Exploring the Concept of Net Credit and Its Importance in Financial Analysis

In today’s financial landscape, it’s essential to grasp the concept of balances that impact our economic decisions. These figures play a crucial role in determining our overall fiscal health and how we approach various transactions. Whether you’re a small business owner or an individual managing personal finances, having a clear picture of one’s standing is fundamental.

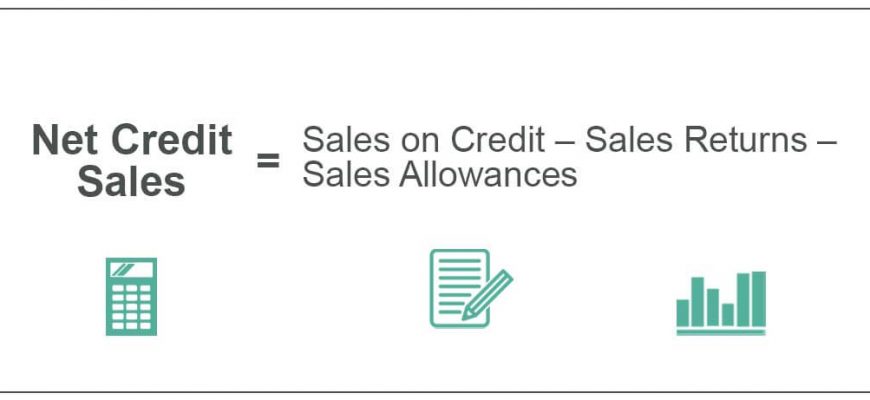

This discussion dives into the intricacies of overall amounts that can be available for use. It’s fascinating how many layers there are to consider, from the elements that contribute positively to those that detract from the sum. With multiple factors at play, being informed can lead to more strategic choices and potentially better outcomes.

Explore the dynamics of your financial interactions! Understanding these figures not only enhances your awareness but also equips you with the knowledge to navigate through various financial scenarios confidently. Whether you’re looking to invest smarter or simply keep track of your expenses, knowing where you stand has never been more important.

Understanding the Concept of Net Credit

When diving into the world of financial transactions, one often encounters various forms of monetary evaluations. It’s essential to grasp the fundamental ideas behind these assessments, as they play a significant role in personal finance, business dealings, and overall economic health.

In simpler terms, the balance between what is owed and what is earned forms a core part of financial discussions. This topic touches on the intricate dance between inflows and outflows of resources, shedding light on one’s financial standing. By exploring this balance, individuals can make informed choices regarding their expenses, investments, and savings.

Understanding this balance is not just for accountants or financial analysts; it’s relevant to anyone looking to manage their money effectively. It involves analyzing various factors, including spending habits, income sources, and obligations. By being aware of these elements, one can gain a clearer picture of their financial situation.

Ultimately, knowing the dynamics of these monetary interactions empowers individuals and businesses alike. It fosters better decision-making and promotes a proactive approach to managing finances, ensuring that goals are met and resources are utilized wisely.

Factors Influencing Net Credit Calculations

In the world of finance, several elements come into play when assessing the overall lending situation. These factors can significantly sway the resulting figures, impacting businesses and individuals alike. Understanding these variables is crucial for anyone looking to navigate the landscape of borrowing and lending effectively.

Economic Conditions: The state of the economy is a major contributor. When the economy is flourishing, lending tends to increase, leading to a higher potential for obtaining funds. Conversely, during downturns, caution takes over, affecting the overall willingness to lend.

Borrower’s Qualification: Creditworthiness plays a vital role as well. Lenders closely evaluate the borrower’s financial history, including past loans and repayment behaviors. A strong financial record can open doors to more favorable terms, while a spotty history may restrict options.

Interest Rates: The cost of borrowing directly influences decisions. Fluctuating rates can alter the total expenses associated with loans, prompting borrowers to either seize opportunities or hold back based on affordability.

Regulatory Framework: Government regulations can affect lending standards. Stricter rules may limit access to funds or adjust the criteria for approval, while a more relaxed framework could lead to expanded access.

Market Competition: The degree of competition among lenders also shapes the borrowing landscape. A saturated market can lead to better deals for borrowers, fostering an environment where favorable terms are widely available.

By recognizing these components, individuals and organizations can make informed decisions that align with their financial goals and circumstances. Proper insight into these dynamics can ultimately lead to better borrowing strategies and outcomes.

Implications of Net Credit on Financial Health

Understanding the balance between what one borrows and what one owes plays a significant role in determining overall financial well-being. This dynamic influences not only the immediate ability to manage day-to-day expenses but also long-term planning and stability. When individuals or businesses navigate the complexities of their financial obligations wisely, it sets the stage for healthier economic decisions.

Positive outcomes often emerge when the management of borrowing reflects a well-considered strategy. Access to funds can enable investments in opportunities that yield returns, fostering growth and security. On the contrary, a struggle to maintain that balance can lead to stress and restrict options for financial recovery or expansion.

Moreover, the perception of financial stability is crucial in various scenarios, from securing loans to negotiating contracts. Lenders and partners often assess reliability based on the interplay between what is taken out and what is repaid. A responsible approach not only enhances credibility but also paves the way for better deals and favorable terms.

Ultimately, the implications of this balance extend beyond numerical values and influence the broader landscape of personal or organizational well-being. Prioritizing responsible management can transform challenges into opportunities, shaping a more secure future.