A Step-by-Step Guide to Adding a Credit Card to QuickBooks for Hassle-Free Transactions

In today’s digital age, streamlining financial processes is essential for efficient business management. Keeping track of expenses and payments can be simplified with the right tools. Connecting your payment method to your financial platform not only helps maintain accuracy but also enhances your overall workflow.

The journey to seamlessly incorporate your payment option into your chosen software starts with a few straightforward steps. It’s all about ensuring that you can manage your transactions effortlessly and keep your accounts in order. Embracing this integration will allow you to focus more on what truly matters: growing your business.

Whether you’re a seasoned entrepreneur or just starting out, understanding this process can provide significant benefits. With everything in one place, you can quickly monitor spending, generate reports, and maintain a clear overview of your financial health. Let’s explore the process of connecting your payment method, ensuring you reap the rewards of a well-managed financial system.

Setting Up Your Payment Method

Establishing a method for processing transactions is essential for managing your finances effectively. This step allows you to streamline your payment processes, ensuring that you can accept various forms of payments from clients or customers with ease. In this section, we’ll guide you through the fundamentals of arranging this feature, making it simple and straightforward.

First, you’ll want to access your main settings. Look for the area dedicated to financial options, where you can manage different ways to receive payments. It’s crucial to provide accurate information to avoid any complications down the line. You can include details like your account number and any other necessary identifiers to ensure smooth transactions.

Once you have entered your information, take a moment to review everything. Double-check that all your entries are correct, as even a minor mistake can cause issues when processing payments. After confirming the details, save your changes to activate this functionality.

With your payment method set up, you can now focus on serving your clients and growing your business. Embrace this feature to enhance your financial management, leading to a more efficient and organized approach to handling transactions.

Steps to Link Your Card

Connecting your payment method is a straightforward process that streamlines your financial tasks. It allows for seamless transactions and helps manage your expenses more effectively. Let’s dive into the steps to get everything set up without any hassle.

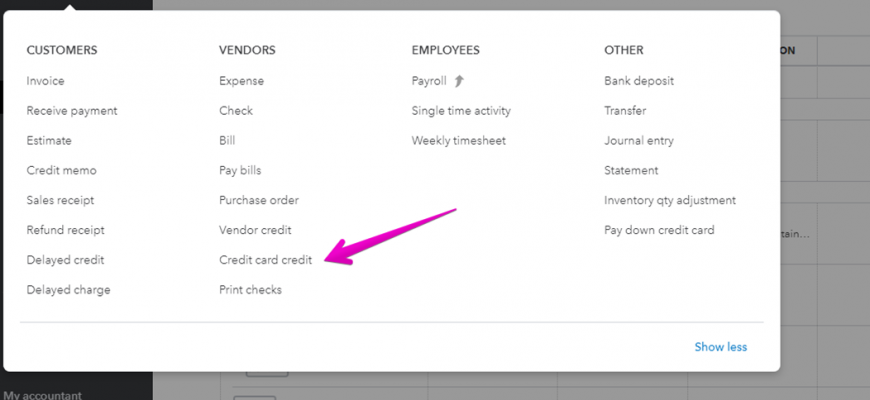

First, navigate to the settings menu. Look for an option related to payment methods or financial accounts. This should be your starting point for establishing a connection.

Next, select the option to connect a new payment method. You’ll likely be prompted to enter relevant information, such as the number associated with your account, expiration details, and any security codes. Make sure to double-check that everything is input correctly to avoid any issues.

Once you’ve entered the required information, review the terms and conditions that pop up. It’s essential to understand what you’re agreeing to, even if it seems straightforward. After that, confirm the connection.

Lastly, take a moment to verify that the link has been successful by checking your account dashboard. You should see a confirmation or indication that your payment method is now active and ready for use. If everything looks good, you’re all set to start enjoying the benefits of your new connection!

Troubleshooting Common Issues

Sometimes, users encounter obstacles when trying to incorporate their payment methods into the system. It’s not uncommon to face challenges along the way, whether it’s due to connectivity problems, incorrect information, or software glitches. The good news is that most issues are usually straightforward to resolve with a bit of guidance.

If you notice that your payment option isn’t being recognized, double-check the information you’ve entered. A simple typo or an expired option can lead to frustration. Additionally, ensure you’re using the most recent version of the software; updates often contain important fixes that can streamline the process.

Another frequent issue involves connectivity problems. If you’re having trouble accessing the service, check your internet connection. Sometimes, a weak connection can cause the application to behave unexpectedly. Restarting your device or switching networks might do the trick.

If you’re still facing difficulties, consider checking online forums or the official support page. Many users share their experiences and solutions that may resolve similar challenges. A little community input can go a long way in helping you navigate any bumps in the road.

Remember, patience is key. Taking a moment to systematically go through potential issues can save you time and stress. Before you know it, you’ll be back on track and enjoying the full functionality of your financial tools.