A Comprehensive Guide to Paying Your Credit Card Bill Efficiently

If you’re juggling finances, keeping track of your monthly obligations can sometimes feel like a daunting task. It’s crucial to stay on top of these recurring expenses to maintain a healthy financial life. With modern tools and services, handling these payments has become more accessible and straightforward. Let’s explore some effective strategies for managing these regular duties.

The first step in this journey is understanding the different options available to ensure timely submissions. Whether you prefer automated systems or manual processes, having a clear plan can save you from unnecessary late fees and help maintain a positive financial reputation. It’s all about finding what works best for your lifestyle and routines.

Lastly, consider the benefits of making these payments on time. Not only does it enhance your financial habits, but it also positively impacts your overall credit score. Engaging in this practice can open doors to better interest rates and borrowing opportunities in the future. Let’s dive into the various methods and tips to streamline this essential aspect of financial management.

Understanding Your Payment Options

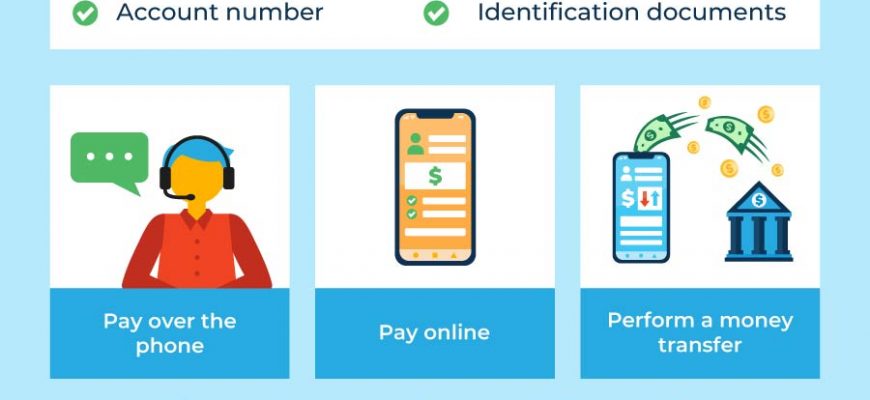

When it comes to managing your monthly obligations, it’s essential to know the various methods available to settle your financial responsibilities. Whether you’re looking for convenience, speed, or costs associated, there are several choices that could fit your needs. Each option has its advantages, which can make your experience smoother and help you avoid unnecessary fees.

Online Payments: Many financial institutions offer a simple way to handle your dues through their websites. This option provides quick processing and often allows you to automate future transactions, so you never miss a due date. Plus, you can typically access your details anytime, making it easy to keep track.

Mobile Apps: In today’s digital age, using a mobile application is an incredibly efficient way to manage your obligations. With just a few taps on your smartphone, you can send funds directly from your bank account or linked service. It’s all about making your life easier while keeping you in control.

Mailing Checks: While it might seem old-fashioned, sending a physical check is still a valid option. If you prefer a tangible method, writing a check allows you to maintain oversight of your finances. Just be mindful of mailing times to avoid late penalties.

In-Person Payments: For those who value face-to-face interaction, visiting your financial institution to complete a transaction can offer peace of mind. This method allows you to ask questions and resolve any potential issues directly with a representative.

Exploring these diverse methods can empower you to choose what aligns best with your lifestyle. By understanding the available options, you can ensure that you meet your financial commitments on time and with minimal hassle.

Steps to Effectively Manage Your Payments

Successfully overseeing your financial obligations is crucial for maintaining a healthy economic status. Adopting a structured approach can alleviate stress and prevent unexpected hassles. Here are some practical steps to ensure you remain on top of your commitments.

First, create a detailed schedule. Knowing exactly when your dues are due empowers you to allocate funds accordingly. Mark these dates on a calendar or use a reminder app on your smartphone to help keep the deadlines visible.

Next, consider setting aside money regularly. Instead of scrambling at the last minute, designate a specific amount from your income to cover these expenses. This habit not only simplifies the process but also helps in avoiding late fees.

Additionally, explore automatic transactions. Many institutions offer options that allow you to link your account for seamless transfers. This convenience ensures that you never miss a payment by eliminating the risk of forgetting.

Furthermore, always review your statements. It’s essential to verify that all charges are accurate. If discrepancies arise, addressing them promptly can save you from unwanted complications and potential penalties.

Lastly, stay informed about your finances. Regularly checking your budget helps you grasp where your money goes and allows you to adjust as necessary. Knowledge is power, and being proactive will lead to a stress-free financial life.

Common Mistakes to Avoid When Paying

When handling your financial obligations, it’s easy to fall into some pitfalls that can lead to unnecessary fees or complications. Many people overlook simple but crucial steps that can save them both time and money. Here are some common missteps to steer clear of in order to keep your finances in check.

One frequent error is missing the due date. It might seem obvious, but life can get busy, and deadlines can slip your mind. Setting reminders or scheduling payments in advance can help you avoid late fees and potential interest rate hikes.

Another mistake is underestimating the total amount owed. It’s essential to double-check your statements and understand any additional charges that may apply. Ignoring that can result in insufficient payments that leave you with a lingering balance and extra costs.

Additionally, relying solely on minimum payments can be detrimental. While it may seem convenient, this approach can extend your debt longer than necessary and lead to higher interest accumulation over time. Striving to pay more than the minimum can significantly reduce your balance and save you money.

Finally, not reviewing your transaction history regularly can lead to missed errors or fraud. Always keep an eye on your expenditures, as spotting inconsistencies early can protect you from larger issues down the line. Being vigilant is key to effective financial management.