Exploring the Average Amount of Financial Aid Packages Available for Students

When it comes to pursuing higher education, many students find themselves navigating a complex landscape of funding opportunities. It’s no secret that tuition costs can be daunting, and that’s where various assistance programs come into play. Exploring these options can help alleviate some of the financial burden associated with college expenses.

As you dive into this topic, you might wonder what kind of support you can expect based on different factors. Various institutions offer an array of solutions tailored to meet the needs of students from diverse backgrounds. Knowing what to anticipate can make a significant difference in your planning process, allowing you to focus more on your studies and less on monetary concerns.

In this discussion, we’ll delve into the typical levels of support available, shedding light on what many students might receive during their educational journey. Understanding these elements will empower you to take informed steps toward your academic goals, ultimately helping you make the best decisions for your future.

Understanding Average Financial Aid Offers

When it comes to pursuing higher education, many students encounter various types of support to help lessen the burden of expenses. It’s essential to get a grasp on what these offerings typically look like and how they can positively impact your journey. Knowing the kinds of assistance available can make navigating this process much simpler.

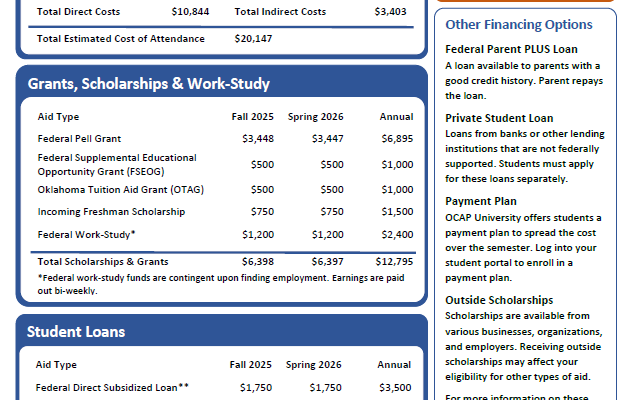

Students often receive a mix of grants, scholarships, loans, and work-study opportunities. Each institution has its own criteria for distributing resources, resulting in different sums based on numerous factors, such as financial need and academic performance. It’s important to explore how these contributions can work together to create a comprehensive support system for your education.

Understanding what to expect can make planning for college less daunting. Familiarizing yourself with common trends in support distributions helps set realistic goals. You’re not alone in this pursuit, and numerous resources are available to guide you through the complexities of funding your studies.

Factors Influencing Assistance Amounts

When it comes to determining how much support one can receive, several elements come into play. Each individual’s situation can vary greatly, impacting the final sum of resources available. It’s essential to understand that these influences can stem from both personal circumstances and broader economic factors.

One significant aspect is the student’s family income. Typically, households with lower earnings may qualify for more substantial support, as the goal is to bridge the financial gap for those in need. Additionally, assets, including savings and investments, are considered to assess overall financial health.

Another factor is the cost of attendance at a particular institution. Schools with higher tuition fees often provide more assistance to help make education accessible. Geographic location can also play a role, as living expenses vary significantly from one area to another, which can affect the required funding.

Academic performance and achievement can further influence the available support. Scholarships based on merit often supplement need-based resources, rewarding students not only for their financial situation but also their dedication and hard work.

Lastly, the type of institution–whether public, private, community college, or university–can significantly affect funding options. Each of these institutions has different policies and resources that can shape what support looks like for students.

Comparing Types of Financial Assistance

When it comes to supporting your education, there are various forms of help available. Understanding these options is crucial in determining which might be most beneficial for your circumstances. Whether you’re exploring grants, scholarships, or loans, each type has its unique features and implications.

Grants are typically need-based opportunities that do not require repayment, making them a desirable choice for many students. Scholarships, on the other hand, are often merit-based, awarded for academic achievements, talents, or other special criteria. These can significantly alleviate tuition costs while fostering a competitive spirit among applicants.

Loans usually come from government bodies or private institutions and must be repaid, often with interest. While they can provide immediate funding, it’s essential to weigh the long-term financial impact. Understanding how these options align with your academic goals can help create a more tailored approach to managing education expenses.

Ultimately, evaluating these different forms of support allows students to make informed choices about their educational investments. Being aware of what’s available can lead to more strategic decisions that enhance both academic and financial well-being.