Understanding the Value of Tax Credits Available for Children and Their Impact on Family Finances

Bringing little ones into the world comes with a world of joy, but also significant responsibilities, especially when it comes to finances. Many parents are keen to know what kinds of governmental support are available to ease the financial load they carry. Whether it’s funding basics like education and healthcare, or simply daily necessities, these aids can play a vital role in family budgeting.

Among the options available, there are specific allowances aimed at assisting households with children. These allowances can provide a significant boost to family finances. But how do these financial perks actually work? What are the eligibility criteria, and what should you know to take full advantage of these benefits?

In this section, we’ll explore the various benefits provided for families with young ones, explaining the different facets that make them valuable. By the end, you’ll have a clearer picture of how these perks can positively impact your financial landscape, allowing you to make informed decisions for your family’s future.

Understanding Child Tax Credit Amounts

When it comes to financial support for families, various benefits can significantly ease the burden. One such advantage revolves around the assistance provided for dependents, which can positively impact your budget. It’s important to explore these offerings to maximize potential savings that may come your way.

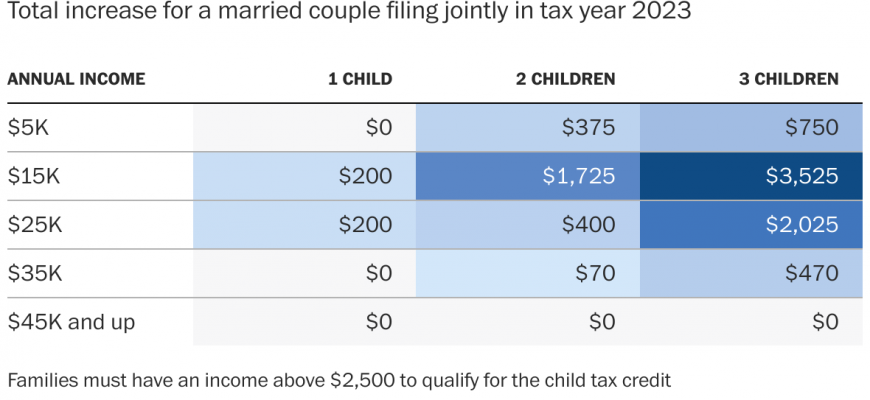

The assistance provided to families varies depending on several factors, including income levels and the number of dependents. Each year, the government outlines specific parameters that determine the overall amount available to qualifying households. Knowing these figures can help you plan better and utilize your available resources effectively.

Eligibility criteria play a crucial role in determining the support one can receive. Generally, factors such as age, residency, and income are key components considered in the evaluation process. Being well-informed about these details can empower families to take advantage of financial opportunities that may be available.

It’s also good to keep in mind that the amount of assistance hasn’t always remained constant. Changes in legislation can influence the figures allocated and who qualifies. Staying updated on recent developments ensures you’re fully aware of what you can claim, allowing for better financial planning.

Ultimately, understanding the specifics of these parental benefits can lead to greater financial security. By familiarizing yourself with the amounts and conditions, you can make informed decisions that contribute to financial well-being for you and your family.

Eligibility Criteria for Financial Benefits

Understanding who qualifies for financial assistance can be quite enlightening. Various factors determine eligibility, and these can significantly affect the support one can receive. It’s essential to navigate the requirements to ensure that individuals do not miss out on available resources.

Age Requirements: One of the primary considerations involves the age of the dependents. Usually, specific age brackets are outlined that dictate who qualifies, so keeping that in mind is crucial.

Income Thresholds: Another aspect to consider is the income level of the household. There are often ranges established that can help determine if one qualifies for support. Higher incomes may limit eligibility, while lower ones can increase the chances of receiving benefits.

Residency Status: Where one resides also plays a vital role. Typically, eligibility can depend on whether the individual is a resident of the corresponding state or country. Different regions may have unique criteria.

Filing Status: The way one files their taxes can significantly impact eligibility. Categories such as single, married, or head of household each may have varying qualifications.

By understanding these essential elements, individuals can better assess their situations and the financial assistance available to them. It’s always wise to check the specific details that pertain to one’s personal circumstances.

Impact of Financial Assistance on Family Finances

When it comes to managing household budgets, every bit of support can make a notable difference. Families often look for ways to ease their financial burdens, and various forms of financial aid can play a crucial role in this process. By providing additional funds, these supports can alleviate some pressure, allowing parents to allocate resources more freely.

One of the primary benefits of these financial initiatives is the potential increase in disposable income. This can lead to improved quality of life, enabling families to afford necessities such as food, clothing, and education. Furthermore, having extra funds can also allow for occasional treats or savings for future investments, such as college funds or family vacations. Essentially, this assistance can transform the everyday experiences of families.

In addition to immediate benefits, the long-term impact cannot be overlooked. Fostering a sense of financial stability can help parents make more confident decisions about their family’s future. This could involve purchasing a home, investing in higher education, or even starting a small business. By reducing financial stress, these supports not only help in the present but also pave the way for a more secure future.

The ripple effect of financial aids on family dynamics is significant as well. When families feel more secure financially, it often leads to a healthier home environment. Parents can focus more on nurturing relationships rather than worrying about bills or expenses. Ultimately, this sense of security enhances not only the family’s well-being but also their community, as happier families contribute positively to society.