Understanding the Value of the Child Tax Credit and Its Impact on Families

Many families look for ways to ease their financial burdens, particularly when it comes to supporting their little ones. There exist programs that aim to provide monetary assistance, helping parents manage expenses that come with raising children. This financial aid can significantly impact a household’s budget, allowing for more flexibility and security.

Exploring various options available for families can reveal important information about how to maximize these benefits. Different factors, including income levels and number of dependents, play a vital role in determining potential outcomes. Parents are encouraged to familiarize themselves with these aspects to make informed decisions that align with their unique situations.

Whether you’re a seasoned parent or just starting your journey, navigating through available resources may pave the way for a more manageable financial experience. Seeking knowledge about these supports fosters greater confidence in taking advantage of what is offered, ultimately contributing to a brighter future for you and your loved ones.

Understanding the Child Tax Credit Amount

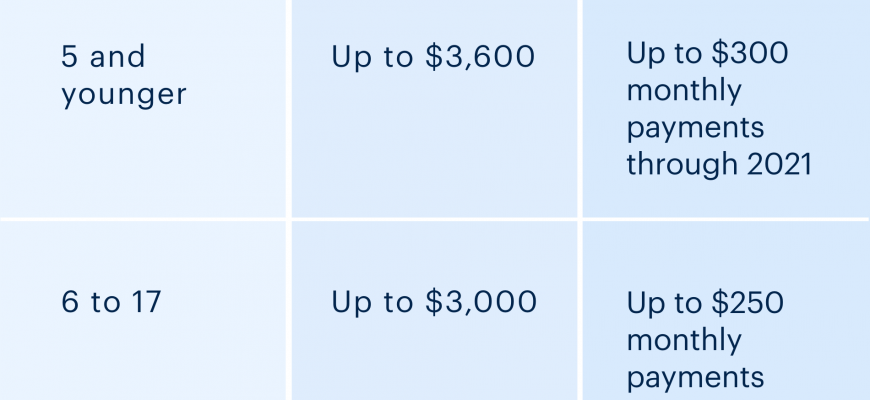

When it comes to financial support for families with dependents, one important aspect to consider is the monetary assistance available to assist with raising kids. This initiative aims to alleviate some of the financial burden associated with nurturing children. The amount that families may be eligible to receive can vary based on several factors, including income and the number of dependents.

Many parents are eager to know what kind of financial relief they can expect, and it’s essential to grasp the guidelines set forth by the authorities. Eligibility requirements play a significant role in determining who benefits from these funds and how much. Knowing the specifics can empower families to plan better for their children’s needs.

It’s also worthwhile to recognize that recent reforms and updates impact the financial outlook for many households. Changes to eligibility criteria and benefit amounts over the years have created fluctuations, making it vital to stay informed about the latest developments. Understanding these nuances can ensure families take full advantage of available resources.

Finally, preparing the necessary documentation and knowing when to apply can make a difference in securing this support. With the right information at hand, families can navigate the process more efficiently and maximize their potential financial aid.

Eligibility Criteria for Receiving Credits

Understanding who qualifies for financial benefits can be quite essential for families aiming to take advantage of available support. Several factors play a role in determining if an individual or household will meet the necessary conditions to receive these invaluable monetary aids. It’s important to grasp these elements to ensure you’re not missing out on assistance you may be entitled to.

Typically, residency status is a primary consideration. Most programs require applicants to be residents or citizens, making this a crucial aspect of eligibility. Additionally, income levels often factor significantly; households must meet specific limits to qualify for benefits. This ensures that assistance goes to those who need it most.

Age of dependents also has its importance. Programs often stipulate requirements regarding how old children must be to allow families to benefit. Furthermore, filing status can impact eligibility as well; certain classifications may open up or restrict access to these funds.

Lastly, having a valid Social Security number plays an essential role in the application process. This requirement is critical for record-keeping and verification purposes. By understanding these criteria, families can navigate their options with confidence and take full advantage of the assistance available to them.

Recent Changes and Impacts on Payments

Recent adjustments in financial assistance aimed at families have sparked considerable discussion. These modifications are designed to provide enhanced support, reflecting the evolving needs of households across the nation. Understanding these shifts can help parents navigate their new financial landscape more effectively.

One significant change has been the variation in support amounts provided. With recent legislation, many families noticed differences in their monthly distributions. These fluctuations can greatly influence budgeting and planning, so it’s essential to stay informed about the specifics.

Additionally, adjustments in eligibility criteria have also come into play. Some households may find themselves qualifying for more assistance, while others could be impacted differently. Keeping track of these eligibility changes ensures that families can maximize their benefits and adjust their financial strategies accordingly.

The broader impact of these alterations goes beyond mere figures on paper. For many families, this support can lead to improved access to necessities like education, healthcare, and childcare. As parents plan for the future, recognizing how these new guidelines play a role in their overall financial picture becomes crucial.