Understanding the Cost of PayPal Credit and Its Benefits for Consumers

When it comes to navigating the world of online financial services, many individuals find themselves pondering various aspects of the available options. One key consideration often revolves around the expenses associated with utilizing these platforms effectively. With so many choices available, comprehending the value and associated fees can seem overwhelming.

In today’s digital age, the convenience of managing finances online comes with its own set of questions. From transaction fees to potential interest rates, knowing what you’re up against is essential for making informed decisions. This exploration highlights the different elements that can influence your overall spending when leveraging these modern financial tools.

Understanding the nuances of these costs can empower users to optimize their financial choices. With joint insights into how these services operate, you can better appreciate what’s at stake, enabling you to take full advantage of the benefits offered without facing unexpected charges.

Understanding PayPal Credit Basics

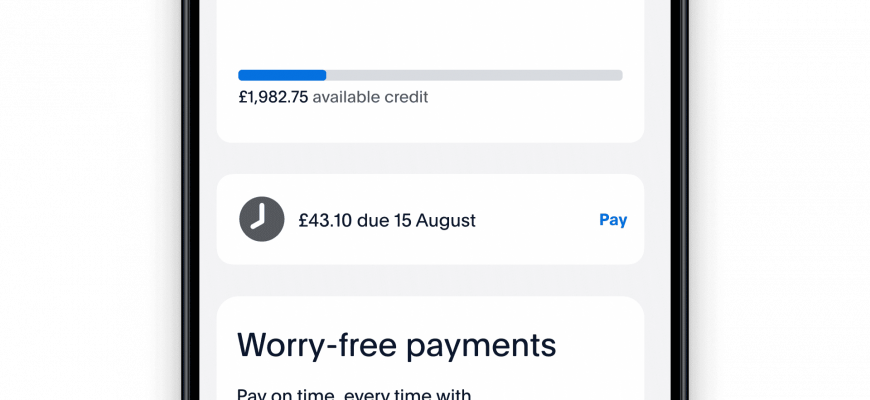

When it comes to managing your online purchases, there’s an option out there that can enhance your experience and provide some flexibility. This financial service is designed to help users handle transactions without the immediate burden of payment. It allows you to make purchases confidently, knowing you have a bit of extra leeway with your expenses.

It’s essential to be informed about the key features of this service. Generally, you can expect a quick application process that delivers a decision almost instantly. Once approved, you can use your available balance for various purchases, whether it’s at checkout on your favorite websites or in stores that accept it as a payment option.

Another aspect to consider is the repayment terms, which can significantly impact your financial planning. Users will typically have a designated period to pay off their balances, often with promotional offers to encourage timely payments. This can make budgeting a lot easier if you use it wisely and keep an eye on the due dates.

Interest Rates and Fees Explained

Understanding the costs associated with borrowing can be a bit overwhelming, but it’s crucial for making informed financial decisions. Rates and charges can vary significantly, and grasping these details helps avoid surprises down the line. A clear picture of what to expect allows you to budget effectively and repay any borrowed amount responsibly.

Interest rates are often presented as annual percentages, giving you an idea of how much extra you’ll be paying for using funds over a year. However, it’s important to note that these rates can change based on factors like your creditworthiness and prevailing market conditions. Additionally, some arrangements might come with introductory offers that temporarily lower rates, enticing users to sign up.

Besides interest, there might be other expenses to consider. For instance, late payment fees can add up quickly, causing your total balance to swell. Some programs may also charge an annual fee or transaction costs, depending on usage. Always review the terms to fully understand any potential cost you might incur during the repayment period.

Taking the time to analyze these elements not only prepares you for what’s ahead but can also aid in selecting the best option for your financial needs. Remember, knowledge is power, particularly when it comes to managing your finances wisely.

Applying for PayPal Credit: Requirements

When considering a line of financing through a well-known online payment platform, it’s essential to understand the specific criteria you’ll need to meet. This process can often seem straightforward, yet it involves certain prerequisites to ensure that both parties are set for a successful experience.

Firstly, applicants must be of legal age, essentially 18 or older, and reside within the applicable regions. Having a valid Social Security Number or Individual Taxpayer Identification Number is also crucial for identity verification purposes. Additionally, maintaining a reliable source of income will bolster your application, proving your ability to manage repayments.

Another key point is your credit history. While a perfect score isn’t a requirement, a reasonable credit profile can enhance your chances of approval. It’s wise to check your credit report beforehand, so you’re aware of where you stand financially. Furthermore, be prepared to provide some personal information, such as your address and banking details, as part of the application process.

In summary, understanding these requirements can smooth the path toward obtaining financing, making it easier for you to enjoy the conveniences offered by this payment option.