Strategies for Effectively Paying Off Your Credit Card Debt

Finding yourself with outstanding balances can be a daunting experience, especially when those amounts seem to grow larger every month. It’s easy to feel overwhelmed by the prospect of getting everything sorted. Thankfully, there are manageable strategies that can help you regain control over your finances and pave the way to a more secure future.

Many individuals encounter similar dilemmas, yet not everyone knows the most effective approaches to tackle these situations. Establishing a clear plan is essential. This section aims to explore practical ways to handle these liabilities, allowing for a smoother journey toward financial freedom.

With dedication and the right mindset, you can turn the tide and transform your current financial situation. From setting realistic budgets to embracing smart spending habits, each step you take brings you closer to achieving that sense of relief you desire.

Effective Strategies for Reducing Debt

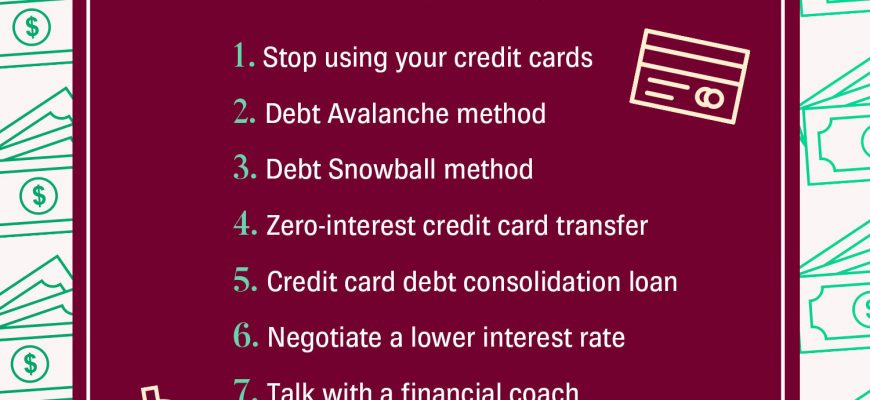

Finding ways to tackle obligations can feel overwhelming, but with the right approach, you can make significant progress. It’s about creating a game plan that suits your situation while keeping your motivation high. Let’s dive into some practical techniques that can help you take control of your finances and move towards a more secure future.

Prioritize Your Obligations – Start by listing all your financial commitments. Knowing what you owe and to whom will give you a clearer picture of your overall situation. Focus on high-interest balances first, as these can accumulate quickly and become a heavier burden.

Create a Budget – Establishing a well-defined budget is essential in managing your funds effectively. Track your income and expenses, and find areas where you can cut back. This will free up extra cash that can then be directed towards reducing your outstanding amounts.

Consider the Snowball Method – This approach involves paying off the smallest balances first. The psychological boost from eliminating a debt can motivate you to tackle larger amounts. Each time you clear a balance, direct those funds to the next smallest obligation until you’ve made your way through them all.

Negotiate Lower Rates – Reach out to your lenders and see if you can negotiate for better terms. Sometimes a simple phone call can lead to lower interest rates or more favorable payment plans. Companies may be willing to work with you, especially if you’ve been a loyal customer.

Explore Consolidation Options – If you have multiple commitments, look into combining them into one lower-rate solution. This can simplify your payment process and potentially reduce the total interest you pay over time.

Automate Payments – Setting up automatic payments helps you avoid late fees and keeps you on track. It can also provide peace of mind knowing that your obligations are being handled regularly without needing constant oversight.

Seek Professional Guidance – If your situation feels especially daunting, don’t hesitate to consider financial counseling. Professionals can provide personalized advice and strategies tailored to your unique circumstances.

Implementing these techniques can significantly ease the pressure of financial burdens. Remember, progress may take time, but each step you take moves you closer to financial freedom.

Understanding Your Credit Card Terms

Getting a handle on your financial tools is crucial for making informed decisions. You’ve probably noticed that there’s a lot to digest when it comes to the agreements tied to your plastic money. Familiarizing yourself with these details can not only save you money but also enhance your overall experience. It’s like knowing the rules of the game before you start playing.

Interest Rates: One of the key aspects to consider is the interest rate applied to outstanding balances. This figure, often expressed as an APR, tells you how much extra you’ll owe if you don’t settle your dues in full each month. Understanding this can help you strategize effectively.

Fees: Keep an eye on potential charges that can crop up, like annual fees or late payment penalties. Being aware of these costs will prepare you for any surprises down the line. Some providers even impose foreign transaction fees, so if you travel, that’s an essential detail to keep in mind.

Credit Limit: The maximum amount you’re allowed to borrow plays a vital role in ensuring your finances stay in check. Knowing this helps you avoid overspending, promoting responsible usage while also enhancing your credit score when managed wisely.

Grace Period: Many lenders offer a grace period during which no interest accumulates on new purchases if previously outstanding balances are cleared. Grasping how this time frame works can help you optimize your payment strategy, potentially saving you a nice chunk of change.

Ultimately, being well-versed in these components arms you with the knowledge to make choices that align with your financial goals. It’s all about making those agreements work in your favor!

Budgeting Tips for Managing Payments

Creating a solid plan for your finances can simplify the journey towards eliminating debts. By keeping track of your income and expenses, you can establish a strategy that ensures your monetary commitments are met without unnecessary stress. It’s all about being mindful of where your money goes and making adjustments to stay on track.

First, set clear financial goals. Determine what you want to achieve in both the short and long term. This will guide you in making sound decisions about how to allocate your funds effectively. Whether it’s saving for an emergency fund or targeting a specific debt, clarity can motivate you to stick with your plan.

Next, prepare a realistic budget. Factor in all your necessary living expenses along with your monthly obligations. Don’t forget to include a small allowance for discretionary spending. By creating a balanced framework, you’ll find it easier to see where you can cut back or save more.

Consistent tracking of expenses is also crucial. Use apps or traditional methods, like a notebook, to document every transaction. This practice helps in identifying spending patterns, allowing you to adjust your habits accordingly. Recognizing areas where you might be overspending can lead to insightful changes.

Consider automating your payments. Setting up automatic transfers for your obligations can ensure you never miss a due date. This not only simplifies your financial life but can also help you avoid late fees and maintain better credit standing over time.

Lastly, don’t hesitate to revisit and modify your budget regularly. Life changes and so do your financial needs. Staying flexible ensures that you can adapt to new challenges while keeping your financial objectives in sight.