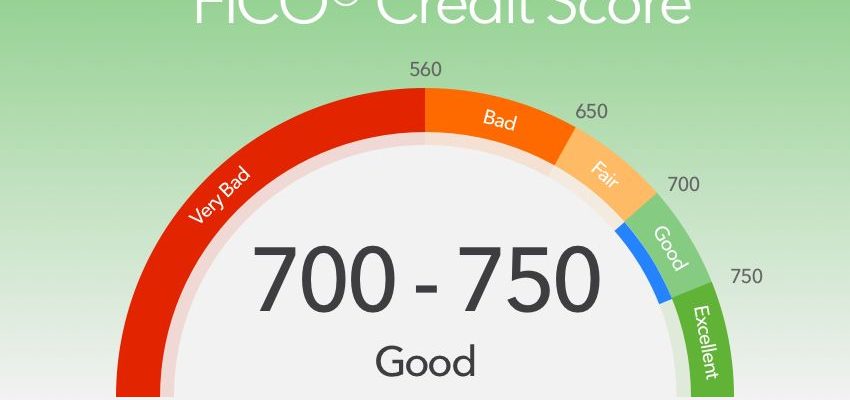

Understanding the Benefits and Implications of a 750 Credit Score

When it comes to navigating the financial landscape, numbers often hold significant weight. Among these figures, there exists a particular benchmark that tends to open many doors for individuals seeking favorable terms in their financial endeavors. Achieving a specific numerical threshold can lead to advantages that extend beyond mere suggestions of trustworthiness.

Many people wonder what it truly means to reach this level of evaluation. It’s not just about the digits themselves; rather, it’s about the opportunities and options that become available once you attain this threshold. From lower interest rates on loans to increased chances of securing rental agreements, the implications are noteworthy and can positively influence your financial journey.

In this exploration, we’ll dive into the implications surrounding this prominent figure in personal finance. We’ll uncover how it affects various aspects of life, including borrowing power, insurance premiums, and even employment considerations. Join me on this journey to comprehend the nuances of this figure and discover its significance in today’s economic climate.

Understanding the 750 Credit Score

When it comes to personal finance, certain numbers carry a lot of weight. Among them, a particular figure stands out as a reflection of your financial health and reliability. This important metric plays a crucial role in determining how lenders perceive you, particularly when it comes to securing loans and favorable terms. It serves as a benchmark that can open doors to various financial opportunities.

Reaching a level in this numeric spectrum indicates that you have a solid history of managing your debts and commitments. It suggests you are likely to fulfill future financial obligations, which is precisely what lenders want to see. A rating like this can significantly enhance your borrowing power, leading to lower interest rates and better approval chances. Moreover, it often translates into lower insurance premiums and even more favorable rental agreements.

Maintaining such a commendable position requires consistent effort and sound financial habits. It is essential to keep an eye on payment histories, utilization ratios, and the diversity of your credit accounts. By nurturing these aspects, you can ensure that your financial standing remains robust and attractive to lenders.

In addition, being aware of the factors that influence this essential figure can empower you. For anyone aiming to improve their financial situation, understanding the nuances associated with such a rating is invaluable. It not only fosters better choices but also builds confidence when navigating the world of finance.

Advantages of an Excellent Financial Profile

Achieving a high financial rating opens doors to numerous opportunities that can enhance your life in various ways. Individuals with such a standing often enjoy favorable conditions in their financial dealings, leading to significant benefits that can make a real difference.

One of the primary perks is the access to lower interest rates. Whether you’re looking for a mortgage, personal loan, or credit card, lenders are more inclined to offer attractive rates to those with a strong standing. This means you save money over time, making it easier to manage your finances.

Another advantage relates to approval chances. When applying for new financing, having a solid standing increases the likelihood of being approved. Financial institutions view you as a low-risk borrower, meaning you can secure necessary funding when you need it the most.

Moreover, a robust profile can enhance your negotiating power. With a reputable standing, you may be able to negotiate better terms on loans or even rent agreements. Landlords and lenders see you as a reliable candidate, resulting in more favorable conditions.

Additionally, you can benefit from quicker application processes. Many institutions offer streamlined services for individuals with stellar ratings, which means less hassle and waiting time when seeking financing.

Lastly, the peace of mind that comes with a strong financial profile is invaluable. Knowing that you are likely to be approved for the resources you need can alleviate stress and empower you to make better financial decisions.

Steps to Achieve a Higher Score

Elevating your financial reputation isn’t just a dream; it’s an attainable goal with a few strategic actions. By implementing certain practices, you can enhance your standing and unlock better opportunities for loans, rentals, and more. Let’s dive into some effective strategies to help you reach that desired level.

First off, keeping a close watch on your accounts is essential. Regularly reviewing your statements allows you to spot any discrepancies or unauthorized transactions. If you find errors, addressing them promptly can prevent negative repercussions.

Next, make it a habit to pay off outstanding balances on time. Timely repayments signal reliability to lenders and can have a significant impact on your overall standing. Even small, recurring payments need to be handled responsibly to build a positive pattern.

Another critical aspect involves managing your utilization rate. Try to maintain low balances compared to your overall limit. This strategy demonstrates that you’re capable of handling credit wisely, which can lead to a more favorable perception.

Don’t hesitate to diversify your loan types when it makes sense for you. Mixing revolving credit like credit cards with installment loans, such as personal or auto loans, showcases your versatility and may positively influence your standing.

Lastly, avoid opening too many new accounts in a short period. Each inquiry into your financial history can temporarily drop your standing. Instead, approach new credit judiciously to maintain a stable trajectory.

Incorporating these methods into your routine can set you on the path to enhancing your financial reputation. With patience and diligence, you’ll likely see positive results over time.