Exploring the Benefits and Opportunities of a 720 Credit Score

When it comes to financial health, one aspect often stands out as a key indicator of your borrowing potential. It’s a number that can affect your ability to secure loans, influence interest rates, and even impact your insurance premiums. Understanding what a specific rating represents can empower you to make informed financial decisions and enhance your financial well-being.

In the realm of personal finance, maintaining a strong reputation is not just about managing debts and payments. There are various factors at play, including payment history, credit utilization, and the length of your borrowing history. All these elements contribute to how lenders perceive you, determining not just your access to funds but also the terms of those funds.

So, if you find yourself holding a particular rating, it’s worth diving into what it signifies. Is it a stepping stone towards better financial opportunities, or should it prompt a reassessment of your overall fiscal strategy? Let’s explore the implications and advantages of having such a rating in today’s lending landscape.

Understanding Ratings and Their Impact

When it comes to your financial wellbeing, one crucial factor plays a significant role in determining how lenders perceive you. This measurement reflects your reliability in managing borrowed resources, influencing everything from mortgage approvals to credit card interest rates. It’s like a report card for your financial habits, indicating how responsibly you’ve handled your obligations over time.

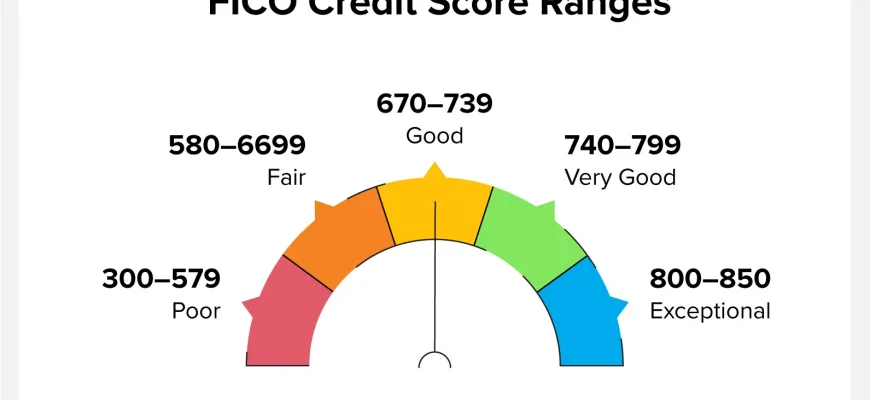

Many people often wonder just what this number means and how it affects their economic opportunities. Higher values generally open doors to better offers, favorable terms, and, in many cases, lower interest charges. Conversely, lower values can lead to challenges in obtaining loans or securing advantageous rates. Understanding this number and its implications is essential for anyone looking to navigate the financial landscape effectively.

Maintaining a strong standing on this scale involves several key practices, such as timely payments, low debt utilization, and a healthy mix of different types of loans. Each of these factors contributes to how you are evaluated. Keeping an eye on your status can empower you to take control of your financial future and make informed decisions regarding major purchases or investments.

The Advantages of a 720 Rating

Achieving a particular numerical value in your financial evaluation can open numerous doors. This level of assessment signifies that you are viewed as a reliable individual by lending institutions, which can lead to a series of benefits that make managing personal finances much easier.

One of the most significant perks is access to favorable interest rates. Lenders typically offer better terms to those with higher evaluations, meaning that you can save a considerable amount over time on loans or mortgages. This can make a substantial difference in your monthly payments, contributing positively to your overall budget.

Additionally, a strong assessment enhances your negotiating power. When applying for loans, you might find yourself in a position to discuss terms that suit your needs better, potentially resulting in lower fees or additional perks that individuals with lesser ratings might not receive.

Beyond just loans, this level of evaluation can also simplify the rental process. Landlords are more inclined to approve applications from candidates with favorable ratings, giving you an edge in competitive housing markets. This can lead to more options and less stress in finding a suitable place to live.

In the realm of insurance, a robust evaluation can lead to lower premiums. Many companies consider your financial reliability when determining rates, so being viewed positively can translate into savings in various areas of your life.

Lastly, a strong evaluation can enhance your overall peace of mind. Knowing that you are perceived as a dependable individual can reduce financial anxiety and empower you to make wiser financial decisions moving forward.

Enhancing Your Financial Standing

Improving your overall financial reputation can seem challenging, but there are effective strategies you can adopt to elevate your standing over time. With consistent effort and informed choices, you can pave the way for a brighter financial future. Here are some practical tips to get started:

- Check Your Reports: Regularly review your financial reports for any errors or inaccuracies. Dispute any discrepancies you find to ensure your information is correct.

- Make Payments Promptly: Timely payments are crucial. Aim to pay all your bills on or before their due dates, as this demonstrates reliability.

- Reduce Debt: Focus on lowering existing debts, especially those that carry high interest rates. Develop a plan to tackle them systematically.

- Utilize Credit Wisely: Try to keep your usage below 30% of your total limits on any revolving accounts. This helps show that you can manage credit effectively.

- Avoid Unnecessary Inquiries: Limit the number of new accounts you apply for. Each application can lead to a hard inquiry, which may impact your financial reputation.

Implementing these strategies can yield positive results over time. Consistency is key; small changes can lead to significant improvements in your financial standing.