Exploring the Lifetime Limits of Financial Aid Opportunities Available to You

In today’s world, pursuing higher education often comes with a hefty price tag. Many individuals find themselves wondering about the extent of assistance available to them throughout their educational journey. As a student, understanding the landscape of support options can help you make informed decisions about funding your studies.

From scholarships to grants, a variety of resources exist to alleviate the burden of tuition and associated costs. Each opportunity has its unique requirements and benefits, which can sometimes lead to confusion. It’s crucial to familiarize yourself with the different types of support available and how they may affect your overall educational experience.

As we delve deeper into this topic, we will examine the various forms of support and the factors influencing the amount one may receive. This exploration will provide clarity and guidance for those seeking to navigate the complexities of financial assistance in education.

Understanding Lifetime Financial Aid Limits

Navigating the world of educational support can feel like a maze at times. There are specific guidelines that dictate the total assistance one can receive throughout their academic journey. These limitations can influence your decisions and planning for the future.

It’s essential to recognize that various programs and resources have their own ceilings. For instance, federal grants, loans, and scholarships might each impose unique caps on the maximum sums disbursed to individuals over their educational pursuits. This means that what you receive in one program may affect eligibility for another.

Timing and application play a crucial role in this process. Understanding the different phases of support and managing your resources wisely can help you maintain access to opportunities. Balancing current needs and potential future requirements is key.

Ultimately, being well-informed about these restrictions will empower you to make smarter choices, ensuring that you maximize the benefits available to you along your educational path.

Types of Assistance Available

When it comes to pursuing education or training, there are numerous forms of support that can help ease the financial burden. It’s important to understand the different options, as they can vary widely in terms of eligibility and application processes. Some offers are based on need, while others focus on merit or specific criteria.

Grants are one of the most sought-after resources. These are often awarded based on demonstrated necessity and typically do not require repayment, making them particularly appealing. On the other hand, scholarships reward excellence in academics, sports, or other talents, providing recipients with funds that they similarly do not need to pay back.

If you’re looking for work experience while studying, work-study programs can be a great option. These allow you to earn money to help cover your expenses while gaining valuable experience in your field. Additionally, there are loans, which, while requiring repayment, can be essential for those needing larger sums to finance their education upfront.

Furthermore, some organizations offer fellowships or assistantships, which often include tuition waivers and a stipend in exchange for teaching or research duties. Each of these types of support plays a crucial role in helping students achieve their goals, and understanding the differences can help you make informed decisions about your own journey.

Factors Affecting Assistance Eligibility

When it comes to receiving support for education, numerous elements come into play that determine who qualifies and to what extent. Understanding these aspects can really help navigate the complex landscape of available resources. Each individual’s situation is unique, and various criteria can influence the results.

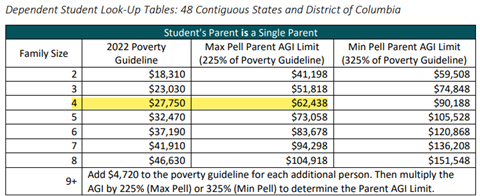

First off, income levels play a crucial role in these assessments. Typically, those with lower incomes may find themselves in a better position to qualify for various types of support, as many programs aim to assist those who need it most. Additionally, the size of a household and the number of dependents can further impact eligibility, as more dependents usually mean more financial pressure.

Another significant factor is the type of institution one is attending. Different colleges and universities have distinct funding resources and policies, meaning that some might offer more opportunities than others. Public vs. private institutions can also make a difference, with varying levels of available support based on their funding structures.

Furthermore, the timing of applications can be essential. Some opportunities have strict deadlines, and applying early can make a world of difference in securing necessary resources. It’s also important to stay informed about any changes in policies or available funds, as these can shift from year to year.

Lastly, personal circumstances, such as military service or disability status