Understanding the Amounts You Can Receive from Financial Aid Programs

When it comes to pursuing higher education, many individuals find themselves inquiring about the assistance available to alleviate the financial burdens. The landscape of educational funding can be quite complex, filled with various options and criteria that play a significant role in determining what one might receive.

Considering the differing circumstances of each student, the amount provided is influenced by factors such as income, family size, and institutional policies. Moreover, navigating through scholarships, grants, and loans can present a challenge, but it’s crucial to understand the possibilities that exist.

Exploring this topic opens the door to valuable insights into the support systems in place. Recognizing what is required to apply and qualify can empower prospective students to make informed decisions about their educational journey.

Understanding Types of Financial Aid

When it comes to supporting education, there are various options available that can significantly lighten the burden of expenses. These resources can take different forms, each designed to address specific needs and circumstances. Understanding the distinctions among them empowers students and families to make informed decisions on their educational journeys.

The most familiar category is grants. These are essentially funds that do not require repayment, making them an appealing choice for those seeking assistance. They often come from the government or educational institutions, focusing on financial needs or academic achievements.

Another popular option is scholarships. These awards are typically merit-based and can be granted for a range of reasons, including academic excellence, athletic skills, or talent in the arts. Since they also do not demand repayment, many students actively pursue scholarships to ease their financial burden.

Loans represent a different approach, as they require repayment over time, often with interest. While loans can help bridge the gap between available funds and educational costs, it’s essential to consider the long-term implications of borrowing money for schooling.

Additionally, work-study programs offer a unique opportunity for students to earn money while pursuing their education. Through these initiatives, individuals can gain valuable experience in their chosen field while managing their academic responsibilities.

Each option plays a vital role in the landscape of educational support. By comprehending the various forms available, students are better equipped to navigate their choices and find the assistance that aligns best with their needs.

Eligibility Criteria for Assistance Programs

Understanding the requirements for various support initiatives is key to determining who qualifies for resources and benefits. It’s essential to recognize that these prerequisites can vary significantly depending on the program in question. Factors like individual circumstances, residency status, and specific needs often play a crucial role in the assessment process.

Typically, applicants may be evaluated based on their income level, household size, and existing financial obligations. In addition, certain programs may consider demographic factors such as age, disability status, or educational enrollment. Each assistance option has its unique stipulations designed to target particular segments of the population, ensuring that resources are directed where they are most needed.

Moreover, it’s important to stay informed about any updates or changes to eligibility criteria, as these can shift with new policies or funding availability. Gathering documentation and preparing to demonstrate your situation can also significantly enhance your chances of receiving the necessary support, so being proactive is always a good idea.

Factors Influencing Aid Amounts

Various elements play a crucial role in determining the support one might receive. Understanding these factors can significantly affect the outcome of applications. By recognizing what influences the evaluation process, individuals can better prepare themselves and their submissions.

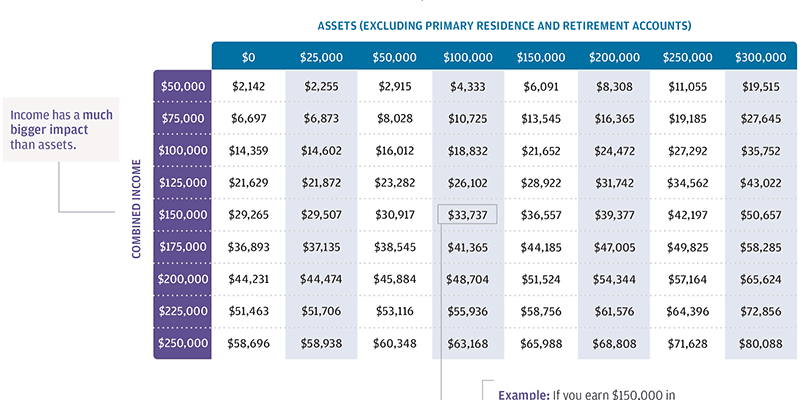

- Family Income: The financial situation of a household is a primary consideration. Lower income levels often lead to increased assistance as institutions aim to bridge the gap.

- Number of Dependents: Families with multiple dependents may qualify for greater resources. The more individuals relying on the same income, the more support may be needed.

- Cost of Attendance: Educational expenses differ widely among institutions. The higher the costs, the more likely one is to receive significant help to cover those expenses.

- Academic Performance: Scholastic achievement can influence assistance levels. Outstanding grades or test scores might unlock additional scholarships and grants.

- Eligibility for Programs: Specific qualifications for government or institutional programs can affect the availability of funds. Meeting certain criteria can enhance the chances of receiving optimized support.

- Timing of Applications: Submitting applications early often leads to better outcomes. Many funds are distributed on a first-come, first-served basis, making timeliness a key factor.

Awareness of these influencers can empower individuals in their pursuit of support. By tailoring applications according to these aspects, they can maximize their potential assistance.