A Comprehensive Guide to Making Payments on Your SBI Credit Card Bill

In today’s fast-paced world, staying on top of your financial responsibilities is crucial. With various options available, keeping track of your expenditures and ensuring timely settlements can be a smooth process. Understanding the mechanisms that simplify this task can not only save you stress but also enhance your overall financial well-being.

There are numerous methods to fulfill your monetary duties effectively, allowing for flexibility and convenience. Whether you’re inclined towards digital avenues or prefer traditional approaches, the key is recognizing which option suits your lifestyle best. By adapting to modern solutions, you can streamline your routine and focus more on what truly matters.

Exploring the different avenues available will empower you to make informed decisions. Embracing technology enhances your experience and provides a sense of control over your finances. With just a few steps, you can ensure that your obligations are met promptly, leading to a more organized financial life.

Understanding SBI Credit Card Billing

Managing the financial obligations that come with a banking product can sometimes feel overwhelming, especially when it involves monthly responsibilities. Each month, the issuer provides a detailed statement that outlines the expenditures, charges, and any applicable fees. Having a grasp of this process is essential for effective budgeting and maintaining a healthy financial profile.

A typical billing statement serves as a comprehensive summary of all transactions carried out within the billing cycle. It includes crucial information such as the total amount owed, the minimum required remittance, and the due date. Understanding these details can help individuals make informed decisions regarding their financial commitments and avoid potential late fees.

The document also highlights the interest rates applied to carried balances and any rewards or cash back earned during the period. By familiarizing oneself with these aspects, users can strategize their spending and repayment efforts to maximize benefits while minimizing costs. Clarity on how interest accumulates and the importance of timely contributions can significantly impact overall financial health.

Moreover, it’s important to recognize the different methods available for fulfilling these monthly obligations. There are various options, including online transfers, automatic deductions, and traditional methods like checks. Each avenue has its advantages, and being aware of them can streamline the process, ensuring that payments are made efficiently and without hassle.

Methods for Paying SBI Credit Card Bills

Managing your finances involves keeping track of various obligations, and paying your dues on time is crucial. Thankfully, there are several convenient options available to help you settle your monthly dues efficiently. Let’s explore different ways you can fulfill this responsibility without any hassle.

Online Banking: One of the most popular choices is utilizing your bank’s online platform. With a few clicks, you can transfer funds directly from your savings account to your account. This method is straightforward and allows you to track your transactions easily.

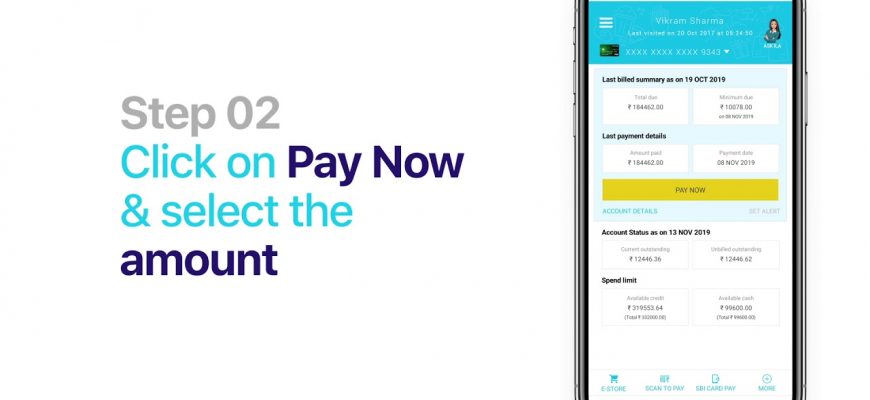

Mobile Applications: Advanced technology has made it possible to manage your finances right from your smartphone. Many banking apps offer seamless integration, enabling you to handle transactions on the go. Simply download the app, log in, and follow the prompts to complete your transfer.

Auto-Debit Option: For those who value convenience, enrolling in an auto-debit feature can be a game changer. By setting this up, the amount gets automatically deducted from your linked bank account each month, ensuring you never miss a due date.

Third-Party Payment Services: Numerous third-party platforms provide alternate methods for settling your accounts. These services often allow for quick transactions and come with user-friendly interfaces, simplifying the entire process.

In-Branch Payments: If you prefer a more traditional approach, visiting your local bank branch is always an option. Here, you can make payments in person, receive instant confirmations, and resolve any queries directly with bank staff.

Whatever method you choose, ensure you maintain good habits regarding financial management. By utilizing these options, you can stay on top of your payments and enjoy peace of mind.

Advantages of Punctual Settlements

Staying consistent with your financial obligations can open doors to a multitude of benefits. By ensuring that you meet your due dates, you create a positive impact not only on your immediate finances but also on your long-term financial journey.

- Improved Credit Score: Regular and timely settlements contribute to a better credit history, enhancing your credit score over time.

- Avoiding Late Fees: Keeping up with your obligations means steering clear of those pesky extra charges that can add up quickly and strain your budget.

- Lower Interest Rates: Consistent and punctual behavior can lead to more favorable interest rates in the future, making any borrowing cheaper.

- Enhanced Financial Reputation: Timeliness establishes you as a reliable individual, which can be beneficial when applying for loans or other forms of credit.

- Increased Spending Power: A strong credit profile can enable higher credit limits, giving you more flexibility in your financial planning.

All these advantages not only help you in managing your current finances better but also pave the way for a more secure monetary future.