Understanding the Requirements to Qualify for the Child Tax Credit

Stepping into the world of financial assistance can feel overwhelming, especially when it comes to securing additional support for your family. Understanding the various programs available can open up new avenues for help, alleviating some of the financial pressures that come with raising kids. With a bit of guidance, navigating these options will become a more straightforward task.

Picture this: additional funds that could ease the monthly budget or contribute to your child’s future. Many caregivers don’t realize that specific eligibility criteria exist, which, when met, can lead to significant financial relief. It’s not just about filling out forms; it’s about ensuring you’ve got all the necessary information to make the most of the benefits available.

As you embark on this journey, consider the key elements that play a role in accessing such resources. From understanding the relevant income limits to learning about the various phases of eligibility, each detail matters. With the right knowledge at hand, you can take confident steps toward securing important financial assistance for your family’s needs.

Understanding Eligibility Requirements

Navigating the specifics of financial benefits meant for families can sometimes feel overwhelming. Knowing the criteria that must be met can help parents make informed decisions. Let’s break down what factors contribute to determining eligibility for these essential financial supports.

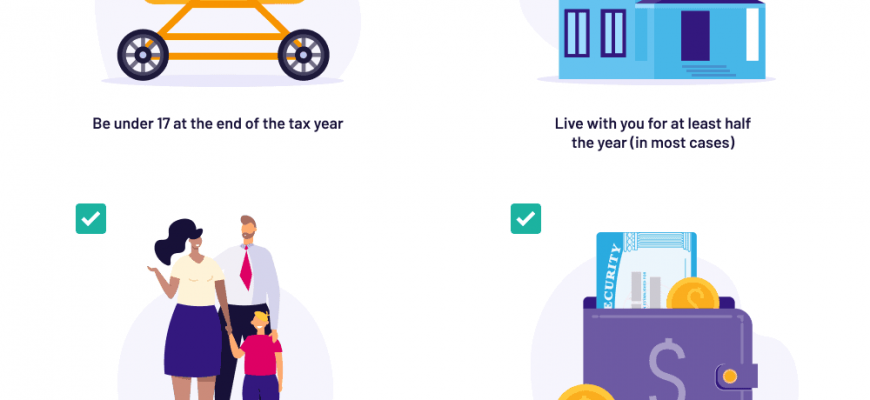

First off, the age of the dependents plays a pivotal role. Typically, there are age limits that dictate whether a caregiver can receive relief. Additionally, income levels are closely examined. Understanding the thresholds can provide insight into what families can expect in assistance. Household structure also matters; whether a parent is single or married can influence the overall benefits available.

Residency is another crucial aspect. It’s important to ensure that the dependent lives with the parent or guardian for most of the year. Legal status and citizenship of the child can also come into play, affecting what options are available. Lastly, knowing if other tax benefits have been claimed can impact eligibility as well.

Income Limits and Filing Status

Understanding the financial thresholds and your filing category is essential when navigating benefits related to dependents. The amounts you earn and how you file your taxes can significantly influence the available support you might receive. It’s vital to familiarize yourself with the specifics, as these factors can determine eligibility and the extent of assistance.

For those filing as single or head of household, your income must fall below a certain level to access maximum advantages. Similarly, if you’re married and filing jointly, there’s a different threshold that applies. Being aware of these limits helps in planning and ensures you don’t miss out on potential benefits due to income considerations.

In addition to earnings, consider your filing status, as it plays a crucial role in determining what you can receive. The tax system recognizes various statuses, and each has its own criteria. Couples, whether married or living together, need to assess their combined income to understand their position better. Knowing these details will help you make informed financial decisions moving forward.

Required Papers for Claiming

When it comes to receiving financial benefits related to dependents, having the right paperwork is essential. This process can seem daunting, but by gathering the necessary documentation, you can streamline your claim and avoid any potential issues. It’s all about having everything ready and ensuring that you meet the specific guidelines set by the authorities.

First and foremost, you’ll need proof of your relationship with your dependents. This often involves birth certificates or legal adoption papers. Additionally, a valid Social Security number for each qualifying individual is crucial, as this uniquely identifies them for the purposes of the financial benefit. Make sure you have these documents organized and accessible when you begin your application.

In addition to personal identification, consider providing any relevant income statements or tax returns from the previous year. These documents help verify your financial status and ensure you meet the necessary criteria. It may also be useful to keep records of any recent changes in your circumstances, such as a change in employment or marital status, which could impact your eligibility.

By ensuring that you have all the right documents in order, you’ll set yourself up for success in navigating the application process. It allows you to focus on what matters most–supporting your dependents and securing the benefits they deserve.