Understanding How to Secure and Lock Your Credit Score for Better Financial Protection

In today’s world, protecting your financial details has become increasingly vital. With the rise of identity theft and online fraud, many individuals are seeking ways to safeguard their financial standing. It’s essential to explore the steps that can be taken to create an added layer of security against potential threats.

Many might not realize that maintaining control over how their financial data is accessed plays a pivotal role in this process. By understanding the available tools and methods, individuals can effectively manage their financial exposures. The aim is to empower people to make informed decisions about their financial futures while navigating the complexities of personal finance security.

As we delve deeper into this subject, we will uncover various strategies that enhance your ability to prevent unauthorized access to your financial accounts. Whether through services offered by major reporting agencies or self-imposed restrictions, there are practical steps everyone can take to fortify their financial well-being.

Understanding Credit Lock Mechanism

In today’s financial landscape, safeguarding personal information is more crucial than ever. One effective strategy involves controlling access to sensitive financial profiles. This approach is designed to provide individuals with the ability to manage who can view their credit history, ultimately helping to prevent identity theft and unauthorized activity.

At its core, this mechanism acts as a protective barrier around your financial credentials. By restricting access, individuals can ensure that only authorized parties, such as lenders when applying for a loan, can obtain their information. This system not only enhances security but also provides peace of mind, knowing that personal data remains confidential.

Furthermore, the process of implementing this safeguard is designed to be user-friendly. With a few simple steps, individuals can activate or deactivate this feature as needed, offering flexibility in maintaining their financial privacy. Overall, understanding this system empowers individuals to take proactive measures in protecting their financial identities.

Benefits of Securing Your Financial Profile

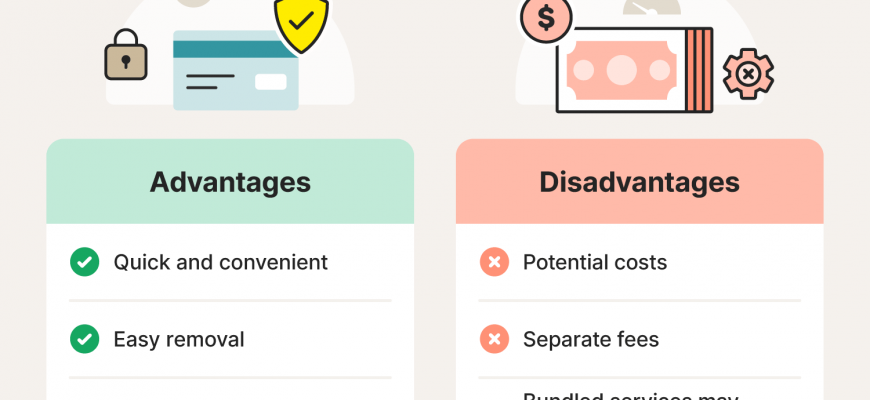

Taking steps to safeguard your personal financial information can bring about numerous advantages. It’s all about preventing unauthorized access to your sensitive data, which in turn allows you to enjoy greater peace of mind. By implementing these protective measures, you’re not just enhancing your security; you’re also creating a more stable financial future for yourself.

One key benefit is the significant reduction in the risk of fraud. When your confidential details are secure, the chances of identity theft diminish greatly. This means you can confidently manage your finances without constantly worrying about potential threats lurking around every corner.

Another advantage is the improved control over your financial journey. By restricting access, you can dictate who gets to view your information and when. This sense of empowerment allows you to make informed decisions about your financial health without unexpected interruptions.

Moreover, your credit score can potentially benefit from this approach. Keeping unwanted eyes away from your financial records can lead to more favorable lending conditions should you decide to apply for loans or credit in the future. Essentially, taking these precautionary actions now can save you money down the road.

Lastly, embracing this strategy fosters a proactive mindset regarding your financial well-being. It encourages you to stay engaged with your financial situation, making you more vigilant and informed about your resources. Overall, the benefits of maintaining this level of security can positively impact various aspects of your financial life.

Steps to Secure Your Financial Report

Protecting your financial profile is crucial in today’s world, where identity theft and fraud are common concerns. By taking proactive measures, you can ensure that your personal information remains safe and out of the wrong hands. Here are some straightforward steps to enhance the safety of your financial details.

First, consider placing a hold on your financial records with major reporting agencies. This creates a barrier that prevents unauthorized access, making it difficult for identity thieves to open new accounts in your name. Each bureau has its own process, typically involving a simple online form or a phone call.

Next, keep an eye on your statements and reports regularly. Monitoring your accounts not only helps you catch any suspicious activity quickly but also lets you understand your financial situation better. Set reminders to check your records at least once a year to stay informed.

Another effective tactic is to use strong passwords and two-step verification for your online accounts. Combining something you know (your password) with something you have (a phone for verification) adds an extra layer of protection, making it harder for fraudsters to access your information.

Lastly, be mindful of the personal information you share online. Avoid posting sensitive details on social media and be cautious with websites that ask for excessive information. The less you share, the lower the risk of unwanted exposure.