Understanding the Reasons Behind the Decline of My Credit Score

Have you ever noticed a dip in your financial standing and wondered what could be causing it? Many individuals experience fluctuations in their financial health, often leaving them puzzled and anxious. It’s a common scenario where certain aspects of your financial behavior can lead to unexpected shifts, making it essential to dig deeper into what might be affecting your overall stability.

Various elements play a significant role in shaping your financial image, and unearthing these factors can help illuminate the reasons for any decline. From payment history to overall credit utilization and even the length of your financial journey, each detail contributes to the bigger picture. Remember, this isn’t just about numbers; it reflects your commitment to managing your finances responsibly.

In this exploration, we’ll cover the dynamics that can weave together and impact your financial standing. With the right knowledge, you’ll be better equipped to navigate any challenges that arise and work towards restoring a healthier status. Understanding the root causes enables you to make informed decisions and implement strategies to improve your financial narrative.

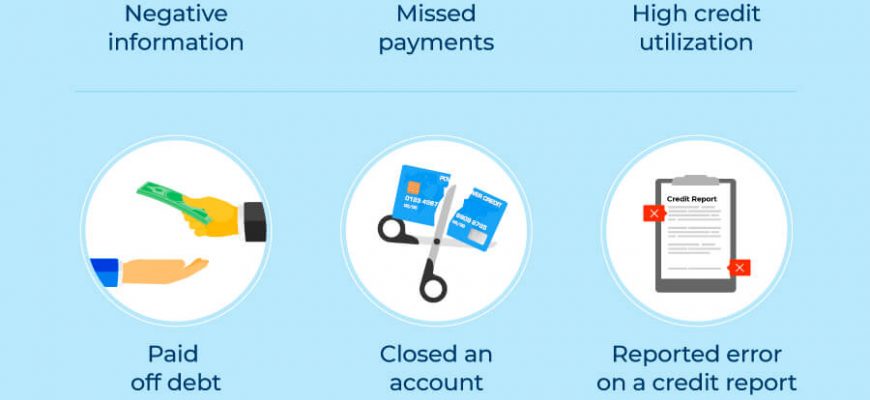

Common Factors Affecting Credit Scores

There are various elements that can influence your financial reputation. Understanding these factors is essential for anyone looking to maintain or improve their standing in the eyes of lenders. Certain behaviors and circumstances can play a significant role in shaping this aspect, and being mindful of them can

The Impact of Late Payments

Missed deadlines in making payments can have a lingering effect on your financial health. This issue often leads to increased stress and can complicate future borrowing opportunities. The repercussions of these delays extend far beyond immediate penalties, affecting your overall financial reputation.

One of the most significant outcomes of late payments is the negative mark it leaves on your financial history. Each instance can be documented, and these records serve as indicators to lenders about your reliability and responsibility when it comes to managing obligations. Such a pattern can hinder access to favorable loan options or even result in higher interest rates.

Additionally, being consistently late may lead to increased fees and charges, which further exacerbate financial strain. Not only do you have to manage the discomfort of penalties, but the accumulation of these costs can also make it harder to regain your footing.

Moreover, the psychological impact shouldn’t be underestimated. The worry and anxiety associated with overdue payments can make it challenging to focus on other important aspects of life, creating a cycle of stress and oversight. Ultimately, staying aware of payment deadlines is crucial in maintaining a stable and healthy financial situation.

Impact of Available Credit Usage on Ratings

Managing how much of your open lines of borrowing you utilize plays a significant role in determining your overall financial reputation. When you tap into a large portion of your available funds, it can send red flags to lenders. They often view heavy reliance on borrowed amounts as a potential sign of risk, suggesting that you might struggle to manage your finances effectively.

It’s essential to maintain a balanced approach to utilizing these lines of credit. Keeping your usage below certain thresholds can signal responsibility and financial savvy. Many experts recommend aiming for a utilization percentage of 30% or lower to present a positive image to prospective lenders. Essentially, showing that you can handle credit wisely can enable you to achieve better offers and terms in the future.

Regularly monitoring your usage helps you stay on top of any changes that could adversely affect your financial standing. A responsible approach not only enhances your attractiveness to creditors but also contributes to a healthier financial future.