Understanding the Value of FAFSA Financial Aid and What It Means for Your Education Costs

When it comes to pursuing higher education, many students find themselves navigating the complex world of funding options. It’s essential to grasp the various resources available that can significantly lower the financial burden of college expenses. This section will explore how these resources can help bridge the gap between costs and personal finances.

For countless individuals, understanding the intricacies of these programs can make a tremendous difference in their educational journey. With so many variables at play, from household income to specific school requirements, unraveling this financial puzzle becomes crucial. Exploring the nuances of the process can reveal opportunities that many students might overlook.

As you delve into the types of assistance available, you’ll discover that options vary widely based on individual circumstances. Knowing what’s out there and how to access it can empower you to make informed decisions. In this discussion, we’ll break down the essentials to give you a clearer picture of what you might expect and how to optimize your chances of receiving support.

Understanding FAFSA Financial Aid Packages

When it comes to funding your education, it’s essential to grasp the different elements that comprise the support you might receive. This assistance often stems from various sources, including federal programs, state initiatives, and institutional offerings, all tailored to help students manage their expenses while pursuing their academic goals.

Breaking Down the Components of these support packages can seem overwhelming at first. Essentially, they may include grants, scholarships, work-study opportunities, and loans. Each of these components plays a distinct role in helping you cover tuition fees, textbooks, and living costs. Understanding what each type of support entails can empower you to make informed decisions regarding your educational journey.

It’s also important to consider the timeline involved in receiving this support. Once you submit your application, you’ll typically receive a summary of your eligibility. This summary outlines the amounts and types of assistance you might qualify for, giving you a clearer picture of your financial resources for the upcoming academic year.

Ultimately, taking the time to review and comprehend your support options can lead to more strategic planning as you embark on your studies. Being proactive about understanding these packages can significantly impact your overall experience and success in higher education.

Types of Support Available Through FAFSA

When it comes to funding your education, there are various forms of assistance that can alleviate financial burdens. Understanding the different options can help you make informed decisions about your academic journey. These resources range from loans to grants, all designed to support students in achieving their goals.

One prominent type of support is grants, which are essentially funds that don’t have to be repaid. These are often awarded based on financial needs and can significantly reduce the cost of tuition. Then, you have loans, which provide money that you’ll need to pay back after your studies, usually with interest. While this option requires careful consideration, it can still serve as a valuable resource for many students.

Additionally, you may encounter work-study programs, allowing you to earn money while attending school. This not only helps with expenses but also provides experience that can be beneficial in your future career. Lastly, scholarships are another fantastic avenue, often based on merit or specific achievements, giving students a chance to access funds without the burden of repayment.

Overall, knowing the various forms of assistance available can empower you to navigate the financial landscape of higher education more effectively. Each option has its own unique benefits, and exploring them can lead to a more manageable educational experience.

Calculating Your Potential Support

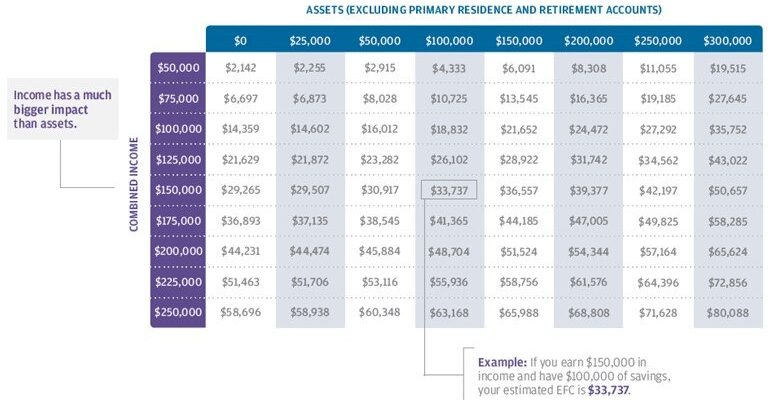

Determining the amount of support you may receive can be an essential step in your journey toward education. It’s not just about knowing what you might get, but understanding the various factors that can influence that number. There are numerous aspects to consider, from your financial background to the institution you are attending.

To start with, your income, assets, and family size play crucial roles. The process often begins with gathering your financial documents, as these will help paint a clearer picture of your situation. Additionally, schools may have their unique formulas to assess eligibility, which can impact the total assistance available to you.

Another important element is deadlines. Ensuring you submit all necessary information on time can significantly affect the level of support offered. Don’t forget to explore other available resources, such as scholarships and grants, that can supplement the aid you receive.

Lastly, staying informed about changes in your financial status or federal and state programs can help you maximize the support available. Regularly check in with your school’s financial office for updates and personalized advice tailored to your circumstances.