Exploring the Extent of Financial Aid Coverage for Students

Navigating the world of educational support can feel overwhelming at times. Many students and their families grapple with questions about the extent of assistance available to them. It’s not just about the sums that are available, but also about how these funds fit into the larger picture of college expenses, including tuition, books, and living costs.

When considering the various types of support available, it’s essential to know what to expect. Some forms of assistance are more generous than others and may cover a significant portion of costs. In this journey, understanding the nuances and intricacies of each option can empower prospective students to make informed decisions about their educational paths.

Every student’s situation is unique, and so is the support they might receive. Let’s delve into the different aspects and explore how individuals can evaluate what they might realistically receive and how it aligns with their educational aspirations.

Understanding Financial Aid Types

When it comes to navigating the world of education funding, it’s essential to grasp the different sources available to support your journey. Each type brings unique features and benefits, catering to various needs and circumstances. Recognizing these distinctions allows students and families to make informed decisions on the best options to pursue.

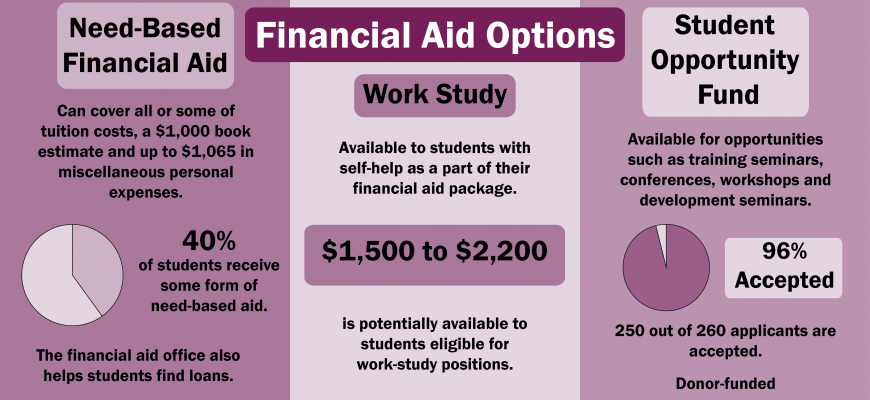

Grants, for instance, are often considered the most desirable form of support since they do not require repayment. These funds typically come from government bodies and institutions, providing students with a financial boost based on need or merit.

Scholarships are another fantastic resource, offering financial rewards based on academic achievements, talents, or specific characteristics, such as belonging to certain demographics or pursuing specific fields. Unlike grants, scholarships can be highly competitive, but they open many doors for eligible candidates.

Loans represent a different avenue, as they require repayment after graduation or once the student ceases to be enrolled. They come in various forms, including federal and private options, each with specific terms and conditions. While they can help bridge the financing gap, it’s crucial to carefully consider the long-term implications of borrowing.

Lastly, work-study programs offer a hands-on way for students to earn money while studying. These positions often provide relevant experience and flexible hours, allowing individuals to manage both their academic and financial responsibilities effectively.

Understanding these various funding opportunities is the first step toward achieving your educational aspirations without undue financial stress.

Factors Influencing Assistance Coverage Levels

When it comes to receiving support for education, various elements come into play that determine the extent of help students can expect. Different circumstances create a unique financial landscape for each individual, affecting the resources available to them. Understanding these factors is key to navigating the complexities of educational support systems.

Income Level: One of the primary influences on the amount of support a student might receive relates to their or their family’s income. Generally, those with lower earnings often qualify for a greater share of assistance, helping to level the playing field in terms of educational access.

Cost of Attendance: The total expense associated with attending a particular institution also plays a crucial role. Schools with higher tuition may enable more substantial support to ensure that students can afford their education without incurring excessive debt.

Dependency Status: Whether a student is classified as dependent or independent significantly affects their eligibility. Independent students typically have different eligibility criteria, which can lead to varied amounts of available resources.

Academic Performance: In some cases, academic achievement can also influence the level of support provided. Scholarships and grants often depend on maintaining specific grades, encouraging students to excel in their studies.

Enrollment Status: Part-time versus full-time enrollment can impact the overall assistance a student qualifies for. Full-time students may have access to more benefits, as institutions often allocate resources based on commitment levels.

Type of Institution: The kind of educational establishment–be it public, private, or community college–can create disparities in assistance levels. Different schools have varying funding mechanisms that directly affect how much support students may receive.

By understanding these dynamics, students can better prepare and strategize for their educational journey, ensuring they take full advantage of the support mechanisms in place.

Maximizing Your Financial Assistance Benefits

Ensuring you receive the most out of your support opportunities can significantly ease the burden of educational costs. With a bit of planning and awareness, you can navigate the complexities of available resources and take full advantage of what’s offered.

Start by thoroughly researching all potential sources of support, including grants, scholarships, and loans. Each type comes with its own eligibility criteria and application processes. It’s essential to be proactive–meet deadlines and submit all necessary documents precisely to avoid missing out on valuable opportunities.

Additionally, maintain open communication with your school’s financial department. They can provide insights into lesser-known programs that might be available to you. Don’t hesitate to ask questions or seek advice; their expertise can prove invaluable.

Lastly, consider reevaluating your budget. This reflection might reveal areas where you can allocate funds more effectively, making you less reliant on external support. By being strategic and informed, you can optimize the resources available to you and create a more manageable financial path.