Understanding the Costs Associated with Care Credit and What You Need to Know

When considering various financial solutions for healthcare and other services, it’s important to get an idea of what you might expect to invest. This area can be quite intricate, with numerous factors influencing the final amount you’ll need. By delving into the specifics, you can make informed choices that suit your financial situation and enhance your experience.

In this section, we’ll explore the different aspects related to these funding options available to consumers. Whether you’re looking at monthly payments, interest rates, or any associated fees, knowing how everything adds up is crucial. With a clear understanding, you’ll be better equipped to navigate your decisions confidently and effectively.

Many individuals encounter varied experiences with similar products, and personal stories can reveal much about what to anticipate. While the numbers can sometimes seem daunting, comprehending the overall picture will empower you to choose wisely for your needs. Let’s unpack this together and get to the bottom of it.

Understanding Payment Options

When it comes to financing healthcare expenses, it’s essential to explore the various options available to make the process easier on your wallet. Different plans can help manage costs, providing flexibility in how and when you pay for medical services. With multiple choices out there, finding a solution that fits your needs can be simple and straightforward.

One of the most appealing aspects of these financing solutions is the chance to break down larger bills into manageable monthly installments. This approach allows individuals to access the care they need without the burden of paying everything upfront. Options might include special promotions, interest-free periods, or low monthly payments that cater to a wide range of budgets.

Another element to consider is the ease of application and approval processes, which are often designed to be quick and hassle-free. Many services allow consumers to know their credit limits and terms almost instantly, enabling timely decisions regarding healthcare services. With personalized plans, individuals can find the right balance between their healthcare needs and their financial situation.

Ultimately, understanding these financing avenues empowers individuals to make informed choices regarding their health expenses. By considering different payment structures and exploring available options, you can pave the way for a more accessible and stress-free experience, ensuring your attention remains focused where it truly belongs–on your well-being.

Interest Rates and Fees Explained

Understanding the costs associated with borrowing can be quite a task. It’s essential to break down the elements that contribute to the total amount you might end up paying. This includes various charges and percentages that can influence your financial obligations.

First, let’s talk about interest rates. These rates determine the additional amount you will need to pay on top of the original sum borrowed. They can fluctuate based on several factors, including your creditworthiness and the overall market conditions. It’s important to look for competitive rates that align with your budget and repayment plans.

In addition to interest, you may encounter fees. These could include application fees, late payment charges, or even annual maintenance fees. Each of these can add to your overall expenses, so it’s wise to read the fine print and be aware of all potential costs before proceeding.

By keeping these aspects in mind, you can make a more informed decision about your financing options, ensuring that you choose a plan that fits your financial situation without any unpleasant surprises down the line.

Comparing CareCredit to Other Financing Solutions

When it comes to managing healthcare expenses, exploring various funding options can be a game changer. There are numerous avenues out there for individuals seeking to cover medical bills without breaking the bank. Understanding the nuances of different offerings can help you make an informed choice that aligns with your financial situation and healthcare needs.

One popular option is personal loans, which often provide a lump sum that can be paid back over a set period. These loans might come with fixed or variable interest rates, providing some flexibility based on your credit profile. Unlike specialized financing, personal loans can be used for a variety of expenses, not just medical ones.

Another alternative is payment plans offered directly by healthcare providers. Many clinics and hospitals allow patients to spread out costs over time, making it easier to manage larger bills. This can be appealing since it simplifies the process and minimizes reliance on external funding sources.

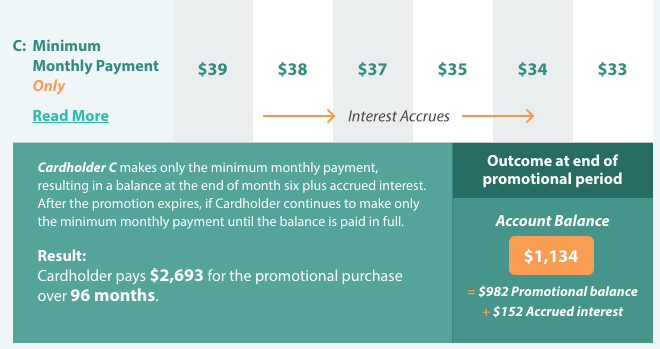

Additionally, some patients consider credit cards with a promotional period offering 0% interest on new purchases. This can be an attractive way to handle immediate costs while providing time to pay off the balance. However, it’s crucial to be mindful of potential interest rates that kick in after the promotional period ends.

Ultimately, the best choice will depend on individual financial circumstances, preferences, and specific healthcare needs. By weighing the pros and cons of each option, individuals can arrive at a financing solution that feels right for them.