Understanding the Process of Financial Aid Disbursement and Its Various Methods

When it comes to educational support, many individuals wonder about the mechanisms that facilitate access to those essential resources. The journey from application submission to receiving funds can be both fascinating and intricate. Navigating through this process is crucial for students looking to alleviate some of their educational expenses.

Various institutions have different methods for distributing assistance, each with its own timeline and requirements. Students often find themselves asking questions like when they will see the funds and in what form. Understanding these particulars can help set clear expectations and reduce potential stress during the academic year.

Ultimately, grasping the nuances of resource distribution is about empowering students. Being informed not only aids in effective financial planning but also enhances the overall educational experience. So, let’s delve deeper into the various ways these resources can be accessed and the steps involved in making it all happen.

Understanding Financial Aid Distribution Methods

When it comes to supporting students in their educational journeys, the way resources are distributed can make a world of difference. There are various approaches to channeling these funds, and understanding them can help students anticipate how they will receive the support needed to succeed academically. Each method has its own nuances, and familiarity with these processes can alleviate some of the stress associated with financing one’s education.

One common approach is direct disbursement to students. In this case, individuals receive the resources directly, allowing them to manage their expenses as they see fit. This method offers flexibility, enabling recipients to allocate funds based on their specific needs, whether it be tuition, books, or living expenses. It empowers students to take control of their financial situations while navigating their studies.

Another popular way involves transferring resources directly to the educational institution. Here, the funds are applied to tuition and fees, reducing the overall burden on students. This pathway simplifies the process for many, as it eliminates the need for individuals to handle large sums. Institutions typically manage these transactions and ensure clarity regarding the remaining balances and obligations.

In addition to these primary methods, some programs may utilize a more gradual release of resources. This staggered distribution can occur in installments, aligning with specific milestones or academic terms. Such an approach not only provides a steady flow of assistance but also encourages students to maintain their progress in their studies, as ongoing support often hinges on satisfactory academic performance.

Ultimately, understanding these distribution methods allows students to better prepare for their financial responsibilities. By knowing how support is granted, individuals can plan accordingly and leverage the resources available to them effectively, paving the way for a smoother educational experience.

The Role of Scholarships and Grants

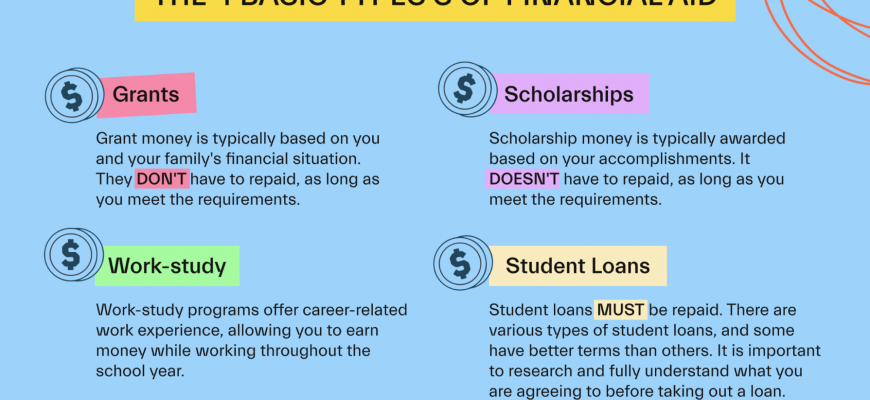

When it comes to pursuing education, many people seek various forms of support to ease the burden of costs. Among these resources, scholarships and grants stand out as powerful tools that can significantly impact a student’s experience. They not only reduce financial stress but also open doors to opportunities that might otherwise be out of reach.

These resources come in various forms, often awarded based on merit, need, or specific criteria set by the funding organizations. Scholarships, typically merit-based, reward students for their academic achievements, talents, or extracurricular involvement. On the other hand, grants often focus on individuals who demonstrate a financial necessity, helping to bridge the gap for those who may struggle to cover their education expenses.

Receiving these awards can encourage students to focus on their studies rather than worrying about how to pay for tuition or other related costs. Moreover, many institutions emphasize the importance of these assists in fostering a diverse and inclusive environment, allowing individuals from various backgrounds to thrive.

Ultimately, scholarships and grants play a crucial role in shaping the educational landscape, making quality schooling accessible and helping students achieve their dreams without the overwhelming burden of debt. The impact of these resources extends beyond the classroom, influencing future career paths and personal growth.

Impact of Student Loans on Payments

When students embark on their educational journeys, the financial support they receive can shape their entire experience. Borrowing funds becomes a common route, providing immediate relief but also bringing long-term considerations to the table. Understanding these influences can help students navigate their academic and financial futures more effectively.

Firstly, loans often dictate budgeting choices. As students account for monthly repayments after graduation, their spending habits may shift dramatically. Prioritizing essentials like housing and food, many find themselves cutting back on personal luxuries or even additional coursework to save money. This can create a ripple effect on their overall college experience.

Moreover, the anxiety associated with repayment can affect academic performance. Juggling studies while worrying about future debt might lead to added stress, which could hinder focus and motivation. Balancing these pressures is crucial for maintaining both mental health and academic success.

Additionally, the amount borrowed significantly impacts the post-graduation financial landscape. Graduates may find themselves in a challenging position if their first job does not provide enough income to cover their dues. This situation can lead to delays in achieving life milestones, such as buying a home or investing in personal development.

Ultimately, understanding the consequences of borrowing for education is essential. Students and their families should evaluate their options carefully, weighing immediate benefits against future obligations. In doing so, they can work towards a financially stable life beyond the classroom.