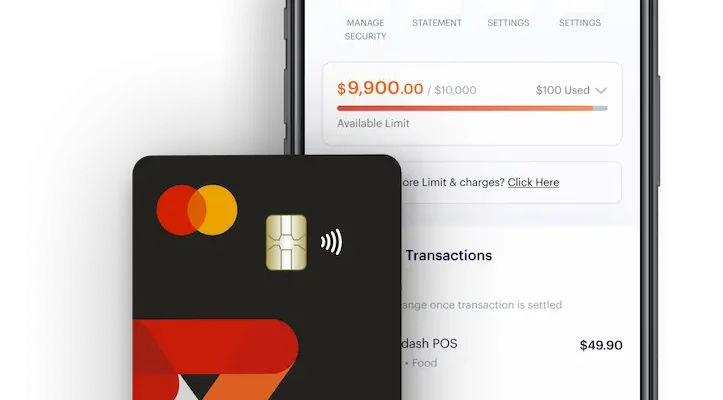

Understanding Zolve Credit Card Benefits

When it comes to modern financial solutions, there are numerous advantages that can enhance your purchasing power and overall experience. These perks not only provide convenience but also open up new opportunities for managing your expenses effectively. Knowing the key features can help you make informed decisions that align with your lifestyle.

One of the standout advantages is the seamless integration with various online platforms. This ease of use means that whether you’re shopping, paying bills, or indulging in events, transactions become smooth and hassle-free. With rewards programs also in play, you can earn points on purchases that can contribute to future savings or exclusive offers.

Moreover, the commitment to security adds an essential layer of protection. Advanced technologies work behind the scenes to ensure that your information remains secure, allowing you to shop with peace of mind. Plus, having access to detailed spending reports can aid in budgeting and tracking your finances.

Additionally, many options come with perks that cater to diverse needs, from travel benefits to cash back on everyday expenses. These incentives can significantly enhance your experience, making it not just about spending, but also about enjoying financial rewards. Embracing such features could truly elevate your approach to managing resources.

Application Process for Zolve Card

Starting your journey with a new financial tool is an exciting step, and understanding the steps involved can make everything smoother. The process is designed to be user-friendly and straightforward, allowing individuals to easily navigate through the requirements. Knowing what to expect can help you prepare effectively.

First, gather the necessary documentation to support your submission. This typically involves personal identification, residency proof, and other relevant financial details. Having everything on hand minimizes delays and helps you fill out the forms with confidence.

Next, visit the official website or platform where the transaction takes place. User-friendly interfaces guide you through each segment, ensuring that you provide all requested information accurately. Don’t rush this part; double-checking personal data can prevent future complications.

After submitting your details, patience is key. The review process may take time, as the institution assesses your application based on various factors. Keep an eye on your email for updates or additional requests, as prompt responses can speed up the decision-making.

Upon approval, you’ll receive further instructions regarding your new financial resource, including activation and usage guidelines. Embrace this new chapter and enjoy the benefits that come with it!

Eligibility Requirements for Zolve Credit Card

When considering this financial product, it’s important to understand what qualifications are necessary to secure one. Meeting specific criteria ensures that applicants are considered for this opportunity, which can be beneficial in managing various expenses and making purchases seamlessly.

Firstly, you should typically be of a certain age, often at least 18 years old. This age requirement is common across many similar offerings, as it indicates a level of financial responsibility. In addition, possessing a valid identity document, such as a passport or driver’s license, is essential. This helps the institution verify your identity and maintain security.

Having a steady source of income is another crucial factor, as it demonstrates your ability to repay any funds that may be borrowed. Many institutions require proof of employment or other income sources to ensure that applicants can handle their financial obligations.

Furthermore, maintaining a good credit history plays a significant role in the evaluation process. A solid track record can positively influence the decision-making phase, showcasing your reliability when it comes to managing debts and payments. In some cases, international applicants may be asked to provide additional documentation to establish their financial background.

In summary, understanding these prerequisites can help you navigate the pathway to obtaining this financial tool, ensuring you are well-prepared when the time comes to explore your options.