| Compare | First free* | Max amount | Min amount | Max term |

|---|---|---|---|---|

| Yes | 1200 € Contratar | 50 € | 5-62 day |

| Compare | Processing time | Max amount | ARP(%)* | Min amount | Age limit | Max term | Schedule |

|---|---|---|---|---|---|---|---|

| 10 min. | € 300 Get | 10 % | € 3000 | 18-75 | 1-3 years | 08.00 - 20:00 10:00 - 20:00 |

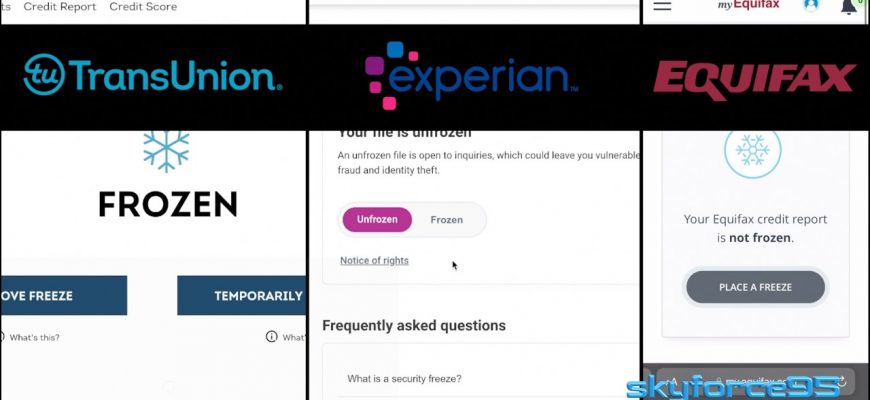

A Comprehensive Guide to Freezing Your Credit with Experian

In today’s fast-paced world, protecting your personal information has become more crucial than ever. The increasing prevalence of identity theft and fraud makes it essential for individuals to take proactive measures in safeguarding their financial profiles. This not only helps prevent unauthorized access but also brings peace of mind in an otherwise uncertain digital landscape.

There’s a specific approach that allows you to limit access to your financial records for potential lenders and companies. This involves a straightforward process that can significantly enhance your security. By following a few simple steps, you can place barriers that prevent others from gathering your sensitive information for financial purposes.

Understanding the procedure for creating these safeguards is vital. By familiarizing yourself with the necessary actions, you can navigate the system with ease and effectively shield your most personal details. Taking control of your financial landscape empowers you to make informed decisions and protects against unforeseen challenges.

Understanding Credit Freeze with Experian

In today’s financial landscape, safeguarding personal information has become more critical than ever. One effective approach to enhance security involves restricting access to your financial records. This method allows individuals to have more control over who can check their history, especially in cases of identity theft.

When discussing this topic, it’s important to highlight that individuals should be aware of both the benefits and limitations offered. Implementing this protective measure can significantly reduce the risk of unauthorized transactions as it prevents potential creditors from reviewing your files without your permission.

The process involves a few straightforward steps that anyone can follow. Typically, it requires personal details that authenticate your identity and allow you to manage your data effectively. Once applied, you’ll receive a unique identification number, which serves as a key to lift the restrictions whenever necessary.

Moreover, understanding the recovery options is vital. If you ever need to grant access for a legitimate purpose, you can easily do so temporarily. It’s a powerful tool for anyone serious about maintaining their financial security in an increasingly digital world.

In conclusion, considering this option can be a proactive measure to protect yourself. It offers peace of mind and a layer of defense against potential threats to your financial wellbeing.

Steps to Initiate a Credit Freeze

Taking control of your financial security is a smart move, especially in today’s digital age. When personal data is compromised, it’s crucial to safeguard your accounts from unauthorized access. One effective way to do this is by restricting access to your financial history.

First, gather the necessary information. You will typically need your identification details, such as your Social Security number, date of birth, and current address. Having this information on hand can streamline the process.

Next, visit the official website of the credit reporting agency you wish to contact. Look for the section related to managing your account security. Often, you’ll find a dedicated area for initiating restrictions.

Follow the prompts carefully. You may be required to fill out an online form or provide information over the phone. Be prepared to answer some security questions to verify your identity.

After completing the initial steps, make sure to keep any confirmation numbers or codes provided. These will be essential for lifting the restriction in the future if needed.

Lastly, consider checking the other two major agencies. While one may have your restrictions in place, it’s wise to extend that layer of protection across all your financial reporting to strengthen your overall security.

Benefits of Securing Your Financial Information

Taking steps to safeguard your financial data brings numerous advantages. By creating barriers against unauthorized access, you can significantly enhance your peace of mind. It’s not just about preventing misuse; it’s about reclaiming control over your personal and financial landscape.

One major perk is the added layer of protection it offers against identity theft. With criminals constantly devising new tactics, ensuring that your sensitive information remains out of reach can make a real difference. By limiting access, you decrease the likelihood of becoming a victim.

Another benefit is the ease of future transactions. When you choose to restrict access, you are encouraged to be more vigilant about your financial activities. This heightened awareness can lead to better financial habits and more informed decision-making.

Moreover, the process often comes at no cost, making it a smart choice for anyone looking to safeguard their assets without incurring extra expenses. It’s a proactive approach that allows you to focus on building your financial future without the constant worry of potential fraud.

Finally, the simplicity of implementing such measures cannot be overlooked. Many services provide user-friendly interfaces, making it easy for you to initiate and manage the restrictions as needed. This convenience empowers you to stay on top of your financial security effortlessly.