Understanding the Amount You Can Expect from Your Financial Aid Refund

When it comes to your educational journey, navigating the complexities of tuition and associated costs can often feel overwhelming. Many students rely on various forms of financial support to ease the burden of educational expenses. It’s essential to comprehend how these funds work and what they mean for your personal finances.

In essence, the process of receiving surplus funds from financial support sources can lead to a range of outcomes, depending on several factors. This situation can be particularly beneficial, enabling learners to manage their living expenses, supplies, or even unexpected costs that may arise during their studies.

In the end, understanding the amount that might be returned after your educational funding is crucial. It allows for better financial planning and helps you make informed decisions about your spending and budgeting throughout the academic year.

Understanding Financial Aid Refunds

When it comes to covering education costs, there are various options available to students. Sometimes, after all the expenses have been settled, there may be some funds left over. This can lead to some confusion as to what exactly happens with this surplus. It’s essential to grasp how these additional resources work and what they mean for your overall financial situation.

Leftover resources are typically the result of scholarships, grants, or loans exceeding the total tuition and fees. In these scenarios, students may find themselves receiving checks or direct deposits. Seeing this extra cash is often exciting, but it’s important to understand its implications.

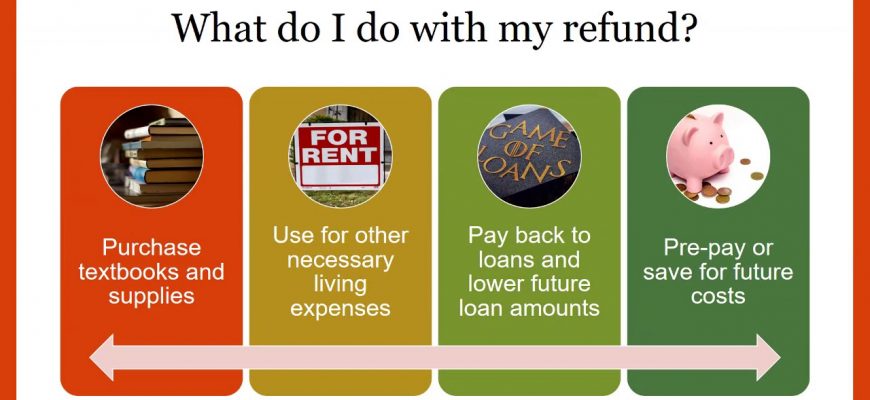

Proper management of the surplus can pave the way for covering living expenses, books, or unexpected costs that arise during the academic year. However, students should remain vigilant and aware of how these funds might impact their future financial plans, especially regarding employment or other forms of assistance.

Staying informed about policies and timelines associated with leftover resources can help prevent unnecessary stress while navigating college life. Make sure to keep communication open with your institution to clarify any questions you may have about the available funds.

Calculating Your Refund Amount

Understanding the amount you’re entitled to receive can be quite a task, but it’s essential for effective budgeting. You need to account for various factors that can influence the sum you’ll actually see in your pocket. Let’s break it down into manageable pieces, shall we?

Start by considering the following elements that impact your total compensation:

- Tuition Expenses: The total cost of your classes plays a crucial role. Be sure to track any adjustments or changes throughout the semester.

- Fees: Don’t overlook additional costs like registration, lab, or technology fees that may affect your overall amount.

- Living Costs: If you’re eligible for support related to housing or other living expenses, include those figures in your calculations.

- Eligibility Criteria: Make sure you understand the parameters that determine your eligibility for receiving support.

After figuring out these amounts, you can follow this straightforward process to estimate what you might receive:

- Add up your total educational costs.

- Subtract any scholarships, grants, or other resources you’ve secured.

- The remaining balance is what you’ll typically expect as compensation.

Keep in mind that this is an estimation. Always consult with your institution’s financial office to confirm details and get the most precise numbers. Clear communication can save you time and help avoid any surprises down the line!

Using Assistance for Educational Expenses

Many students often rely on support systems to help cover the costs of their studies. These resources can alleviate the burden of tuition fees, textbooks, and other necessary expenditures that come with pursuing an education. Understanding how to effectively utilize this support can make a significant difference in managing financial responsibilities while focusing on academic goals.

When considering expenses, it’s essential to prioritize needs. Tuition is usually at the top of the list, but don’t forget about materials, technology, and living costs. Planning ahead allows students to allocate these resources wisely, ensuring that each dollar goes toward supporting their academic journey.

Additionally, keeping track of all the necessary expenses throughout the semester can help in realizing how much support is actually needed. Maintaining a budget can lead to smarter spending habits, allowing students to stretch their resources further. This not only provides immediate relief but also fosters better financial practices for the future.

Lastly, students should be aware of all options available to them. Scholarships, grants, and other forms of assistance can play a vital role in funding their education. Staying informed about these opportunities can lead to a smoother financial experience during school, ultimately helping students concentrate on what truly matters – their studies and personal growth.