Understanding the Extent of Financial Aid Coverage for Each Semester

When it comes to pursuing higher education, many students find themselves wondering about the various resources available to assist with the ever-increasing costs. Knowing what kind of assistance can be accessed is essential for planning budgets and managing expenses effectively. A closer look at the various forms of support reveals not only the financial implications but also the potential to transform academic aspirations into reality.

It’s important to realize that each individual’s situation varies greatly based on numerous factors, such as the institution attended, residency status, and specific needs. Additionally, understanding the various components of support offerings, including grants, scholarships, and loans, can significantly impact one’s financial outlook. By exploring these different avenues, students can make informed choices that align with their educational goals.

With so many options available, it becomes vital to evaluate what assistance truly means for covering those essential costs associated with schooling. This exploration will delve into how various types of support can alleviate the burden of expenses and pave the way for a more manageable and enriching academic experience.

Understanding the Basics of Financial Aid

Let’s dive into the essentials of assistance for education costs. It’s important to grasp the common forms of support available to students, which can significantly ease the burden of tuition. Various programs and resources exist to help individuals afford their studies and minimize the stress involved in financing their education journey.

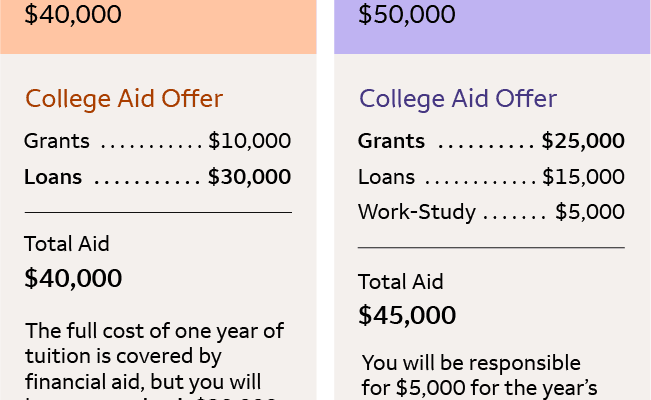

One of the primary types of support comes in the form of grants. These funds don’t require repayment and are often based on financial need. Scholarships represent another avenue, awarded based on merit or specific criteria, sometimes requiring an application or achievement in a particular area.

Loans present another option, where students receive funds they must repay later. It’s crucial to understand the terms, interest rates, and repayment plans associated with such loans to avoid future financial strain. Work-study programs also offer a chance to earn while learning, allowing students to gain valuable experience and lessen their tuition expenses.

Finally, getting familiar with eligibility criteria and application processes is key. Each type of support may have its own requirements, so prospective students should research and prepare accordingly to maximize their opportunities. Understanding these basics can empower individuals to navigate the options and make informed choices for their educational future.

Factors Influencing Assistance Coverage

When it comes to determining the extent of support available, several elements come into play. These factors can significantly sway the amount one may receive, making it essential to understand their implications. With various institutions and programs available, one size certainly doesn’t fit all.

Income Level: A primary consideration in the evaluation process is often the household income. Those from lower-income backgrounds typically have access to more generous resources. This distinction strives to ensure that individuals with greater financial needs can pursue their educational goals.

Type of Institution: The kind of school attended also plays a major role. Public universities might offer different support compared to private colleges. Furthermore, community colleges may have unique options tailored specifically for their student populations.

Enrollment Status: Whether a student is attending full-time or part-time can influence the overall assistance they qualify for. Full-time students often find themselves eligible for a wider array of options, while part-timers might encounter limitations.

Academic Performance: Maintaining a solid academic record can sometimes enhance the level of support obtainable. Scholarships and grants often place emphasis on grades, and meeting such criteria can unlock additional opportunities.

State or Federal Programs: Variations in state and national initiatives also contribute to the financial assistance landscape. Each program has its unique eligibility requirements and allocation amounts, which can affect what one might receive.

Understanding these contributing elements enables students to navigate the complex world of educational support more effectively. Each individual’s situation is distinct, and recognizing these influencing factors is a pivotal step toward maximizing available resources.

Maximizing Benefits for Your Education

Getting the most out of your resources for learning is crucial in today’s world. Many students overlook available opportunities that can significantly enhance their educational journey. Understanding how to optimize these advantages can lead to a more enriching experience both academically and personally.

One effective approach is exploring various support mechanisms, which can include grants, scholarships, work-study programs, and loans. Each of these options can alleviate the financial burden, allowing you to focus more on studies and less on expenses. Be proactive in researching these opportunities; often, institutions offer numerous options that go unclaimed due to a lack of awareness.

Networking is also a powerful tool. Engaging with peers, professors, and alumni can open doors to funding options that may not be widely advertised. Attend information sessions, workshops, and campus events to learn about lesser-known resources available to you. Building relationships with those who have navigated similar paths can provide invaluable insights and guidance.

Finally, managing your budget wisely can amplify the benefits you receive. Keep track of your spending and identify areas where you can save. This could free up additional funds for educational needs. It’s about creating a plan that aligns with your goals and ensures you make the most of every dollar at your disposal.