Understanding the Requirements for Financial Aid Eligibility

Navigating the world of educational support can feel overwhelming, especially when it comes to understanding what it takes to receive help. Many students and their families find themselves wondering what criteria are considered when determining access to various resources. There are specific benchmarks that play crucial roles in the assessment process, deeply influencing the opportunities available to those in need.

Gaining insight into the elements that affect the chances of receiving support is essential. Not only do these factors vary across different programs, but they also take into account personal circumstances, achievements, and other relevant details. Each aspect is weighed carefully, helping authorities establish who may benefit from these valuable resources.

It’s beneficial to explore these key components so that aspiring learners can approach the process with a clearer understanding. By examining the landscape of assistance programs, individuals can empower themselves with knowledge, ultimately allowing for more informed decisions regarding their educational journeys.

Understanding Eligibility Criteria

Navigating the world of assistance can feel overwhelming, but grasping the essential requirements is a key step in the journey. Different programs and organizations have various benchmarks that determine who can receive support. Knowing these factors can empower individuals to better align their applications with what is expected.

Typically, eligibility hinges on a blend of financial circumstances, academic performance, and specific needs. Institutions often assess household income, assets, and criteria like family size to gauge support levels. Additionally, the type of education pursued–be it a degree, certificate, or vocational training–can influence the potential for receiving assistance.

Moreover, the timeline plays a crucial role. Most programs have application deadlines and may require documentation that reflects current financial status. Keeping track of these dates ensures that you provide all necessary information without missing out on available resources. Gathering relevant documentation ahead of time can simplify the process significantly.

It’s also beneficial to explore unique opportunities, such as scholarships based on merit or special talents. Each option has its own set of rules that can diversify potential funding sources. By actively researching and understanding these requirements, individuals can better position themselves to receive the help they need to pursue their educational goals.

Key Factors Influencing Aid Qualification

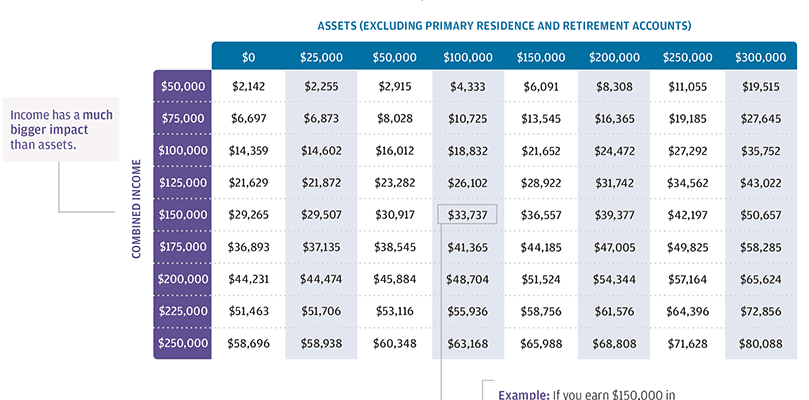

When it comes to obtaining assistance for education expenses, several elements come into play. Understanding these crucial aspects can help individuals navigate the often-complex landscape of support options available. Factors such as income levels, the size of the household, and even assets owned can significantly affect eligibility.

Income: One of the primary determinants is the annual earnings of the individual or their family. Lower income typically enhances the likelihood of receiving assistance, as funding bodies aim to assist those with greater financial need.

Household Size: The number of people living in a household can also play a role. A larger household may mean a lower contribution per person toward educational costs, influencing the chances of receiving support.

Assets: Besides income, the total value of assets, such as savings, investments, and property, is examined. A higher asset level could potentially reduce the amount of support available, as it demonstrates greater financial resources.

Educational Institution: The type and cost of the school or program in question matter as well. Private institutions generally have higher tuition fees, which might lead to a greater need for assistance compared to public options.

In summary, grasping these essential factors enables individuals to better prepare and enhance their prospects in securing the necessary resources for their educational journey.

Assessing Your Financial Situation for Aid

Understanding your economic landscape is crucial in navigating support options. It’s not just about numbers, but painting a comprehensive image of where you stand. This means taking a closer look at your earnings, expenses, and assets to get a true sense of your resources.

Begin by gathering all necessary documentation. Look at your income sources, including salaries, bonuses, or any side gigs. Don’t overlook other streams like investments or rental properties. Then, consider your regular expenditures–rent, utilities, groceries–and any additional costs that might pop up throughout the year.

Next, it’s essential to evaluate your savings and debts. Having a detailed snapshot of your assets, such as savings accounts or investments, will help you complete the picture. On the flip side, understanding your liabilities, including loans and credit card debt, is equally important. Balancing these elements will give you a clear idea of where you actually stand financially.

This approach not only helps in determining assistance options but also fosters better money management practices. Taking the time to dissect your finances may open new doors and opportunities that you hadn’t previously considered.