Exploring the Different Types and Amounts of Financial Aid Available

Deciding to pursue higher education often comes with a flurry of questions about finances. Many individuals find themselves exploring various avenues to ease the burden of tuition and related expenses. In this landscape, support mechanisms come into play, offering assistance that can alleviate some of the financial strain experienced by students.

There are several tiers and forms of assistance available, each designed to cater to different needs and circumstances. From grants that provide funds without the expectation of repayment to subsidized loans that come with favorable terms, navigating this world can feel daunting. It’s essential to grasp the full spectrum of resources fostering educational access and success.

No two situations are identical, and the amount of support received can vary widely based on myriad factors, including family income, academic performance, and even specific fields of study. Being informed about these variations can empower potential students to make sound decisions and seek the most beneficial options tailored to their unique situations.

Understanding Financial Aid Options

Navigating the landscape of monetary assistance can feel overwhelming at first. There are various avenues to explore that can significantly lighten the burden of educational costs. Each route has its own set of guidelines, benefits, and requirements, making it essential to familiarize yourself with the options available.

Grants stand out as one popular choice, offering funding that doesn’t require repayment, often based on need. Scholarships serve a similar purpose, rewarding students for academic achievements, talents, or specific criteria without the expectation of returning the money. Then, there are loans, which can be a helpful solution but do come with a repayment obligation, often with interest.

Additionally, work-study programs present a unique opportunity, allowing students to earn money while gaining valuable experience in their fields of study. Each option plays a crucial role in supporting learners towards achieving their educational goals, so it’s important to carefully consider which path aligns best with your situation.

By understanding the diverse array of choices, you can make informed decisions and ultimately pave your way to a successful academic journey. It’s all about finding what fits you best and ensuring you have the support you need.

Calculating Your Potential Aid Amount

Understanding what support you might receive can feel like a puzzle. It involves piecing together different factors to see how they impact your financial situation. The process can be quite straightforward, provided you have the right information and tools at your fingertips.

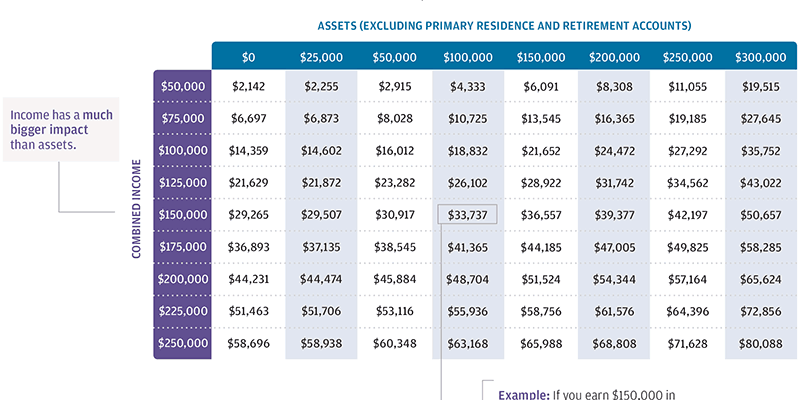

First off, it’s essential to gather your personal and family financial data. This includes income, savings, and any assets you possess. Schools typically look at these details to determine your eligibility for various types of support. Remember, your circumstances may change from year to year, so always keep your information up to date.

Next, explore the available calculators provided by institutions. These tools allow you to input your data and estimate what assistance you could potentially receive. They factor in grants, scholarships, and loans, giving you a clearer picture of your possible funding options.

Finally, don’t forget to consider external resources. Numerous organizations offer support based on specific criteria, such as your field of study or personal background. Researching these opportunities might uncover additional financial resources that can ease your educational journey.

Factors Influencing Monetary Support

When it comes to securing support for education, there are various elements at play that determine the level of assistance one might receive. These components can range from personal circumstances to institutional policies and external economic factors. Understanding these aspects can greatly impact your journey toward obtaining the needed resources.

First off, an individual’s financial circumstances play a crucial role. This includes income levels, family size, and any unique financial obligations. The broader economic environment is also significant; for instance, fluctuations in the job market can influence the availability of certain programs. Educational institutions themselves have policies and criteria that can vary widely, leading to different levels of support across schools.

Another important factor is academic performance. Many forms of assistance consider grades, test scores, and extracurricular involvement. Additionally, special circumstances, such as disabilities or unique talents, may also enhance eligibility. Each of these elements weaves into a complex tapestry that shapes the nature of support available.